This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com.

For those who haven’t heard of or traded the SPXpm, take a look at it. It’s an electronically traded SPX product that trades through expiration Friday afternoon and settles at the end of the day like most other options. The regular SPX options stop trading on the Thursday before expiration Friday and then settle to the opening price of the SPX on Friday morning. The difference between Thursday’s close and Friday’s open can be quite significant, and that can be particularly dangerous if you didn’t close your SPX positions before the end of the day Thursday.

Another facet of these options is that they are electronically traded which can mean speedier execution than with the regular SPX. Finally, another big difference is the liquidity in the options as determined by the spread between the bid and the ask. Remember, option volume and open interest aren’t necessarily reliable indicators of liquidity. Look at the “narrowness” of the bid/ask, and the depth of those quotes, and I think you’ll agree that the SPXpm is a very liquid instrument to trade, which of course means less slippage getting into and out of trades.

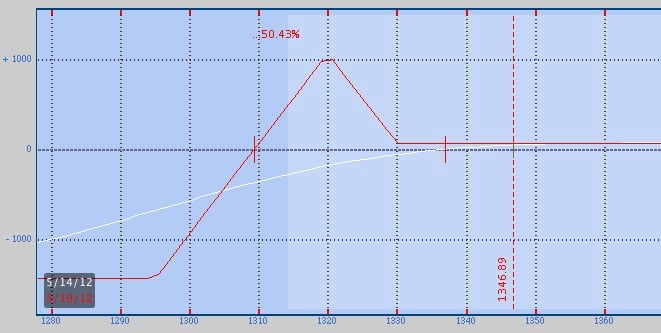

So this week I’ve been tracking a hypothetical broken wing butterfly position on the SPXpm using the May options which expire this Friday. The trade is the May 1330-1320-1295 put broken wing fly. This one is slightly different from all of the other broken fly trades I’ve been tracking in this blog in that this trade uses a wider range of strike prices. As I’ve discussed with my mentoring students over the past few weeks, tweaking the strike prices is incredibly important to achieve a particular trade that will potentially react the best to market movement. Moving one leg of the fly even one strike up or down can make an enormous difference. In fact I’ve been tracking a fly in my trade alert service that synthetically creates a strike that doesn’t exist – all for the purpose of creating what I think is the best potential position.

Here’s a look at the risk of this hypothetical May trade.

Trade safe!

Greg Loehr

Optionsbuzz.com

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commisions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

No relevant positions.

One Comment on “Expiration week and the SPXpm”

What happened to this trade? I did not see a follow up.