SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. Today, Greg Harmon of Dragonflycap.com will be discussing the use … Read More

Free Webinar Tuesday, September 11th at 5pm EDT : Greg Harmon of Dragonflycap.com Options opportunities emerging from technical analysis.

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. Next week , Greg Harmon of Dragonflycap.com will be discussing … Read More

TRADING THROUGH A HURRICANE

The storm was brewing in the Gulf of Mexico. I had been tracking it for a week, and it was only a matter of time before it would bring tremendous amounts of rain, damaging winds, possible tornadoes, and dangerous flooding to my area. Twelve hours before Hurricane Isaac was projected to hit my area, I told Andres (Salazar) and Bradley … Read More

Free Webinar Today at 5pm EDT: Iron Condors with author Michael Benklifa

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. Today, Michael Benklifa, author of “Profiting with Iron Condor … Read More

Free Webinar Tuesday, September 4th at 5pm EDT: Iron Condors with author Michael Benklifa

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. Next Week, Michael Benklifa, author of “Profiting with Iron … Read More

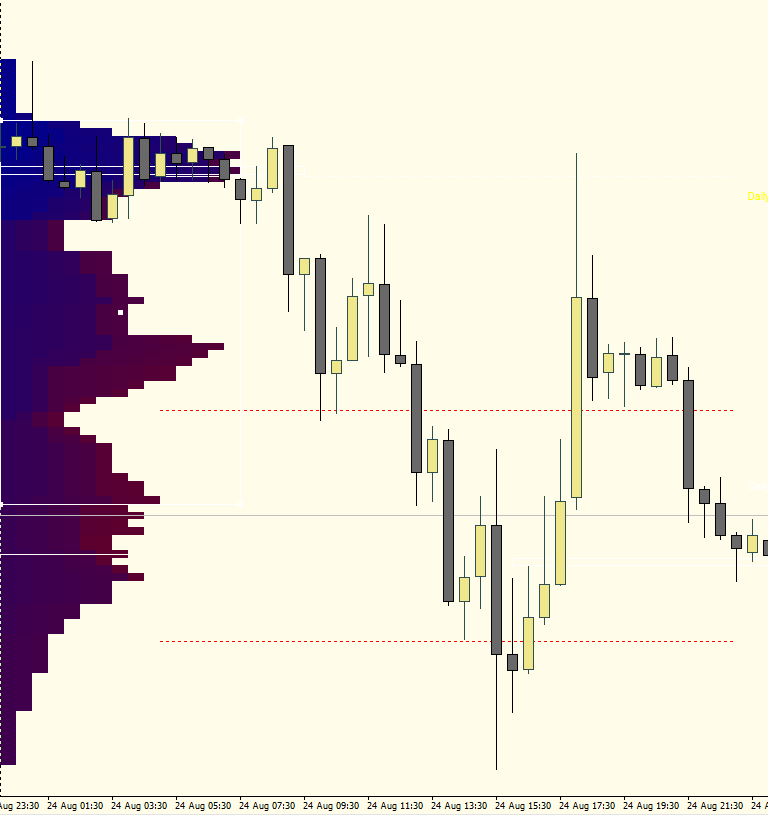

Unleashing Trading Potential: Leveraging Market Profile Strategies

The new trader is usually in a rush. They want to be handed a system that will make them profitable practically overnight. A professional and consistent trader is one who is usually informed in a way that goes against the conventional. Getting to that level of knowledge requires building enough experience with conventional information so that you can make it … Read More

Free Webinar Today at 5pm EDT: Russell Rhoads of the CBOE discusses the $VIX index and $VIX Option Trading

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. Today, Russell Rhoads of the CBOE returns to discuss … Read More

Free Webinar Recording – Trading Follow Through Trades with Steve Spencer

The theme for Steve Spencer’s 2012 Webinar Series will be “Do the Right Thing”. On the third webinar of the year, Steve discussed how to enter follow through trades in the days following a powerful earnings move. He discussed GMCR, FSLR, FOSL, KORS and LNKD. Trading Follow Through Trades with Steve Spencer from smbcapital