I thought I would kick off the month, and my blogging at SMB, with a look at major market sectors and money flows between those sectors. I will also share an analytical tool I have found useful when trying to understand sector strength and rotation.

Though there are a few competing standards, the market is traditionally broken down into 10 major sectors: Energy, Basic Materials, Financials, Consumer Discretionary, Consumer Staples, Technology, Telecom, Utilities, Health Care, and Industrials. (A good reference can be found here.) Some of these sectors are considered defensive, meaning that money will usually flow into these sectors when investors are feeling risk-adverse. The thinking is that people are going to need electric power, toothpaste, cleaning supplies and telephone service regardless of the condition of the economy, so these companies should be relatively (key word) insulated from a downturn in the economy. Cyclical stocks have more natural exposure to the business cycle, and may be considered more or less speculative, as money will often go into these sectors when investors are feeling confident and are seeking outsized returns. This is, of course, a gross oversimplification, but it is important to keep this framework in mind.

Most textbooks will tell you that there are only three defensive sectors: Consumer Staples, Utilities and Telecom. I would argue several points:

- Telecom now includes an ever-increasing percentage of cell phone and wireless data service which may introduce an element of cyclicality, making this sector less defensive.

- Healthcare probably occupies a gray area between defensive and cyclical.

- Many people think that movements in Materials, Industrials and Energy stocks have great forecasting power for the future of the overall economy. I would argue that most of these companies are very good at hedging, which smooths out their revenue streams and reduces their usefulness in this regard (and also, by the way, reduces their exposure and sensitivity to the price of the underlying commodity).

- There are degrees of cyclicality. Retail stocks and consumer discretionary in general are probably ultra-cyclical. The surprising resilience of many consumer stocks through the financial crisis of 2007-2009 (TRLG, BKE, BID, etc) was, to me, a clue that the stock market was probably going to recover faster than most people thought likely.

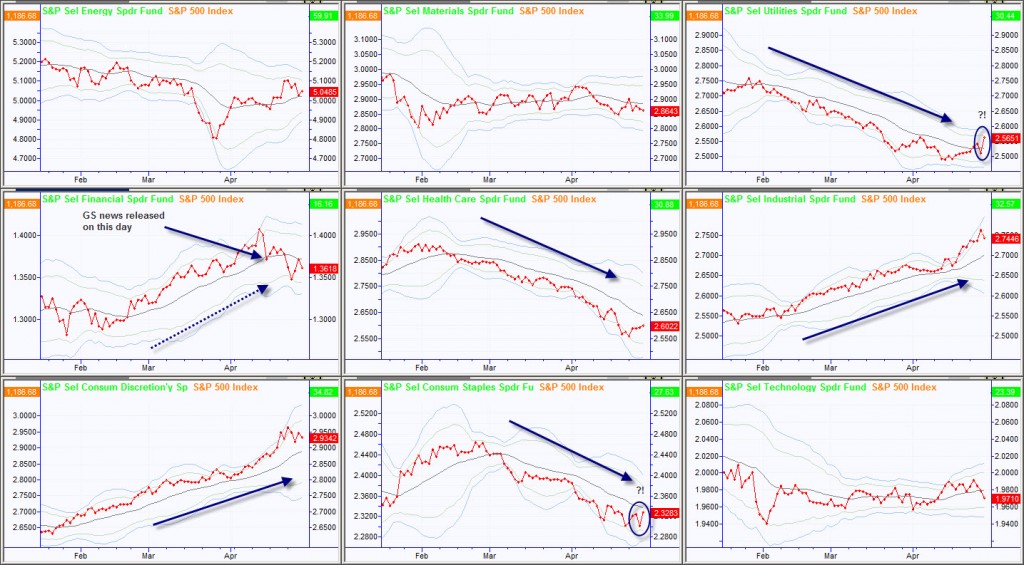

To understand sector rotation and money flows, it is important to consider sector movements relative to each other and to the overall market. That consumer discretionary stocks are up 20% over a specific time period tells you nothing. What if the broad market was up 30% or down 5% in the same time period? A completely different picture. I have found it useful to create spread charts for each of the sectors by dividing the price of a sector index (the S&P Sector Spyders such as XLE and XLF are useful for this purpose) by the price of a major market index such as the S&P 500. The result is a line that shows the relative performance of each sector to the S&P which immediately highlights strength and weakness between the various sectors.

