Friday was an interesting day for me. We had a large down move Thursday followed by a large drop in overnight futures. When we see this sort of price action we immediately shift our AM Gameplan to a discussion of market related ETFs as with more volatility they offer the least risk with good upside. We also want to look at market leaders such as AAPL and FB where money will flow in the event of a market bounce. With all of this excitement I also knew that I would be trading less than a 1/2 day as I had planned a surprise 50th anniversary party for my parents, which required me driving to Long Island by midday.

With the above back drop in mind I planned to buy stocks around key support levels outlined in this written game plan. I understood that unless the market behaved in a very specific way I most likely would miss out on the majority of trading opportunities for the day.

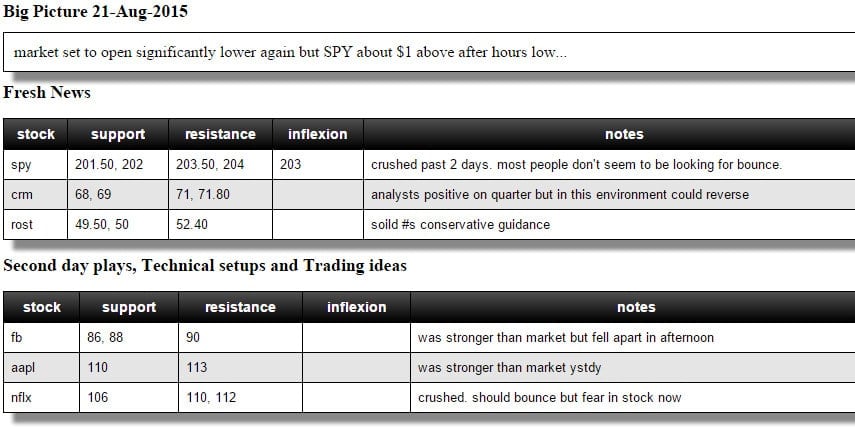

As I had mentioned on Thursday on StockTwits I bought SPY around 203.25 in the after hours and the odds were good for a gap higher on the Open. Thursday’s close was 203.90 so my after hours purchased gave me a bit of a “cushion” even if there was a gap lower. Futures dropped overnight indicating a SPY equivalent low of 201.50. The next morning I woke up and SPY was just about where I had bought it in after hours. I decided to take no action until we got closer to the Open to give the market a chance to trade above Thursday’s close. By the time I began my AM Meeting SPY had failed around 203.50 and was $1 lower. It was fairly clear the market would have a gap down Open and I would need to adjust my trading plan in SPY to trade against the overnight low vs. the pre-market high. Here are some of the trades I executed Friday morning.

There was never enough of a bounce on the Open in the SPY for me to get positive in the name. As you can see from the “inflexion” mentioned in the game plan what was needed was a clear hold above 203 for buyers to take control and have a strong bounce into 204-204.50 (support for most of 2015). Make sure to pay close attention to this area when we do bounce as it is a likely area for longs to sell and many to establish good risk/reward short positions.

The next stock is CRM that reported earnings. Numbers were good and management seemingly was very conservative on guidance. It bounced off of after hours lows and I thought was a good short setup mainly because of deteriorating market conditions. The counter argument is even on days market is getting destroyed the dollars need to flow somewhere. I entered an auto-scrip to short 71 and cover above 71.50. First move was down so I didn’t get executed. Got shares later but was stopped out. It’s worth noting that CRM held 68.50 support three times Friday.

The next stock is FB, which I bought a small position after hours on Thursday above 90. It was set to open below 88 so many eyes were focused on the next major support of 86. It quickly flushed to the 86 level right on the Open and I was able to get long for a quick snap back to 88. I sold most of the position and put in a stop below 87 for my remaining shares plus what I bought when it pulled back to 87.30s after 10AM. This is one of the few stocks outside of the index ETFs I will be focused on being long for a market bounce next week.

The final stock to discuss is AAPL which is now down more than 20% from its all time high. Unless the fundamentals change in this stock it has limited downside from its Friday closing price below 106.

I also sold the remainder of my NFLX puts for $14.25 right on the Open, which I had bought earlier in the week for 56 cents. I got long stock in the pre-market below 106 as this was where it broke out from in late July before trading to 129. The trade initially worked bouncing to the 110 level on the written game plan but eventually rolled over with the rest of the market.

One thing to keep in mind when the market becomes this nasty as most stocks will trade down to major support from the past few months. The key will be how they behave at those levels. Is large volume done at these areas and do stocks hold these levels or at least significantly slow the rate of descent setting up a bottoming process that can lead to a tradeable bounce.

This is a different market than we have had in recent months. There should be more of a focus on trading move to move with shorting holding times. Some setups that worked well recently will no longer work. We are holding a webinar after the market close to discuss market structure and trading setups that make sense in this sort of environment. Sign up below.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 19 years. His email address is: [email protected].

Steven Spencer is currently long AAPL & SPY