The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Kicking Around On a Piece of Ground: Embrace Trading Success in Your Hometown

“Ticking away the moments that make up a dull day You fritter and waste the hours in an offhand way. Kicking around on a piece of ground in your home town Waiting for someone or something to show you the way.” Makes me wonder if someone from Pink Floyd tried being a remote trader. Trading from home alone is both … Read More

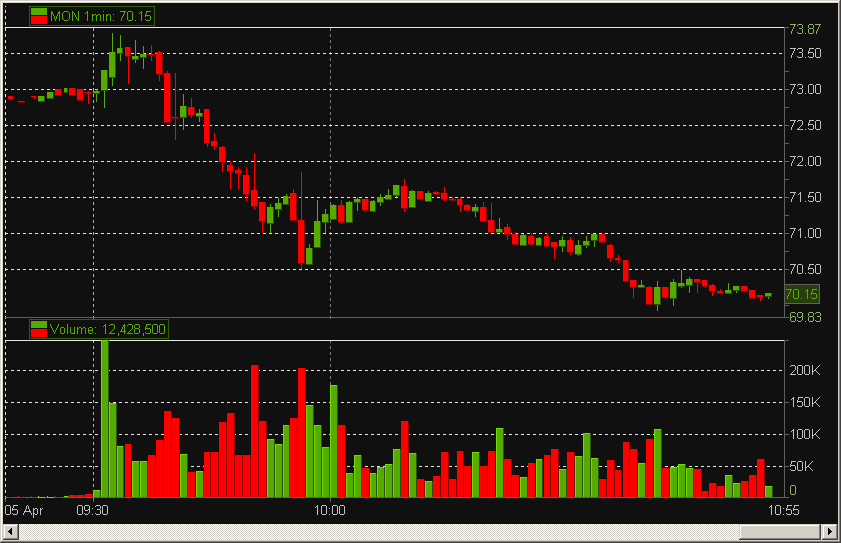

What are your trades in MON? (The answers)

Non-experienced traders should not be trading MON during a conference call. Experienced traders not listening to the conference call should not be trading during the conference call. Experienced traders who do not know a great deal about MON should not be trading this during the conference call. So this was a bit of a trick question (couldn’t fool @thearmotrader). But … Read More

4/6/11 Stock Scans (with some questions answered)

Here are today’s scans And two questions: >I lost my notes from the webinar. Is it archived? Yes. Scroll down a few posts back and you will see that Roy posted the video. For other people looking at these scans who did not see the video, you might want to watch it. These probably make more sense in context of … Read More

Can I Trade Options While Holding Down a Busy Full-Time Job? How About While I’m Asleep?

While there are common themes to every kind of trading discipline, there are of courses differences as well. Options spread trading, for example is a very different world in many respects from day trading. At SMB, our intraday equity traders tend to focus on the opening hour and the closing hour of trading, with sometimes very high speed activity and decision-making … Read More

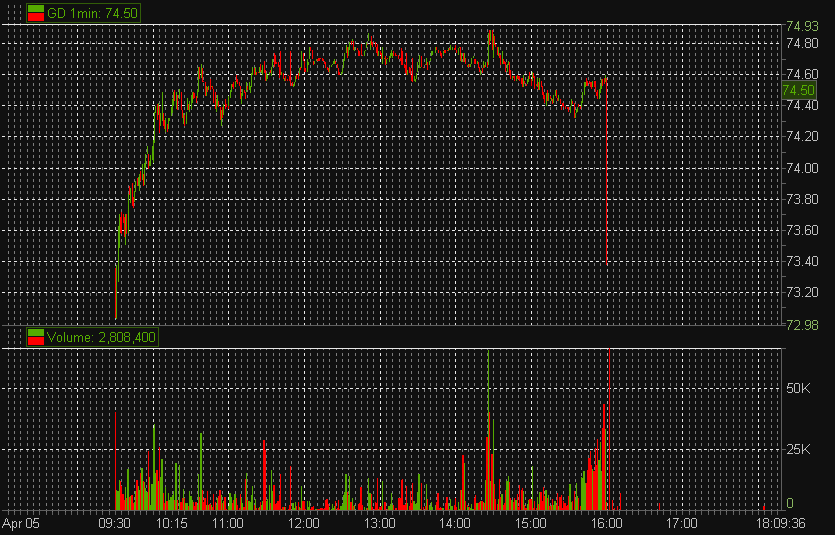

Traders Ask- GD Trading

Hi Mike, I am hoping for your insight on a trade I’m making today. My uncertainty in this trade it typical of what I find in a lot of my trades. I am trading GD as a second day play. My thinking is that the sell-off yesterday was overdone and that it ultimately held important support at 73. I was looking … Read More

Finding an edge in random markets

Adam asks if traders can make money using trailing stops in random walk markets.

What are your trades in MON?

What are the intraday trading opportunities from MON on the Open? First we have to indentify the patterns that are worth our attention. And then we can hammer down on how best to execute. From the chart below what trades makes sense to you. Be back later with some thoughts of my own. Hint: during our AM meeting we identified … Read More