My best stock in 2007 was RIMM. It had an incredible run trading up over 400% as AAPL made the world believe that smartphones were going to become a mainstream consumer product. The massive move in RIMM offered a multitude of short term trading setups. Several years later after the smartphone market exploded it was clear that there were two winners and RIMM wasn’t one of them. But as the market often does it overshot in the other direction as most assumed BBRY (ticker changed) would be going out of business sooner rather than later and the stock traded down to about $6.

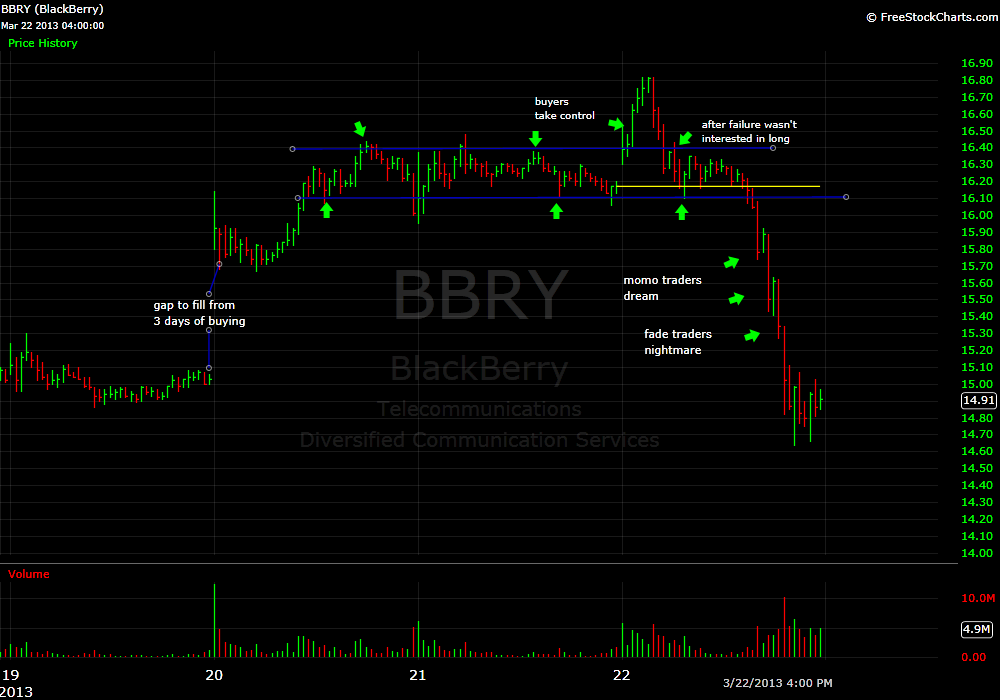

In the past six months it has been in an uptrend and more recently its volatility has picked up considerably. It went from a beaten down stock that made me cringe each time a trader on the desk would mention to at least a Top 10 momo stock. Yesterday I featured it in our AM Meeting as my #1 technical setup for an upside breakout. See the annotated chart below for a description where we traded it long in the morning.

But then around 10:40AM there was an increase in selling pressure and BBRY dropped quickly. Apparently there was a news story on CNBS that there weren’t lines for the new Blackberry 10. I have to admit I chuckled when I heard that information called out on our desk. Has anyone in the history of Blackberry actually waited in a line for a release of their newest product? So my first reaction was look for a spot to load up into 16.40 as this was most recent breakout area.

During the next 30 minutes BBRY began to hold below the 16.40 breakout price as the sellers were in control and was no longer a good long candidate in my opinion. The price action began to compress and someone called out on the desk that BBRY was beginning to show more weakness. That trader got short and about 20 minutes later it began an amazing momentum move to the downside.

I’ve written in the past about how I Love Being Wrong. As a short term trader I will come up with a trading thesis based on my observation of the price action. Many other traders are making similar observations so that if a stock moves in the opposite direction of my original thesis I am confident that many are trapped in positions that they may try to exit. This will create amazing opportunities for the nimble trader with good trading technology. On a separate note don’t be the trader who falls into the trap of buying into the vicious change in direction. You can ruin a good day or even a week with that type of trading.

So long story short, BBRY went up 40 cents from my breakout price on the Open and then dropped $1.50 in the afternoon in a slow to develop reversal that offered several safe entries before the momo party began below $16. That is the kind of price action we love!

Check out SMB AM Meeting and SMB Real Time so that you are in the best stocks. We are only as good as the stocks that we trade!

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 17 years. His email is [email protected].

No relevant positions