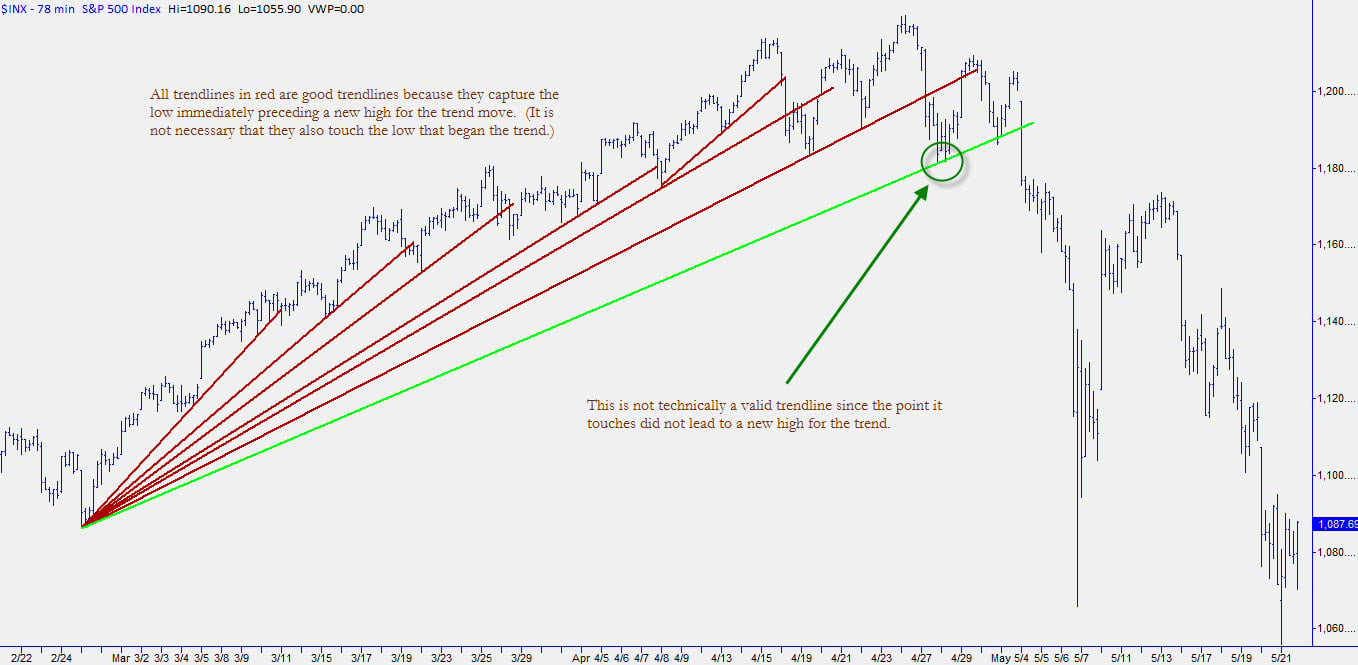

Building some consistent rules for drawing and using trendlines…

SMB Morning Rundown – May 21, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

SMB Morning Rundown – May 20, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Reading the Tape In Multiple Time Frames

I was trading V today for the third consecutive day. My initial bias was short based on the weakness on the tape I had seen during the prior two days. During yesterday’s two point pop in the SPYs I found it to be very telling That V barely bounced. So I came in today ready to get short again. The … Read More

Booms and Busts 101: a little history…

A lot of traders don’t even look at price history from last week… this post digs a little further into history.

Sharing Your Best Trading Set Ups

A few months ago we were talking with Dr. Steenbarger about some improvements we could make to our training program. We decided, through his guidance, to add a new Tradecast, or review session, where we shared the best trading set ups from ALL of our traders with ALL of our traders. Well, why? Isn’t it true that traders have … Read More

Free Trading Seminar In NYC

Trading Setups That Are Working In Today’s Market Please join us on May 15th at our training room in NYC for an interactive seminar on which trading setups are working best in today’s market. The partners of SMB will discuss in detail the setups that have been offering the greatest risk/reward for the past two months in US equity markets. … Read More

Technical Analysis: Four Basic Principles

We have all seen so many lists of trading rules that we sort of become numb to them. Even if they contain good advice (“always respect your stops”), they are so omnipresent in the trading literature and on Internet forums that we probably don’t pay as much attention to them as we should. I want to share a very different … Read More