I ask our traders to only make the *very* best technical trades. Judge each technical trade on a scale of 1-10 and take only those 8/10 or above. What is a Perfect 10 Technical Trade? It’s GENE (Genetic Technologies Limited) from the other day when it traded below a huge technical support level and then dropped 30 percent…in one day….while … Read More

Surround Yourself with Positive AND Negative People: Unleash the Power of Diverse Perspectives

“People are like dirt. They can either nourish you and help you grow as a person, or they can stunt your growth and make you wilt and die.”~Plato I was on the phone with a developing retail trader (let’s call him Saratoga Slayer) who had impressive results in Year1. Why did Saratoga Slayer do so well in Year1 when most fail? He wasn’t sure. … Read More

What Is “Price Action” Confirmation?

I wanted to share a few trades that I executed this morning based on setups discussed in our AM Meeting. Two of the three trades were executed using programmable “scripts” to make it easier for me to manage many positions simultaneously. Once these positions are opened I can trade out of them manually or allow the scripts to continue to … Read More

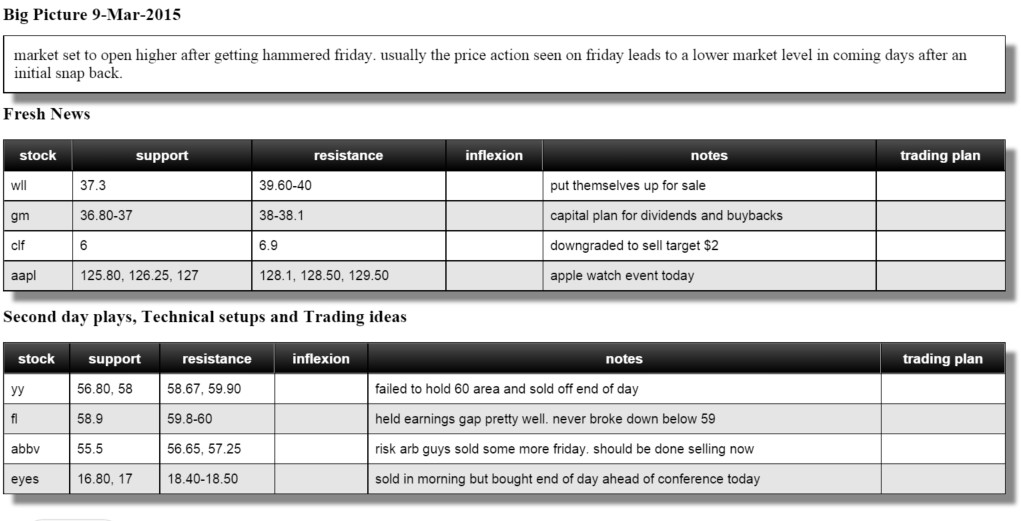

Stock Selection and Game Planning

My morning game plan has helped me navigate some tricky situations over the years. Some days my energy isn’t great due to a poor night’s sleep or maybe I’m just a bit under the weather. Having a clear repeatable methodology each morning allows me to be a bit off but still pull some money out of the market (or avoid larger losses). … Read More

The Pros and Cons of and Keys to Scalping

Hi Mike- Just wanted you to know that you made a huge impact on my trading this afternoon. I listened to your video “The Playbook”. Your statement — “I am too old to be doing scalping” –hit me over the head like a sledgehammer. WHAT???????? So-I was thinking..if Bella is too old for scalping, then so am I. (Darn! … Read More

Only A Few Make It In This Game

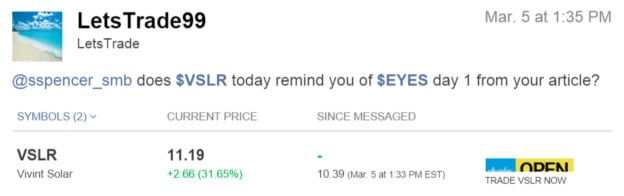

Trading is no different than any performance related field. Many try to make it but few succeed. The other day I wrote a blog Post titled “A Dramatic Shift In Price Action”. It dealt with the stock EYES and a very distinctive change that could be identified on its longer term chart. Today, I received the following question on Stocktwits from … Read More

Enhancing Trader Performance: Does Headline News Matter?

Every day we see the financial media outlets attempt to explain the day’s market action, usually with a headline pointing to a particular event or supposed market moving event that details THE reason the market moved in one direction or the other. The headlines often change from open to close depending upon the day’s action, as the market can be up for one reason in … Read More

Eight Weeks To More Mindful Trading

The topic of mindfulness has exploded in popularity in the broader public. Meditation and meditative activities like yoga are seemingly everywhere, building on the runaway success of books like Eckhart Tolle’s The Power of Now. This whole interest in mindfulness has only just started to filter through into the world of investing and trading, where I think that it can … Read More