In the past few years SMB has built some remarkable trading tools. We led the pack in moving to HTML5 years before others (can use on smartphones and tablets). But beyond the cool technology in Scanner, Radar, and Real Time it is the actual idea flow that comes from very experienced traders. Traders who have spent years learning how to … Read More

Developing new traders into high performing traders at SMB (Podcast with TradingStory.com)

Mike Bellafiore was interviewed on TradingStory.com by Brandon Clay. To see more videos of interviewed traders go to TradingStoryPodcasts or get them on iTunes. Here is an excerpt from tradingstory.com……… Mike Bellafiore – the trading coach developing high performing traders. Mike co-founded SMB Capital with a focus on teaching new traders how to become consistently profitable traders. There is not … Read More

The Fourth Week of More Mindful Trading

In this post, I will continue my eight week experiment with cultivating mindfulness and trading. The earlier posts in the series can be found here: Eight Weeks to More Mindful Trading The Second Week of More Mindful Trading The Third Week of More Mindful Trading To bring new readers up to speed, here is a brief refresher on … Read More

Insider Insights: Lessons from One Good Trade

Marko Gränitz a German trader wrote a book review on One Good Trade by Mike Bellafiore. Below is Marko’s review translated from German to English. Marko: The best trading book: One Good Trade One Good Trade was one of the books that I devoured in no time. A book that absolutely belongs on the shelf. And if you ask … Read More

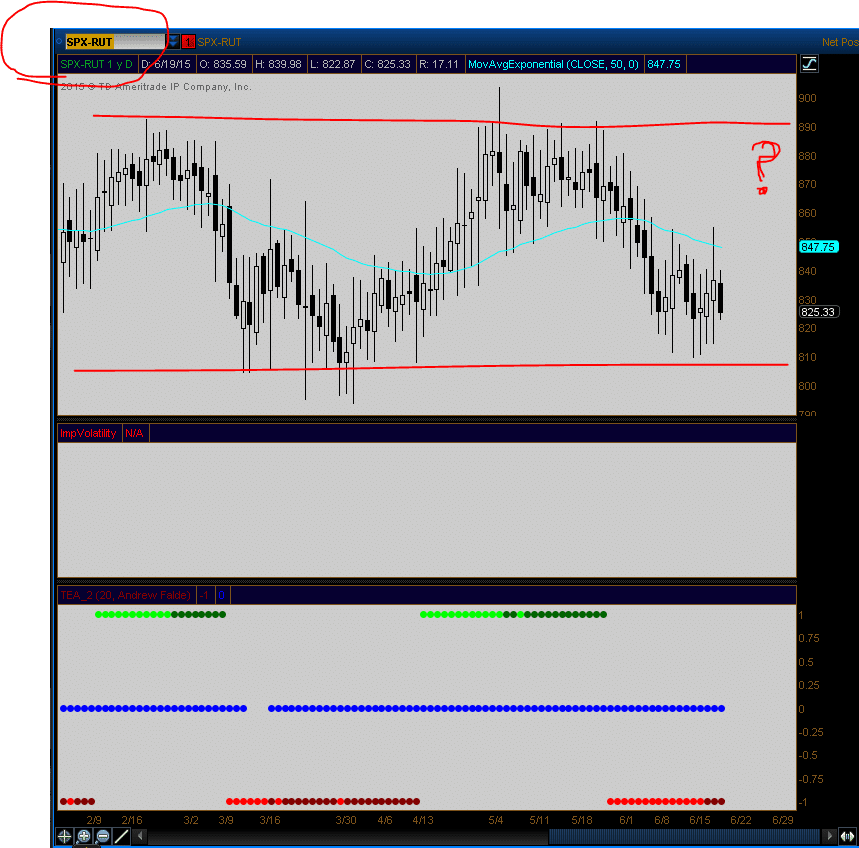

Enhancing Probability: A Guide to Index Mean Reversion Pairs Trade

With RUT accelerating to new highs and the SPX lagging — is there an opportunity for a mean reversion pairs trade? I believe so. The probabilities are high for mean reversion. But, the danger of a mean reversion trade is the possibility of being too early. That is where options can give us additional edges. With options we can “lean” one way … Read More

Oracle Had A Fundamental Catalyst That Made It A Good Short

ORCL reported disappointing earnings after the Close on June 17th. The next morning it traded lower before rallying back $2 with the market. I had two reasons why I thought it would roll over again the next day. One, I believed the large market rally the prior day was the primary driver of its bounce from 41 to 43. Two, after large … Read More

Why Netflix Was A Short Today

Netflix has been on quite a tear since they reported strong earnings in April trading higher by more than $200. But for short term traders who each day look to trade lower time frame trends NFLX offered a good short setup Friday morning. These are some factors I considered prior to sharing the setup in our morning meeting. Netflix had a huge … Read More

A Low Risk Entry For A Long Term Breakout–FEYE

Since the beginning of the year FEYE had been consolidating between 38 and the mid 40s. It has had a lot of positive news flow this year but had many failed breakout between 45-46. I made a conscious decision not to get long in the mid 40s until it cleared all resistance for the year on heavy volume. On May 28th … Read More