Good morning traders. Market sold off sharply yesterday right after the open of trading. Like I said yesterday, I would not be looking for longs in the market unless we saw the gap holding over SPY116.25. Looking at the bigger picture of the market we are consolidating in a range above the previous range. In terms of an upside breakout … Read More

SMB Morning Rundown – October 8, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open

Early Morning Thoughts – FX

The $EURUSD run seems to have temporarily ran out of steam. We had rejection at the top of the trend channel on the hourly chart near the 1.4030 area and put a nice reversal setup in place. For this am we are ranging early in the European session 1.3920 by 1.3945. Expecting heavy volatility to pick up below 1.39 or … Read More

Don’t Make That Mistake!

When a very strong stock fails to make a new high after consolidation some traders are on the prowl to establish a short position. Don’t make that mistake! Let me first define what I mean by a “very strong” stock. A very strong stock is a stock that is trending up for the day and is in an uptrend in … Read More

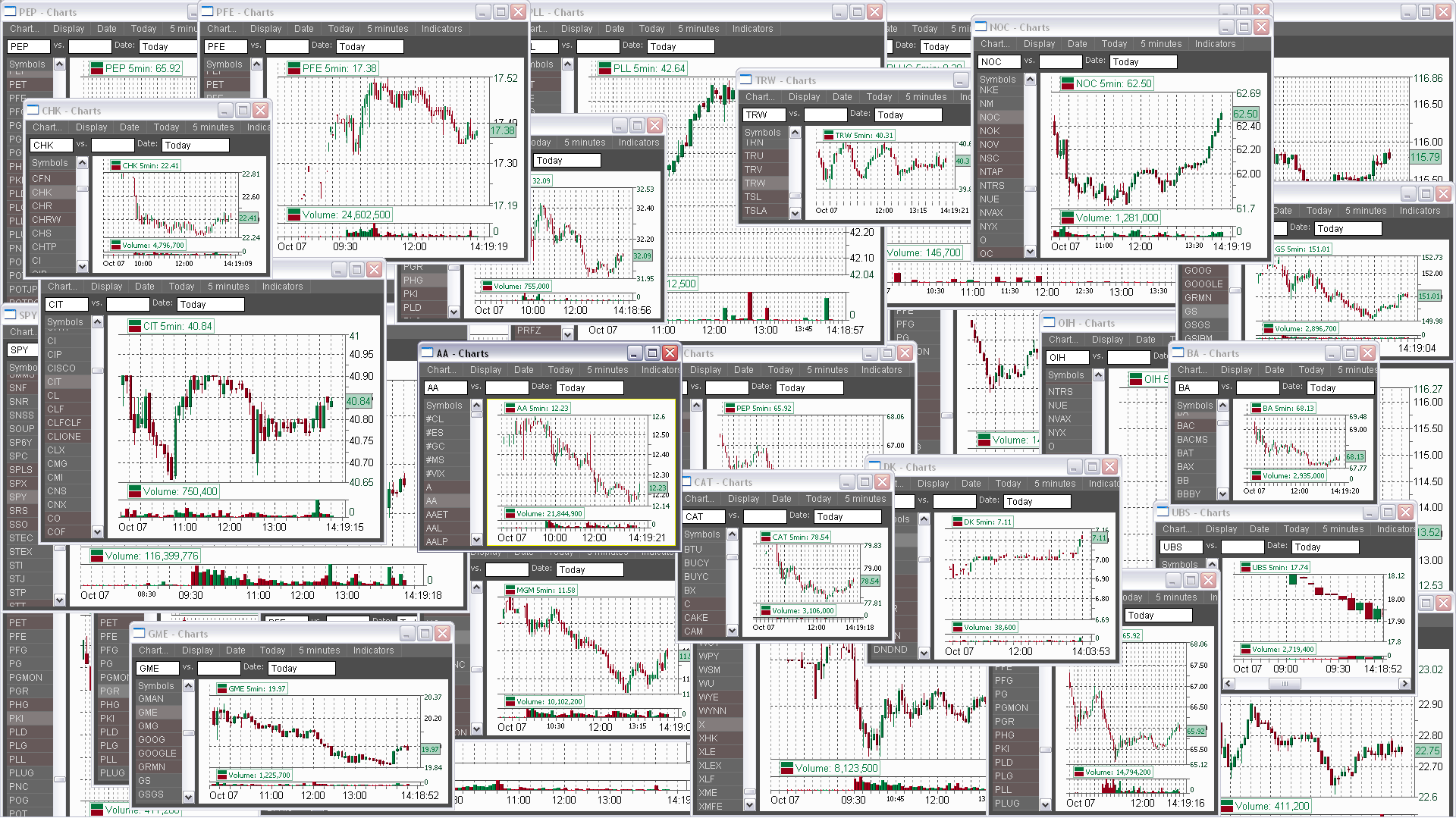

Ripping Through Charts

Before training at SMB I used to rip through charts religiously. I called it the “poor man’s training program” :-). This was several years ago, but I still rip through charts. I find it to be a very useful source of trading ideas and for getting an overall feel of what the market is doing across multiple sectors. Ripping through … Read More

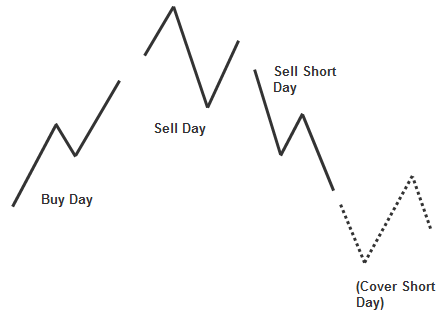

The Taylor Rhythm

A fifty year old system can give valuable insights into the character and structure of each trading day.

Morning Thoughts on October 7, 2010

Good morning traders. Yesterday we saw a mark down of several of the leaders in the cloud computing area. Besides these stocks, the general market showed great resiliency consolidating the previous day’s gains. Yesterday’s action was pretty classic in terms of what to expect after a trend day, as I pointed out yesterday morning. For today I am going to … Read More

SMB Morning Rundown – October 7, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open