Steve Spencer talked to Fox Business about the impact the Facebook IPO has had on investor psychology. * No relevant positions

Credit or debit? And the Art of Position Sizing

This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Throughout this blog I’ve been tracking various hypothetical positions on AAPL, SPX and most recently the SPXPM, using time frames lasting from one week to three weeks. And each time the strategy has been the same: a broken … Read More

Is bad really bad? (Part II)

Yesterday I wrote Is bad ready bad? Today we follow up on this idea by looking at the work of legendary traders/investors. Over the past few years I have noticed some good coming out of what I first thought was all bad. When I lost my mom there was at first only loss, but then I recognized some good. When … Read More

Is bad really bad?

Over the past few years I have noticed some good coming out of what I first thought was all bad. When I lost my mom there was at first only loss, but then I recognized some good. When my dad had a stroke it was at first so horrible, but then some good. When we lost a mess of traders … Read More

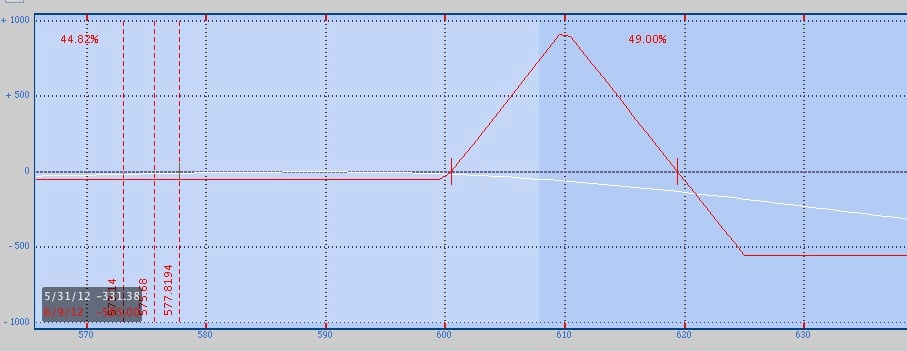

Why FB was a long

I stress for our traders to trade with the trend. We teach generally that if a stock is in a clear downtrend to follow that trend. There are exceptions. FB today was one such exception. After the close I pinged to our traders: Why would it have been correct to get long FB today even though it has been in … Read More

When The Price Action Changes–Facebook

Facebook had been an great swing short since Tuesday morning when it made a new post IPO low. It continued to make lower highs and lower lows. The definition of a “downtrend”. You were hard pressed to spot two consecutive green bars on the 15 minute chart and the few times that did occur there was very little volume and … Read More

New AAPL weekly ‘fly and SPXPM update

This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. The hypothetical butterfly on the SPXPM is progressing nicely. You’ll recall that this was instituted as a “longer-term” trade compared to the weekly broken wing butterflies that I had been tracking on AAPL and SPX. So for now … Read More

Midday Review – May 25th 2012

On this review, Steve reviews PAY and explains why we focus on trading stocks with this pattern. Also references GMCR, NTAP and FB. * No relevant positions