Yes. As long as a stock is offering excellent risk/reward setups over and over I will keep talking about it. And for those of you who don’t know me personally it is not in my nature to repeat myself. I prefer to explain a concept once and then move on to something else. But apparently two blog posts, 5 mentions … Read More

Finding Repeatable Patterns

After the close we discussed some plays from Stocks In Play yesterday. When we look at a stock we search for patterns. Patterns that repeat. Patterns that make sense to us. Patterns that we can work at to master. So for these three stocks we are making risk/reward trades with the patterns we see. We have a full playbook of … Read More

Reversal Rehearsal

I have noticed recently a lot of money being made on the desk via reversal patterns. A reversal pattern is when a stock that has trended in one direction stops trending and then begins a new trend in the opposite direction. Reversal patterns can be much easier to trade than the initial trend as they usually unfold over a longer … Read More

Have you seen the new weeklies?

This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. A simple return of 9% per week on average. That’s what my hypothetical trades in this blog over the past two months or so have done. And although hypothetical in nature these trades were all identified and tracked … Read More

A 2 Day VWAP Trade (CNC)

During a daily review an SMB Trader wrote this about his trading in CNC: CNC pulled back to 2 day VWAP and break out area from yesterday. Waited for break in intraday downtrend to get into this stock. When it began to hold above .70 I was up to 1,200 shares from .72. Was waiting for the push through .80 … Read More

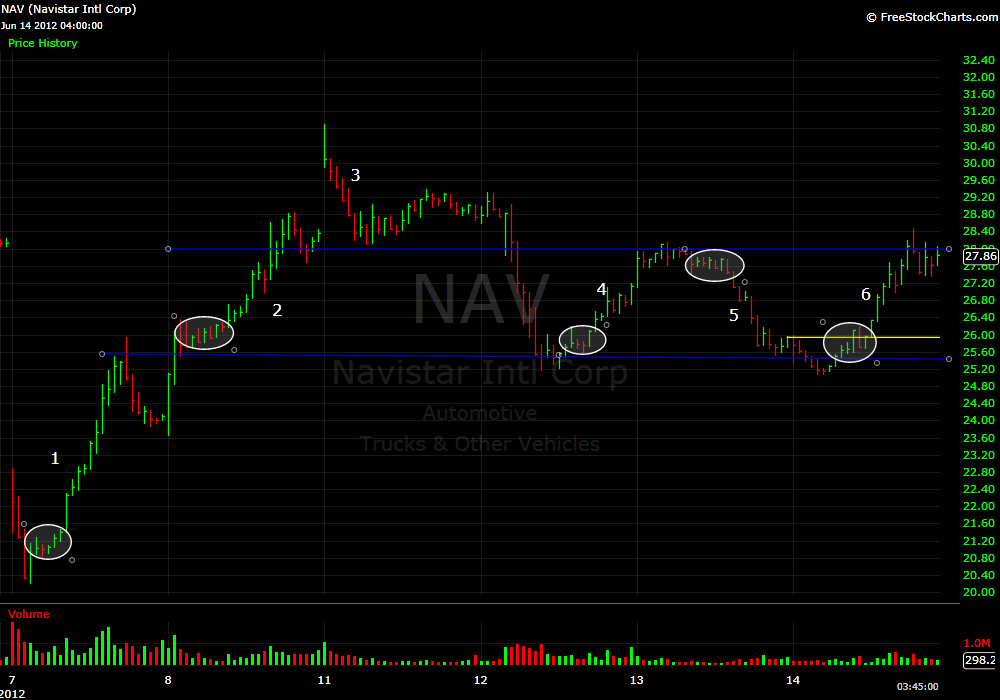

Imprint These Images On Your Brain

I tweeted the following this afternoon: there is “easy money” and “hard money” in trading. your longevity is determined by which one you choose to pursue…$$ I had quite a few responses. Some traders pointed out trading is not easy. And of course I agree with this. Trading successfully requires thousands of hours of practice and skill development. But once … Read More

Learn to Process the “Noise” to Improve as a Trader

I received this email from a prop trader: I’m very disappointed with the way I traded today. I had two more paragraphs written here explaining some potential causes for my under performance. When I started to write the third I realized how simple it all is. To summarize those thoughts, I get worked up and anxious when trading on the … Read More

The myth of the pain threshold

An SMB Trader during his daily review wrote: Today was definitely a day to really pick your spots for initiating trades. I think for the most part I selected the right stocks today but just had trouble managing some of the trades namely in FB and FAST. Something I thought about today after getting stopped out of a FB short … Read More