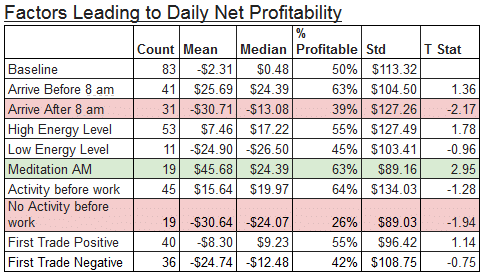

Winning traders embrace the grind. Above is a spreadsheet from a developing trader on our desk measuring his good days and bad. What did he find? When he arrives before 8AM, he is a good trader. When he arrives after 8AM, he stinks. When his activity is high before work, he is a good trader. When his activity is low … Read More

Succeeding with your trading resolutions

It’s New Years Trading Resolution time. And many of you will outline grand plans. And that is excellent. Here is a suggestion to help you SUCCEED with your trading resolutions. You will find some of our well-intentioned resolutions difficult for you to make into habit. The three goals most will struggle with (me too) will be: 1) Journaling 2) Breathing … Read More

10 trading resolutions for you

Happy New Year! Here our ten trading resolutions I wish for you in 2016! 1. I will try to improve each day and stop trying to make money. 2. I will study my trading edge and build from my strengths. 3. I will improve my fitness as this impacts my trading PnL. 4. I will be grateful each day for … Read More

Damn right we talkin about practice!

I had an informative phone chat with a counterpart of mine at a large international prop firm. They house thousands of traders globally. They, like us, back all of their traders. They, like us, have their own proprietary trading technology that only firm traders can use. They, like us, trade many different products. He, like me, trains all of the … Read More

Questions to ask yourself after a trading loss

Yesterday I was trading a stock with a negative news catalyst that was below an important longer term technical support level and intraday VWAP, got short, and took a loss. I would make the trade again. After taking a loss consider whether you would take the trade again. Here are the questions I asked myself: 1) Did I have an … Read More

The unique trader

We as a firm were studying our top five traders this week. Each of them trade a very different style. Said another way, each of them is unique. One is a scalper. Another trades momentum. Another is an inefficiency trader. Another is an arbitrage trader. Still another trades low floats. What is more interesting is that each of them trades … Read More

This is your trading business

We teach a class, SMB DNA, and a student asked this question about the chart above from this class: As you can see from the chart, after price broke above 238.40 and traded above it, price tested and rebounded from the level 4 times. It seems to me that this suggests the level is significant intraday as well. The 3rd … Read More

Buying A Market Pull Back–Part II

In Part I I discussed how I put on the breaks on a planned buy in the SPY on 12/11 when price action lowered the probability of a market bounce. This put me in a much better position to play for a bounce on Monday December 14th. Here is a screenshot of my pre-market game plan where I share my … Read More