In this video Seth Freudberg discusses why he has a problem with the term options income trading. Find out why!

The Best Setup for New Traders: A Changing Fundamentals Trade ($M)

What is the best setup for new traders to trade? A Changing Fundamentals Trade! With a Changing Fundamentals Trade, one day the fundamental strength about the name is substantially different than just the day before. These trade setups tend to move faster than the broad market (both up and down.) They trend intraday. They can trend for 1-3 days for … Read More

SMBU’s Options Tribe Webinar: Options Tribe Member Cat Miles Presents: “The Little Old Lady Trade”

This week, Options Tribe member Cat Miles makes her debut presentation to the Options Tribe community. She will be presenting her approach to covered calls.

Happiness Precedes Trading Success Webinar

Many traders believe they will be happy after they become profitable. In fact, first comes happiness, which then can dramatically propel elite performance. Enjoy the Webinar! *no relevant positions

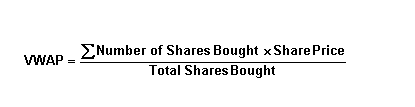

Using VWAP to gain a trading edge

Newer traders often ask us “which indicators are best?” Maybe you have one or more of these indicators on your chart: MACD Bollinger Bands RSI Stochastics SMA EMA Parobolic SAR and on and on and on It must be very confusing for the new and developing trader to find technical analysis tools to gain a trading edge. It must be … Read More

What to Do When Your Bearish Ideas Aren’t Working?

In this video, Andrew shows you the results of a 5+ year back test using VXX and UVXY.

Happiness precedes trading success

Many traders believe they will be happy after they become profitable. In fact, first comes happiness, which then can dramatically propel elite performance. Shawn Archer author of The Happiness Advantage, explains in this article Positive Intelligence: In fact, it works the other way around: People who cultivate a positive mind-set perform better in the face of challenge. I call … Read More

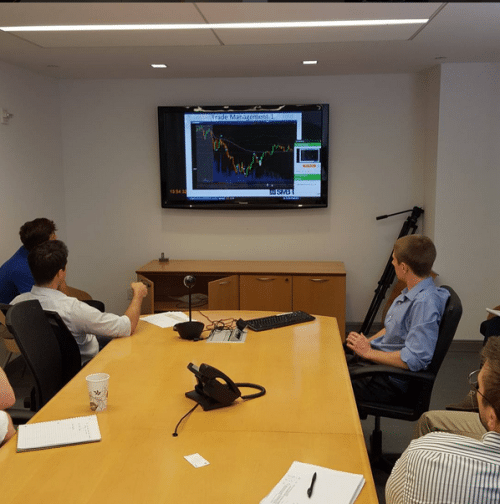

Key Trading Levels from Our Desk

This is an example of one of 15 meetings that are available each week to members of Trader90.