In the fall of 2010 I wrote a post called “The Money Trade“. It outlined the mindset of momo hedge funds and how when they all decide to pile into growth stocks such as CMG, FOSL, CRM, LULU etc. you can quickly identify their fingerprints via after hours and pre-market price action. A few days ago LNKD reported earnings and … Read More

Can You Tell The Difference?

There are three ways short term traders lose money: incorrect analysis, expectancy (a certain % of trades just don’t work), or making trades based on emotion (this one is a biggy for most). Take a look at the price action from GMCR and QCOM after they reported earnings. Since the initial down moves on the Open one has been a … Read More

The AMZN Trade

Here is the followup from my earlier post titled “The Value Added Tweet“. I will break down my thoughts in bullet points to move this along so I can try to get some sleep. AMZN has a history of being bought on large gap downs after earnings. Even if it doesn’t fill gaps it still is capable of having large … Read More

The Lens Matters (2)

Last week I wrote a column talking about how I had moved towards using 15 minute charts more often intraday to keep me focused on a stock’s most relevant trend. I still use lower time frames and the tape to identify the best entries but the higher time frame view will inform whether I am short or long. I thought … Read More

Measuring Opportunity Intraday

After having trading professionally for 16 years I still find the lack of understanding among friends and family as to how myself and other short term traders make a living humorous. Here are some of the comments I still hear on a regular basis from my parents and close friends “Market was flat today so I guess you didn’t make … Read More

The Lense Matters

One of the questions I am asked most frequently by aspiring traders is what time frame do I use on my charts for intraday trades. My stock answer (no pun intended) is that from 9:30-10:00 I am looking at 1min or tick charts and then I zoom out to 5min. But recently I have found that a 15 minute view … Read More

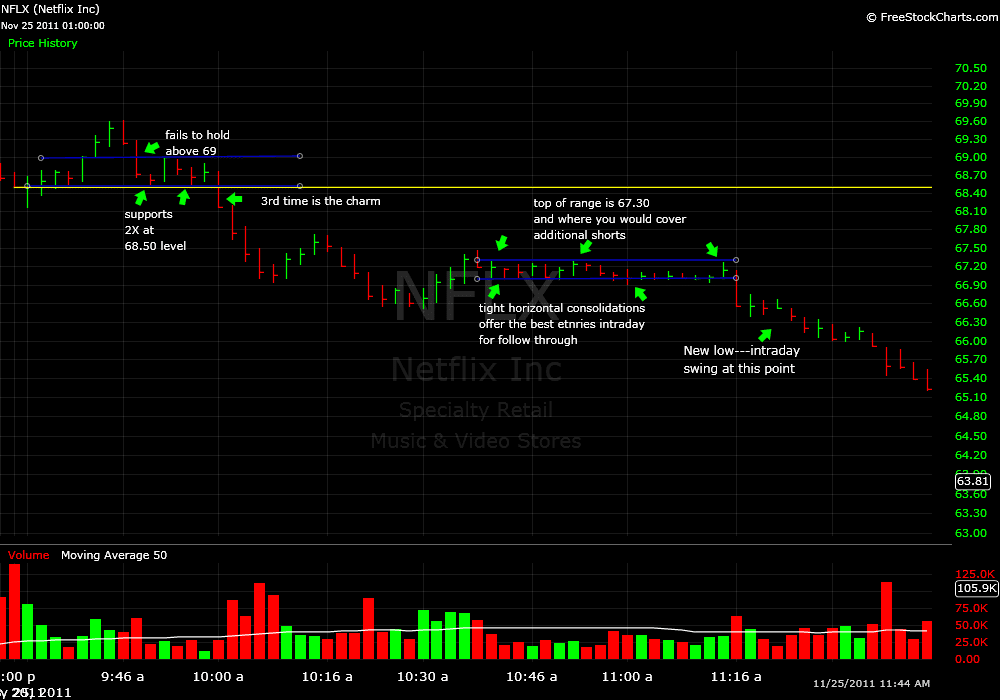

Using Prior Days’ Price Action–NFLX

Prior to the Open of Friday’s shortened trading session there was not much in the way of fresh news catalysts. So my first trading choices were second and third day plays. For those of you who are new to the SMB Blog you can use the “search” feature on the blog to review posts explaining how and why we trade … Read More

Looking for a Bounce

When a momentum stock makes a misstep the market is very unforgiving. A few weeks ago we saw NFLX get hammered dropping around 80 points in a four-day period. This caught the attention of many short term traders. When a stock moves that far that quickly there is a lot of money to be made on the short side but … Read More