trainee: “So this SLV isn’t really doing much this morning” spencer:”Yeah, pretty tight range” trainee:”it is just stuck in a 35 cent range” spencer leaves the desk to attend firm business at 11:00AM. second conversation at 12:20 when spencer returns spencer: “you long this SLV? finally broke out of the range” trainee: “no. i’m watching it.” ———— A large part … Read More

The World’s Leading Traders Charity Webinar

Join Mike Bellafiore, author of One Good Trade, 4:30 to 5:30pm EST on Thursday 26th May for a charity webinar to assist earthquake victims in New Zealand and Japan. Mike’s webinar is titled: The PlayBook: Set ups for Your PlayBook. Set ups that you can make your own Plays our desk are using in this market Set ups to trade … Read More

Spencer’s Setups

I have an idea for a new blog series. I will try at least once a week to post a setup based on SMB Fundamentals: Fresh news, Technicals, and the Tape. But in the interest of it being a learning experience and also a recognition that the readers of our blog are way above average intelligence, I will ask for … Read More

All Caps Webinar Video

Sorry about the technical problems guys. Video w/o commentary below. Will look to post/replace the video with comments later this week. Just wanted to get it out there quickly after the webinar.

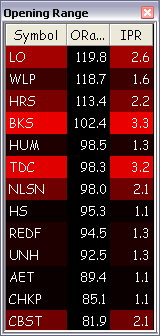

If Check 1, If Check 2, If Check 3 then pounce

One of the ways I use the SMB Radar to identify the best stocks and setups to see if a ticker is appearing at the top of multiple categories simultaneously. At 10:37AM today LO was atop In Play, Weak Today, and Opening Range. It was consolidating at the low of the day after a strong Opening Drive. I love this … Read More

Expiration Week Pinning Trades

Here’s an e-mail I received from a good friend of mine and former mentoring student Options Tribe Member Craig. Craig is a fine option s trader and specializes in “expiration week trades”. These are highly specialized trades that Craig makes almost every month during options expiration week. Each expiration week , I ask Craig what he’s up to this month. … Read More

Is Passion Enough?

First of all, I would like to thank all of you at SMB for the work you do and the content you provide. I have not found a better source out there for actionable, instructive lessons on trading, and God knows I have searched through a lot of content on the internet the past couple of years. I first learned about … Read More

SMB Radar Update for May 23, 2011

Choppy market today, not many stocks giving a high IPR on our Radar. Only two giving a reading above 3.0 are $E and $MOS – readings over 5.8 and 3.7 respectively We prefer stocks that are very In Play. This is indicated by the brightness of the red, along with the IPR number (we prefer above 3.0). In Play stocks … Read More