The chart above shows the performance of the nine S&P Sector Spyders (Telecom is merged with Technology) relative to the S&P. Each dot on the red line is a separate trading day, the black line is a moving average which shows the longer-term trend of over/under performance, and the light colored bands show when the relationship has reached an extreme level. Though this page was produced in TradeStation, you certainly could build these charts in Excel using free data available from Yahoo! Finance. Several points are interesting:

- Consumer Discretionary, Financials and Industrials have led the market for much of this year, while Utilities and Consumer Staples have lagged. This is precisely what we would expect if the bulls are feeling confident.

- The defensive Staples, Utilities and Health Care have lagged the recent (March – present) drive in the market. This also is consistent with investor confidence.

- The pounding that Financials took following the GS news is very obvious on these charts. The XLF/SPY spread completely traversed the overbought/oversold bands within a week, which is an unusual move.

- Consumer staples and Utilities strongly outperformed the broad market Friday.

This last point really caught my attention as I did my review over the weekend. We know the market has been in a mode where every dip has been bought with confidence, and shorts have generally been punished quickly and efficiently. A lot of guys on our desk have correctly observed that, for the past few months, the market pretty much does nothing but go up. This week was different. We finally saw a break in this pattern as we had several days where the market was unable to lift off the lows and closed down on pretty good momentum. For the first time in a long time, the sellers seem to be in control. The question now is, is this the beginning of a downturn that will last several weeks to several months, or can we expect to quickly recover and head to new highs? There are certainly good arguments on both sides of the fence, but I would suggest that, if we are going to turn back up quickly, we should not see sustained money flows into defensive sectors. Friday’s strength in Utilities and Consumer Staples is another warning shot for the bulls.

12 Comments on “Major Market Sectors and Money Flows”

Welcome! 🙂 Excellent!

Welcome! 🙂 Excellent!

great info.

great info.

Great post, very informative. Thanks a lot !

Hopefully you’ll post again in the future 🙂

Great post, very informative. Thanks a lot !

Hopefully you’ll post again in the future 🙂

This explanation was very helpful-thanks

This explanation was very helpful-thanks

Nice perspective on the broader market. Would you consider a comparison against the bond and precious metals ETFs worthwhile? Just curious. Thanks for your sharing your analysis.

Nice perspective on the broader market. Would you consider a comparison against the bond and precious metals ETFs worthwhile? Just curious. Thanks for your sharing your analysis.

Thank you all for your kind words on this post.

@Chris: Short answer is I don’t know. The reason the sector to S&P comparison makes sense is that the S&P, issues of weighting aside (and they can be significant issues), is actually composed of the individual sectors. While you could certainly do relative strength for instance between precious metals, softs, grains, etc I’m not sure exactly how that would work… just a little outside my area of expertise in that regard.

I would caution against a naive interpretation of any of these measures. In other words, if you create the tool be sure you understand it, what it is telling you, and how it may act under extreme circumstances before you start putting any weight on it in your trading decisions.

Thank you all for your kind words on this post.

@Chris: Short answer is I don’t know. The reason the sector to S&P comparison makes sense is that the S&P, issues of weighting aside (and they can be significant issues), is actually composed of the individual sectors. While you could certainly do relative strength for instance between precious metals, softs, grains, etc I’m not sure exactly how that would work… just a little outside my area of expertise in that regard.

I would caution against a naive interpretation of any of these measures. In other words, if you create the tool be sure you understand it, what it is telling you, and how it may act under extreme circumstances before you start putting any weight on it in your trading decisions.