Join us this Thursday for a free webinar with Mike Bellafiore, author of the “trading classic” One Good Trade at 4:15 PM EST. Mike will discuss some trading set ups that you can make your own. More importantly he will focus on the proper thought process for such trading plays. Questions from attendees will be answered at the end of … Read More

Traders Ask: How Does Your Posture Affect Your Trading?

Hi. My question concerns body posture when sitting at a screen for hours a day. I’ve learned I need to be very aware when trading of what’s going on in my brain, what I’m seeing and how I feel and think about it, and what baggage from life might be influencing my mood. Often though I also realise that my … Read More

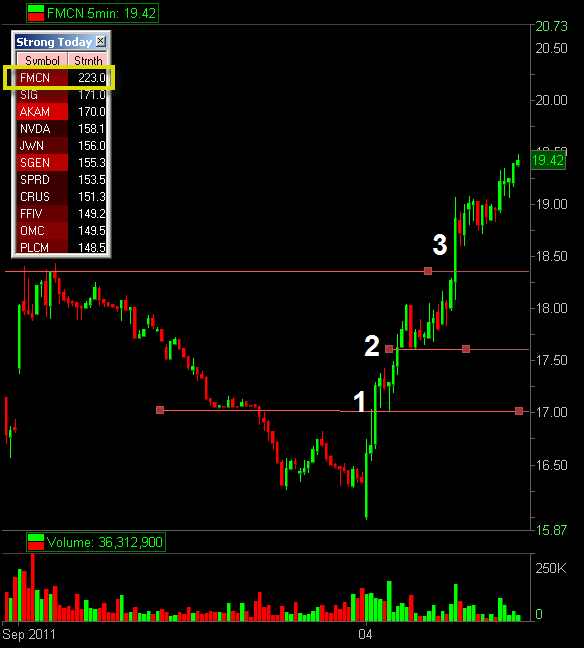

New Plays Emerge – SMB Radar Play of the Day $FMCN

Lately we have been posting some very simple Radar setups that can really step up your trading game. Simple, trend following plays that can be very high probability, good risk / reward plays. Today $OCR made a similar set up to the Spencer Special, however didn’t have as many checks as we would like to see. Consolidation wasn’t very clean, the … Read More

Free Options Webinar: SMB’s Options Tribe: Today at 5pm EDT: Short Term Calendar Spreads

Today at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This … Read More

Making Decisions How to Enter on MOS

A guest post from an SMB trainee, TO: Bella has the entire floor working on their Playbooks on a daily basis, in order to take internalize our best plays. Here is one of my plays on MOS last week. 1. Big Picture: The SPY’s were in an intraday downtrend in the 116’s and next support was 115. 2. Intraday Fundamentals: … Read More

Quint Tatro speaking at SMB Training

Quint Tatro, author of Trade the Trader and the portfolio manager of the Tatro Capital Tactical Appreciation Fund, stopped by SMB Training to talk with some new trainees. In this video below Quint discusses his favorite technical trades, how he rips through 2600 charts every night, and his worst trade.

SMB Welcomes a New Blogger–John Locke

SMB is proud to announce the addition of a new options trader and success coach to our blog, John Locke, of Locke In Your Success, LLC. John is an outstanding options trader and success coach and has worked extensively with traders all over the world to help them improve their game. John has also been a frequent guest on … Read More

Working on your weaknesses may be your biggest weakness.

The time you spend on bringing a weakness up from below average to average will diminish the time you could be spending improving your strengths. I find that people who spend lots of time working on their weaknesses are those who do not know what they want and therefore they feel the need to be good at “everything”. The reality … Read More