Traders watching the S&P 500 have at least four possibilities for market proxies (and most other major indexes have similar issues), but they’re not always created equal. Some instruments do some things better than others and some are completely inappropriate for certain uses. Let’s start with looking at the pros and cons for each SPY proxy: SPY: An ETF that … Read More

SMB Trade of the Week – FDX

SMB Trade of the Week – FDX. A Return to a Technical Break Area Trade

SMB Morning Rundown – September 20, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open

The “Pin Play”

Expiration day can have a strong effect on a stock. This is known as “pinning the stock”. A stock that is stuck at strike on expiration day when the general market is moving will move away from strike after expiration day. Stocks with high open interest at a particular strike usually get pinned near the strike on expiration day. This … Read More

Traders Ask: What Bloggers Should I Follow?

Hi Mike In your book you mention several times that you ask potential traders what blogs a trader reads. Sadly when I thought about this (and prior to this blog) the answer for me was none. I read heaps, seek out videos, study my trades, would love a mentor etc. but no blogs). Why? When I started trading stocks I … Read More

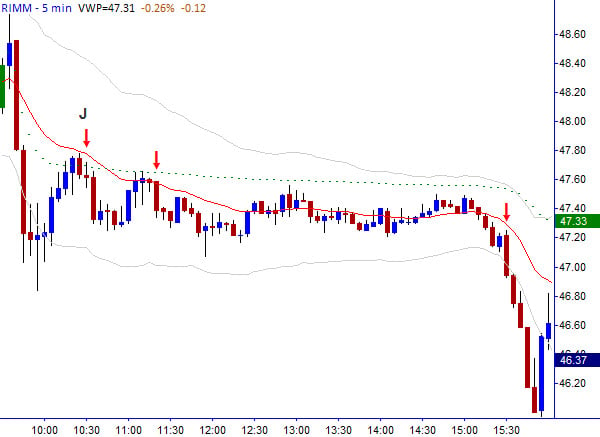

Decoding Pullbacks: A Case Study in RIMM Post-Earnings (9/17/10)

Last week, a reader asked for an example of an easy technical play… a lay-up. Here is an example of One Good Trade in RIMM – a pullback short supported by multiple technical factors.

Traders Ask: What is My One Good Budget?

My name is (XXXXXXXXXXX) and I just finished “One Good Trade.” I enjoyed your book very much and I wanted to send a few comments your way. Personally I am a full time day trader from home. Currently I am concentrating on the SP emini but after reading your book I feel as though I need to start looking for … Read More

Afraid to Trade Reviews One Good Trade

Afraid to Trade recently reviewed One Good Trade: Inside the Highly Competitive World of Proprietary Trading, writing: “few books are similar to Bellafiore’s One Good Trade. One Good Trade takes you into SMB Capital through stories, strategies, experiences, and lessons learned.” Afraid to Trade and SMB are teaming up to give away a free copy of One Good Trade. Visit … Read More