It’s time to move on, time to get going What lies ahead, I have no way of knowing But under my feet, baby, grass is growing It’s time to move on, it’s time to get going Tom Petty Bella, Yesterday I got absolutely chopped up in JPM. I could not believe how much I lost in such a short amount … Read More

Expiration week and the SPXpm

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. For those who haven’t heard of or traded the SPXpm, take a look at it. It’s an electronically traded SPX product that trades through expiration Friday afternoon and … Read More

How to Bounce Back From Failure in Trading

This is one blog post that I hope you never have to read. Why? Because it’s all about failure. The word “failure” has tons of connotations. Shame. Guilt. Disappointment. Anger. These are things that we try to avoid at all costs. If the world were perfect, you would never run into failure in your trading career. I hope that you … Read More

Play Like A Pro

It’s time for Episode 5 of When The Bell Rings. In this episode, I’ll give you some food for thought when it comes to your trading. We’ll talk about some distinct differences among traders regarding their approaches, and it should either give you some added motivation, or a boost in confidence. I hope you get a lot out of this … Read More

Four Quick Ways To Get Better At Trading

Four Quick Ways To Get Better At Trading Usually, the “quick fix” implies fixing something, but only temporarily and in a fashion that won’t help long-term. Luckily for us traders, there are several quick things that we can do that can readily improve our trading. They are quick lessons in that they don’t take much time to grasp, but their … Read More

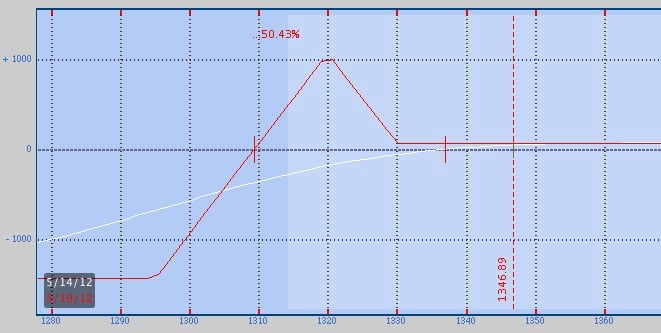

Forex Radar price expectation

Take a peak of our forex radar price expectation video. USD/CAD currency pair has suffered by making the price very weak. Due to these conditions, it had formed break downs at previous lows making “believe” of more downtrends in the currency. But the unexpected is that a rebound comes right after the “fake” break down. SMB forex has recognized these … Read More

This is What a Significant Day of Trading Looks Like

Sent to me from an SMB Trader after the close. Hi Bella, A truly significant day for me, in terms of personal achievements. 1) I was never as big as I played today Last night I was very pissed off about myself. I saw so many occasions where I should have been much bigger but I didn’t. I was being a wuss. … Read More

What Do You Do When You Hit Your Loss Limit?

Over the past 10 days, there have been two occasions where I hit my daily loss limit. Sounds like a tough stretch, but on a net basis it’s actually been positive thanks to some other good days. Mind you, I’m generally a disciplined trader, and in a dozen years of full-time trading I have broken my discipline countless times but … Read More