A sharp pullback to start last week left the indexes testing some important levels and filling some gaps, both of which proved to be technically beneficial for the market. Dip-buyers emerged to stem the losses though, erasing a fair chunk of the deficit from last Monday and Tuesday. More progress will need to be made for the bulls to regain … Read More

Hurry Find the Band Aides!

As children we all used to enjoy putting our parents’ big shoes on our little feet and trying to walk. It was an awesomefeeling until we tried to go a bit too fast. The problem was we just weren’t big enough to handle those big shoes at high speed! I guess we all have an innate desire to grow up … Read More

Free Options Webinar: SMB’s Options Tribe: Tuesday, November 8, 2011 at 5pm EDT: Statistical edges in Option Trading

Tuesday November 8, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

Chasing Trades Isn’t Paying

Current conditions and the overall complexion of the market is always subject to change, but it’s still always worth taking note of. The market seems to be continually morphing into another phase, whether it’s range-bound, trending, highly volatile, or really tame. Right now, we’re in short-term pullback mode after seeing some upside continuation. The past couple of sessions have been … Read More

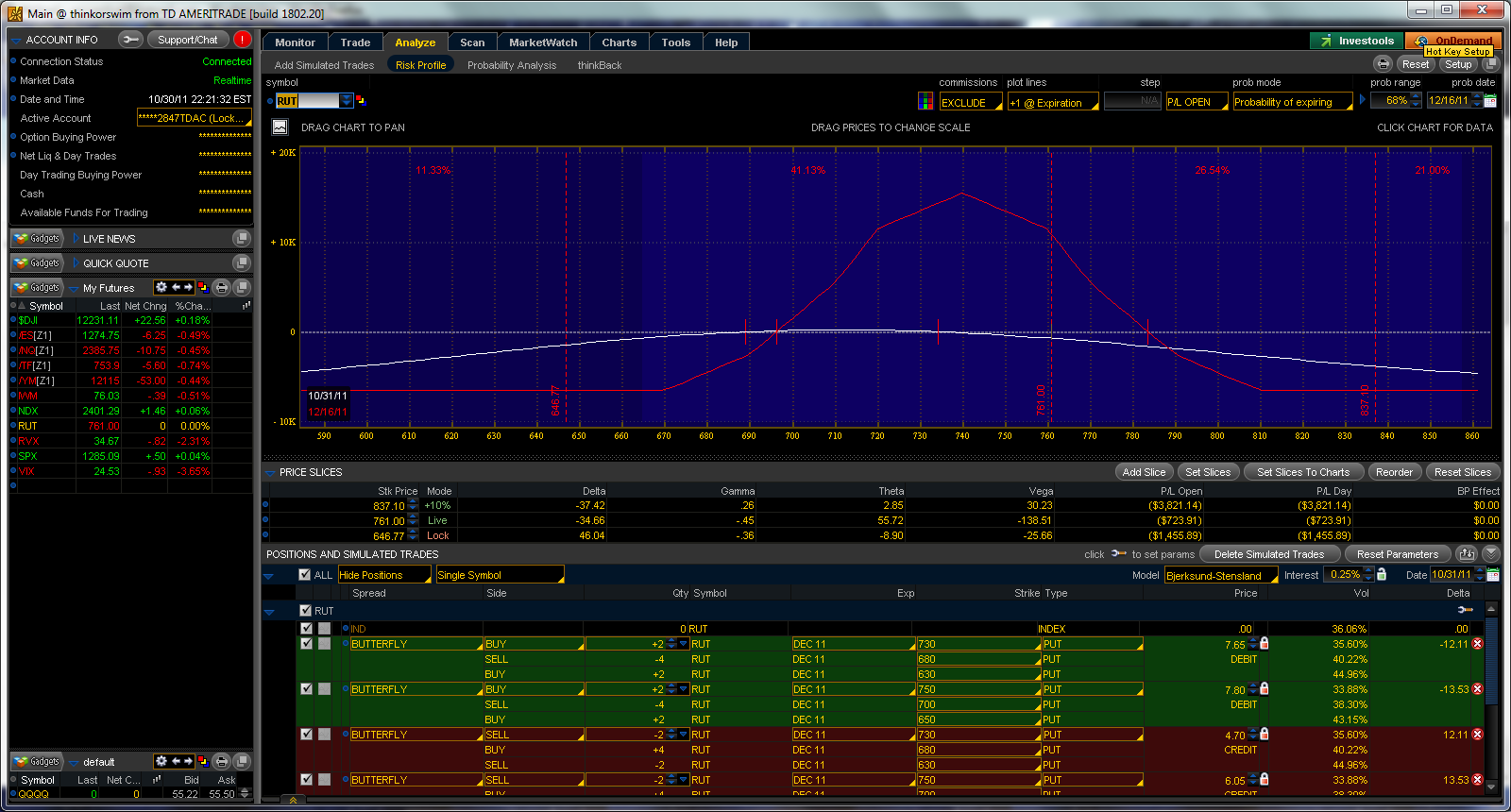

The Continuing Saga of December’s $RUT Bearish Butterfly Trade: Insights and Analysis

Last Thursday’s rally, probably a dim memory at the moment, was so strong that our trade methodology called for us to add a third butterfly and roll the original two butterflies up 60 points each such that the new position is comprised of three 50 point wide butterflies centered at 720,740 and 760. As of last Thursday, the position was … Read More

Free Options Webinar: SMB’s Options Tribe: Today at 5pm EDT: Jim Bittman on Credit Spreads

Today at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This … Read More

Index Video for the 1st Week of Nov

The indexes ran higher last week, bolstered by a European debt deal which had been anticipated for several weeks. Stocks rallied ahead of the news, and the announcement of the deal prompted additional buying rather than a sell-the-news response. As a result, new recovery highs were established across the board. As we head into a brand new week of trading, … Read More