The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Traders Ask: Am I Too Old to Trade?

I have read this book and am incredibly inspired. Without going into further details, would you say age is a barrier to becoming a prop trader? At some point is one past the age where the skill set is present? Let me say that I am 50, have a fulltime job and am up 35% YTD and 140% off … Read More

SMB Trading Lesson of the Week – Combinatorial Explosion

Watch Mike Bellafiore, author of One Good Trade: Inside the Highly Competitive World of Proprietary Trading (Wiley), in our new video series SMB Trading Lesson of the Week for StockTwits U. This week we discuss: Combinatorial Explosion. You can watch here. We hope you enjoy! Don’t forget to follow us on Twitter!

Morning Thoughts on October 12, 2010

Good morning traders, Futures have us opening about .3% down. Well over their overnight lows. Bigger picture the market seems to be wedging up, a pattern that usually resolves itself to the downside. In the intermediate term if the market holds under SPY 115.20 we should expect to see a test of SPY113.20. On the upside SPY117.60 is the next … Read More

SMB Morning Rundown – October 12, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open

Traders Ask: Should I Have a Max Give-Back Rule?

Hey Bella, How is everything? I have a question for you. I have this one problem (amongst many others) that I am having a tough time overcoming. Whenever I make a few good trades on the open and I have a nice P&L for the day I sit there the rest of the day and force trades and give back … Read More

SMB Morning Rundown – October 11, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open

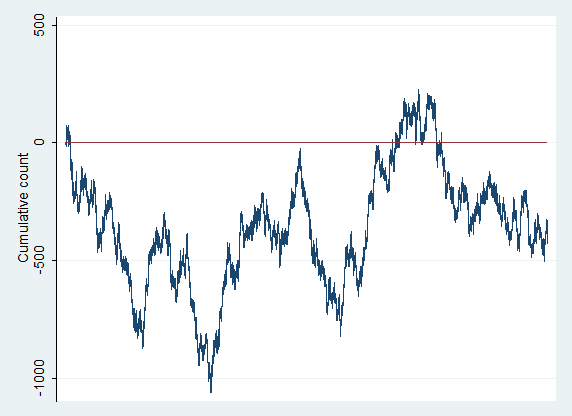

Exploring Randomness: Thought-Provoking Insights and Reflections

Thinking about randomness can be challenging, but there are some important lessons to be learned here.