Trendlines are one of the most used and misused tools in the trader’s toolbox. If you’re going to use them, you have to have a consistent methodology that defines when you will draw them, where you will draw them, and what you will do when price touches them. Too many times, I have seen traders draw random lines on charts with the argument that they might not use it, but it’s good to have it there. I tend to disagree. If you don’t have specific rules then you will draw the trendline you wished was there (which, of course, is the one that supports your current position) rather than the one that actually is there. If you do not have consistent rules, then you are probably just drawing random lines on charts which cannot help your trading and probably hurts it.

First of all, we should define what we expect out of a trendline. There are legitimate trendlines connecting lows of a move to highs of another move, drawn on a “best fit” effort through the center of price action, or drawn through any number of other chart points. I have not found most of these to be useful in my own trading, because I expect something very consistent from a trendline: the main reason I will use a trendline is to delineate the conditions that define the current trend for that market. If the trendline correctly defines those conditions, then penetrations of the trendline are significant.

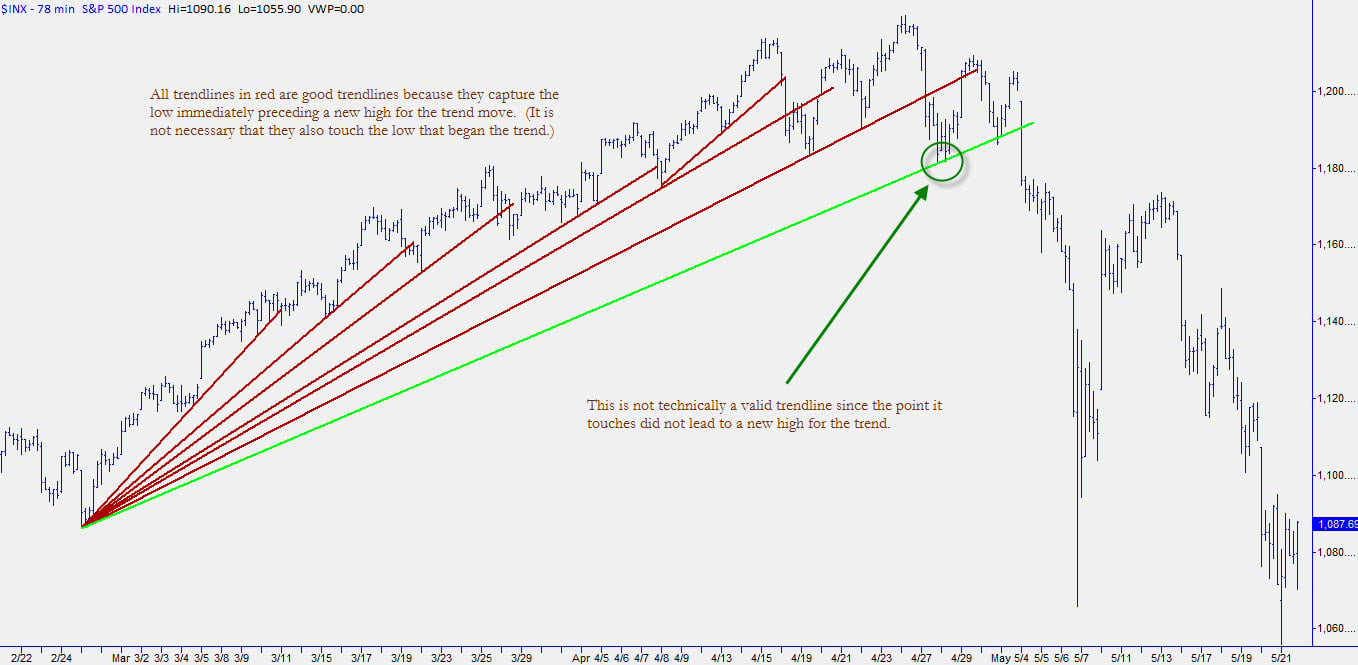

We will explore some further refinements of using trendlines in my next blog post, but for now let’s just focus on the most important element—consistency. There is one specific price point that a valid trendline should capture without cutting through other prices: the low immediately preceding a new high for the trend. Ideally, the trendline should also extend from the actual beginning of the trend (as it does in the example I’m showing below), but that is not essential. If the trend has accelerated, it will not be possible to draw a single long trendline. Note that the trendline may cut through prices past the high (as the trendline is extended), but it should not pass through any price bars before the low.

Rather than write one epic post, I thought it might be easier to absorb this in several, smaller posts. I will wrap this one up here with two parting thoughts and a chart example. First, the trendline defines the limits of the swings that compose the trend, so it is important to be sure there actually are swings before you draw a line. For instance, if you see many consecutive bars where you can draw a line across the lows of those bars (this tends to be common in parabolic moves near the end of trends), a trendline drawn across those lows will probably not be meaningful. You can draw the line, just don’t expect anything out of it! Secondly, do not cut prices when you draw a trendline. Especially with candlestick charts, it can be tempting to draw lines that cut shadows. Again, you can do that, but if the line already cuts price in the past, why should you pay any attention when prices go through it in the future? In my next blog post, we will look at a few more refinements in using and drawing trendlines on price charts.

12 Comments on “How to Draw a Trendline”

It broke the trendline four times and then went to new highs every time.

What were you saying about other methods of drawing trendlines being meaningless?

It broke the trendline four times and then went to new highs every time.

What were you saying about other methods of drawing trendlines being meaningless?

Done exactly right!

Exactly as V Sperandeo suggested.

Done exactly right!

Exactly as V Sperandeo suggested.

Actually the green line would be valid if it were considered part of the triangle that the trend had formed, hence the breakdown that followed.

Actually the green line would be valid if it were considered part of the triangle that the trend had formed, hence the breakdown that followed.

It seems the bottom trend like isn’t valid according to these rules as the next top formed is not a new high?

P

It seems the bottom trend like isn’t valid according to these rules as the next top formed is not a new high?

P

@Phil:

yes, exactly.

@Phil:

yes, exactly.

Im assuming the same goes for down Trendlines? (Must correspond with a new low?)

-Thnx for the post Adam, always good to brush up on stuff like this.

http://www.sketchheroes.com