Mike Bellafiore, Partner at SMB Capital, and author of One Good Trade: Inside the Highly Competitive World of Proprietary Trading was featured in the recent issue of SFO Magazine. In his article, Old School Lessons For Mastering Today’s Markets, Bella discusses what it takes to become a great trader in today’s changing market. A must read for new traders! The … Read More

SMB Morning Rundown – June 1, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Ten Mistakes by BP a Trader Should Never Make

1. No Exit Plan. There was no exit plan for if the rig (RIG?) exploded. Before every trade we must decide where and how we will exit BEFORE entering the trade. 2. Live to Play Another Day. It is not definitive that BP is a viable company going forward even with 6.08 Billion in quarterly profits. 1) When will the … Read More

Intraday Reversals Indicate What?

In the final 3.5 hours of trading Friday we touched 109 three times on the SPY and 110.30 twice. Generally, this type of up down action does not instill much confidence in market participants, and many believe it is a sign of lower prices to come. I’m not in that camp. Someone definitely was dumping a couple of billion dollars … Read More

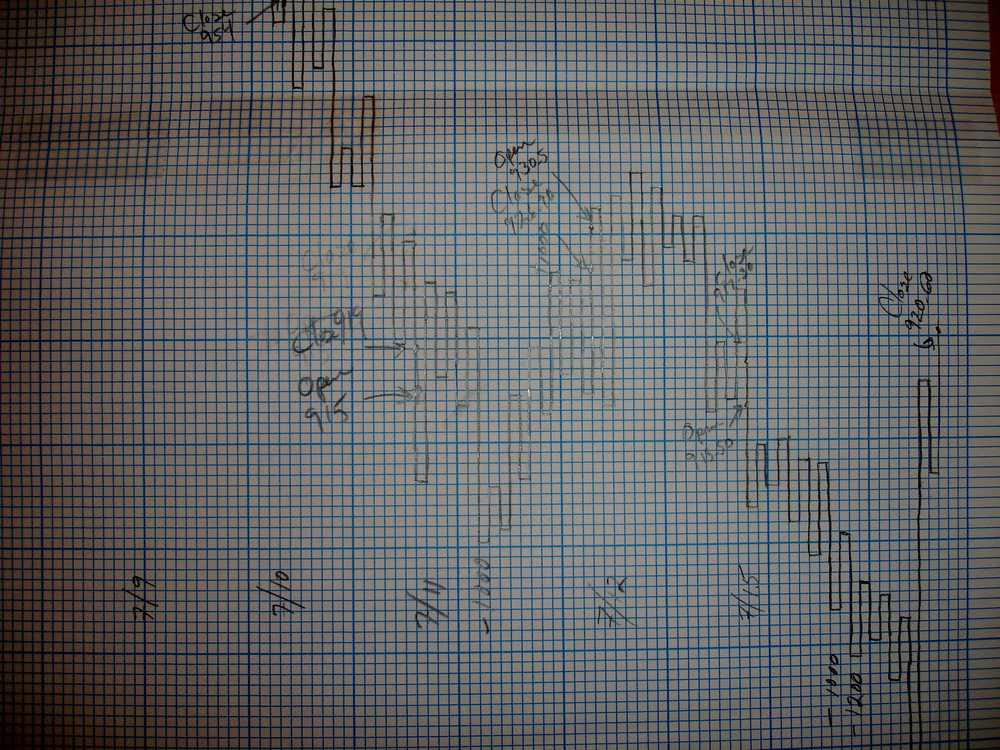

Embracing the Value of Keeping Charts by Hand

Keeping price charts by hand can shorten your learning curve.

Maximizing My Weaknesses

Today I maximized my weaknesses. I found the set up that is a trading weakness for my system, traded it with size, and now sit with a P&L that represents the worst of my trading. In one sense this is quite impressive. I did not just underperform this open. I did as poorly as I possible could. Fresh news … Read More

Traders Ask: Simulation

I received this question from Reader Dhroov: I want to thank you and your team for all the time and valuable information that you put into your blog and videos. I look forward to clicking on my browsers’ “SMB’ favorites link each and every day to catch up on what you and your team are thinking and writing about. I … Read More

Awesome, Awesome, Awesome!!!!!

I woke up to a dream today and it was the market! If you are a short-term trader then it is time to start brown bagging your lunch if you haven’t already. Today’s final 80 minutes of trading provided as much opportunity as you see in an entire trading day. This followed the meltdown we saw yesterday in the final … Read More