Hi Michael, I love One Good Trade. A book on Trading has never been so insightful yet so simple and engaging. Even Mark Douglas and (xxxx) can borrow a leaf or two from the simple, familiar language. I love it. Currently shopping for The PlayBook. Back to trading; in ‘One Good Trade’ you advise traders to avoid stocks with high … Read More

How to make better trading decisions

In this Ted talk below, writer Julia Galef argues that making good decisions is dependent on employing a scout mindset. This talk is helpful for us as traders to make the best trading decisions. Galef breaks mindset into two categories: scout mindset and soldier mindset. The soldier mindset defends their ideas. This “motivated reasoning” tries to make some ideas win … Read More

Trade Options Like an Atom Bomb is About to Go Off in Times Square

In this video Seth Freudberg discusses why it’s so important to have a contingency plan for your trading. Traders never know when something unexpected will happen. Professional Traders always have a contingency plan for unexpected market events. This video reviews some of the viable contingency plans that are used by professional options traders.

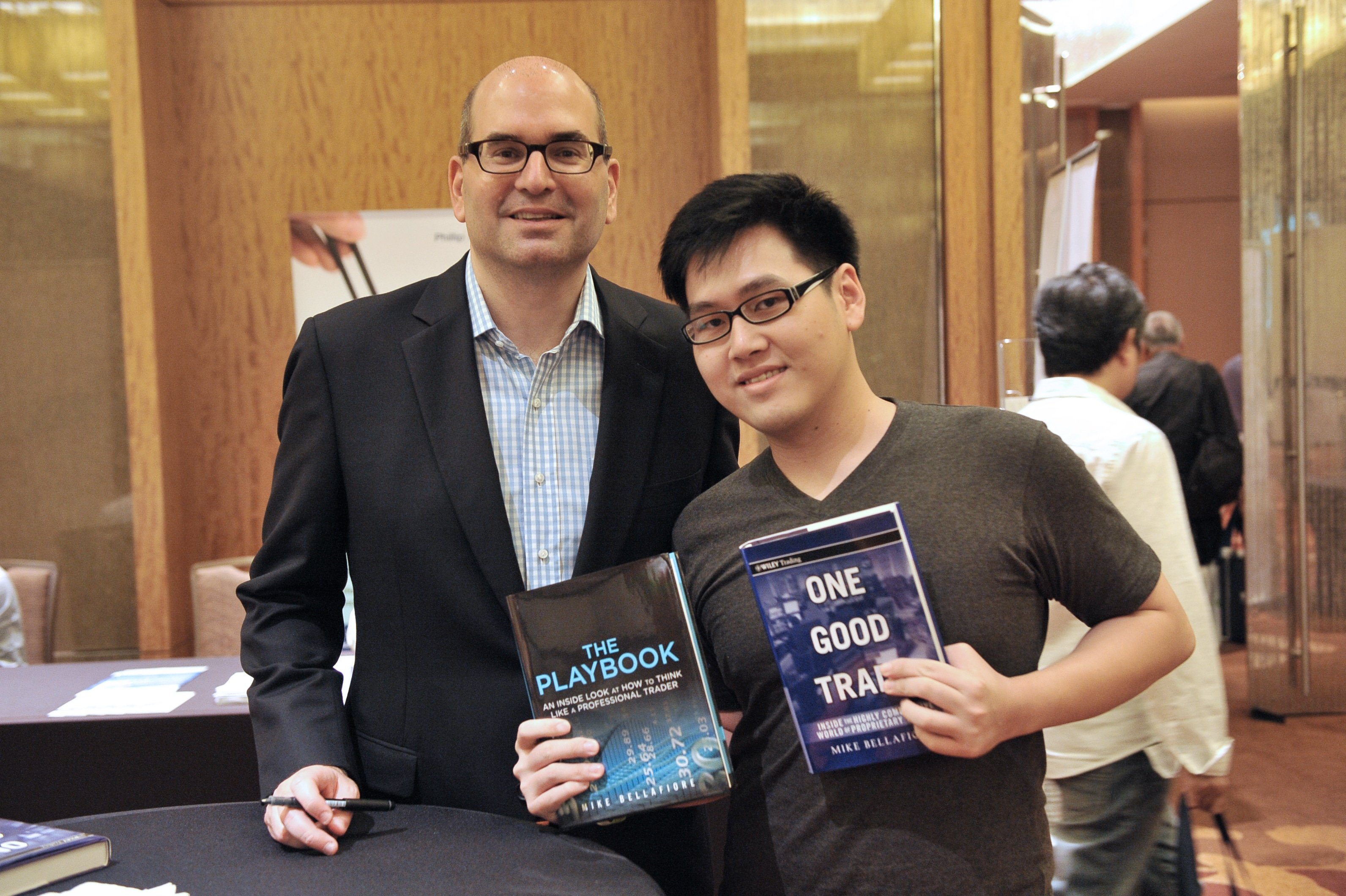

40 trading lessons from The PlayBook

An experienced and successful trader is starting with our desk, powered by Kershner Trading Group, next month. He is one of the more diligent traders you could meet. I have compared him to Tim Tebow in One Good Trade for work ethic. He just powered through One Good Trade and The PlayBook to improve his trading game and better prepare … Read More

SMBU’s Options Tribe Webinar: Bruno Voisin: The Rhino Options Trading Strategy

This week, Bruno Voisin makes his debut appearance on the Options Tribe presenting how he trades the popular Rhino options trading strategy.

Things heard on the prop desk this Monday

Monday’s strength was surprising to some prop traders on the Street, after the huge down move Friday. Let me share some things heard on our prop desk, and then make a trading point. Me: didnt expect today Trader: it’s just so annoying Me: yes yes yes. but good example of…..its our job to trade the market not expect the market … Read More

Man I stink II!

The feedback I received was decidedly positive that Man I stink! was very helpful for traders. It placed in context the challenge many face to become consistently profitable traders. The new trader wants so badly to be a successful trader. Most have succeeded at most things in their life prior. They expect success quickly. And it does not work like … Read More

Man I stink!

There are four traders in our September trading class, chosen from thousands of applicants. 16 days into his trading career one our new traders wrote this review: At the start of your career you are supposed to stink. The path of many traders is: 1) lose too much 2) lose less 3) flat 4) slightly positive 5) consistently positive 6) … Read More