In our options training program, we spend a good deal of time working on high probability iron condor strategies. A high probability iron condor is one of the simplest and most popular options strategies, but it also, in my opinion, is one of the most dangerous. As with most dangerous strategies, it is a deceptively attractive and simple trade. An … Read More

When Charts Don’t Tell the Truth – $HUM $AGP

Yesterday HUM was In Play on earnings. It traded lower, much lower – in fact it had about a 7 point down move from the open. A number of traders on the desk did well in HUM, I wasn’t one of them. Looking back at the chart I saw a lot of different trades that could or should have been … Read More

I had to make an adjustment

All traders deal with frustration. One of my biggest frustrations recently has been my inability to open positions in the pre-market because I am preparing or running the SMB AM meeting. I was watching setup after setup unfold in the pre-market and unable to take advantage. I’m sure more than a few people noticed me grumbling about this on our … Read More

Your Daily Game Plan

Excellence is an art won by training and habituation. We do not act rightly because we have virtue or excellence, but we rather have those because we have acted rightly. We are what we repeatedly do. Excellence, then, is not an act but a habit. Aristotle One our trainees sent me an email over the weekend asking me to review … Read More

Free Webinar: From Good to Great with Steve Spencer

Please join Steve Spencer for another webinar in his Good To Great series on August 3 at 4:30PM. Multi-Day Inflection Points How to trade them Why They Work Works both during and in between earnings season A concept that receives little attention Steve will discuss recent trading setups There will be a Q&A following the presentation Questions on this topic … Read More

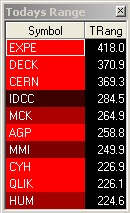

SMB Radar Update for July 29, 2011

Here is a quick snap-shot of the top stocks on the Today’s Range list on the SMB Radar. This is just one of 10 categories that the algo captures. @tarhini_smb

SMB Morning Rundown for July 29, 2011

Market showing some weakness this morning after end of day selloff ystdy. No vote in House ystdy on debt vote not helping. GDP numbers not good for Q2 but info is backward looking. Short bias but most of the downside has been realized prmkt. A pop to 129.40-129.60 would be a safe short area. SPY support 128.35ish Morning Idea: STEC … Read More

No Vote, more uncertainty

Word just broke that there will be no vote on Speaker Boehner’s bill tonight. This will breed more uncertainty to the markets. This is not HardBall or Nightline so I will skip to our thoughts as a trader firstly. I will watch Asia to see how their markets react. So far they are down almost 1 percent as I write. … Read More