News can cause major movements in the currency markets. Many newer traders like to believe that it is possible to trade news events profitably. That idea gets really old fast and/or your account goes to zero faster. Either way as the newer trader gains experience they realize news trading isn’t the most productive strategy.

The question is how can we use news to help shape our decision making process? To answer this question, we need to first understand the role of market news within the context of price action.

News acts as a catalyst for price volatility and can generate enormous momentum in either direction. To simplify its purpose, I like to think of news as a source of randomness in the price action. It doesn’t pay to anticipate market reactions because there are too many variables involved some of which we have no way of knowing. Couple that with liquidity problems and poor execution from most retail brokers, trading news becomes comparable to playing the slots. Slots are actually a better deal because you get pretty lights, graphics, sounds, and drinks.

All kidding aside, in my opinion the best approach is to let the market process the news on its own, and then look for opportunities once prices settle.

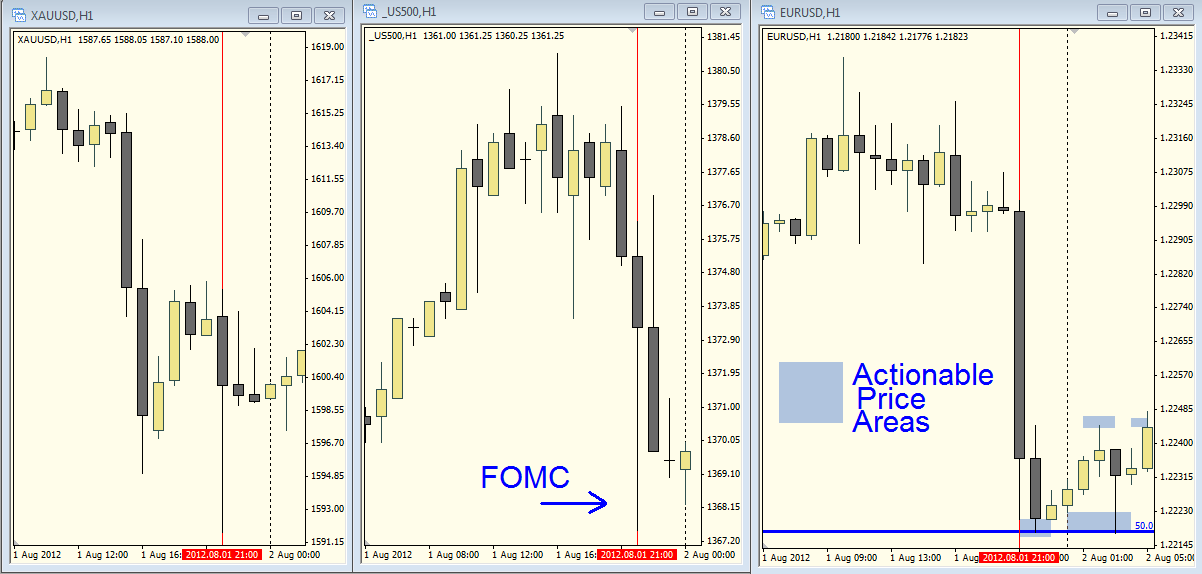

For example let’s look at the recent FOMC decision. The Fed left rates unchanged. On the surface, this is generally dollar bearish or at least neutral. When you look at it within the context of the current global economic environment as market participants did, the reaction was dollar bullish. This outcome caused an equities, currencies and commodities sell off. See the chart examples:

Actionable Prices Area shows where scalping opportunities emerged after the news was priced in.

So if you are not in tune with the true nature of the market sentiment, how can you gain an advantage in terms of consistently taking the right side of the reaction? I think it’s much easier to treat it as a random event.

As retail traders, I believe we have no edge in the news game. What I like to do is simple: Wait. Let all the larger and better informed participants figure it out and take all the risk. As the market processes the news and pushes prices to one of these levels, this is where I am concentrating my price action analysis. This is where I am looking for the specific buying or selling activity that offers enough clarity to measure risk from.

The patterns will eventually emerge and I can take well informed risks in the midst of what appears to be news driven madness.

The lesson to take away is this: Be aware of important scheduled economic reports and other news items. Let the market react the way it wants to and don’t be distracted by large moves and accompanying hype. Stick to your levels, price action analysis and risk control, and you will at least be able to view news as just an event that can lead to an opportunity instead of getting caught in the middle of it.

Marc Principato

Director of SMB Forex

* No relevant Positions