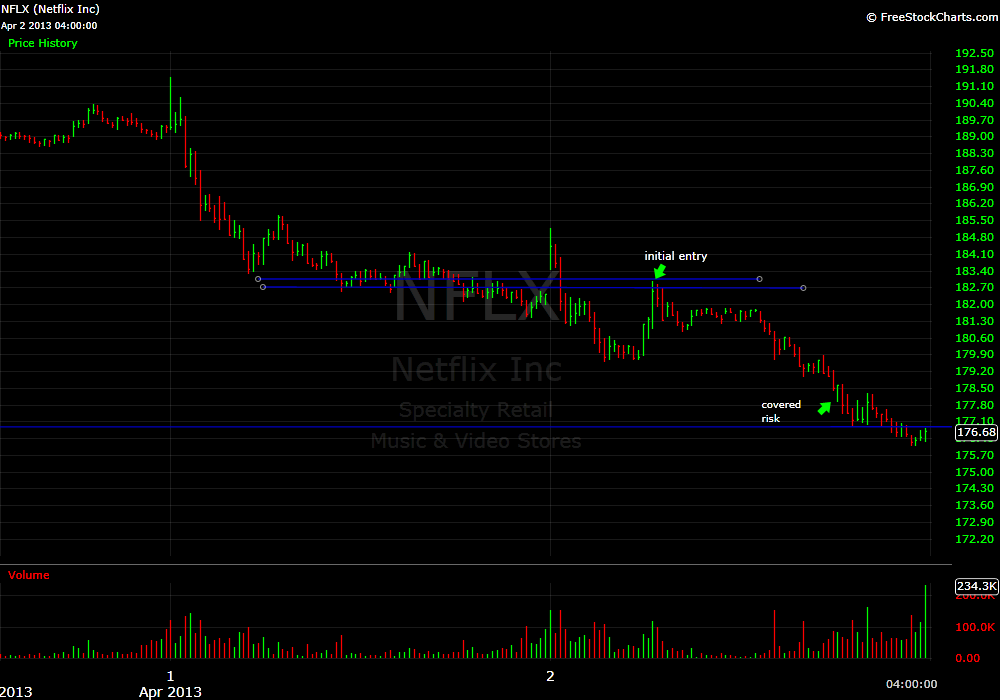

NFLX had a very powerful downtrend the prior day when it broke the March 28th support of 188.70. I was continuing to monitor it for a break of the 180-179 area. I missed the initial short entry on the Open when it held below 182.

As luck would have it I returned to the desk just as NFLX was spiking up to an important support area from the prior day’s trading range. I quickly placed a series of offers from 182.75 to 182.90 to get short. I was operating under the assumption that this quick spike would fail and that entries so far from the morning’s support area would put me in a position of strength for a swing short.

NFLX had just taken out the morning low of 179.60 and this was my heads up that it wasn’t too late to get involved.

I wanted to share how quickly the spike into 180 had failed as traders were using any type of pop to sell the stock. As stocks build momentum in one direction the pullbacks tend to become shallower and shallower as more traders attempt to pile on. This quick failure of a shallow pullback increased in my mind the chances of NFLX testing 176 support shortly.

On a day that I was on and off the desk a bunch of times I felt fortunate for such a great initial entry and to be in a position of strength if NFLX continues the downtrend tomorrow.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 17 years. His email is [email protected].