Today at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This … Read More

A Few Spins Of The Wheel Redux

We made a fundamental error in calculating the returns in our last article, and many thanks to one of our readers who was on his toes and caught it. Some of our calculations were based on dollars per trade and others on dollars per share—clearly a case of pineapples and pomegranates, along with doing the calculations much too late at … Read More

Shifting My Bias

I shorted BIG in the late morning today. It gapped down on its earnings release and then proceeded to consolidate below 36.70, which in my view is an important long term support area. My initial short was when a buyer dropped at 36.20. It quickly dropped about 30 cents and then traded right back up to the 36.20s. I shorted … Read More

Free Options Webinar: SMB’s Options Tribe: Tuesday, December 6, 2011 at 5pm EST: Weekly credit spreads using a trading system

Tuesday December 6, 2011 at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

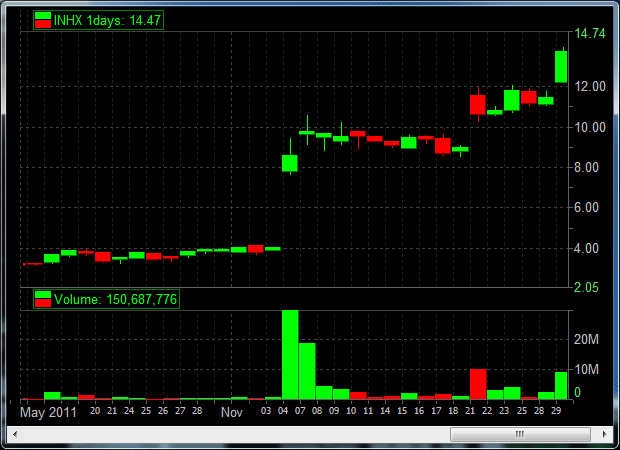

Trading Lesson #1: Buying A Strong Stock At Prior Day’s Afternoon Support

New blog format: Short trading lessons with charts for illustration. Trading Lesson #1: Second Day Play–Buying A Strong Stock After It Pulls Back To Prior Afternoon’s Support Area INHX was on our radar yesterday after another fresh news drug catalyst. As you can see from the two charts below INHX is trending higher on multiple time frames. Here is the … Read More

A Few Spins Of The Wheel

Last week we talked about the casino’s edge which in the trading world is called expectancy, but all that expectancy tells us is whether or not our trading strategy is likely to be profitable or not—but not how much money we might make. How profitable depends on how often we have a chance to trade our system—will it be a … Read More

Free Options Webinar: SMB’s Options Tribe: Today at 5pm EST: Options Trading and Trader Psychology

Today at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This … Read More

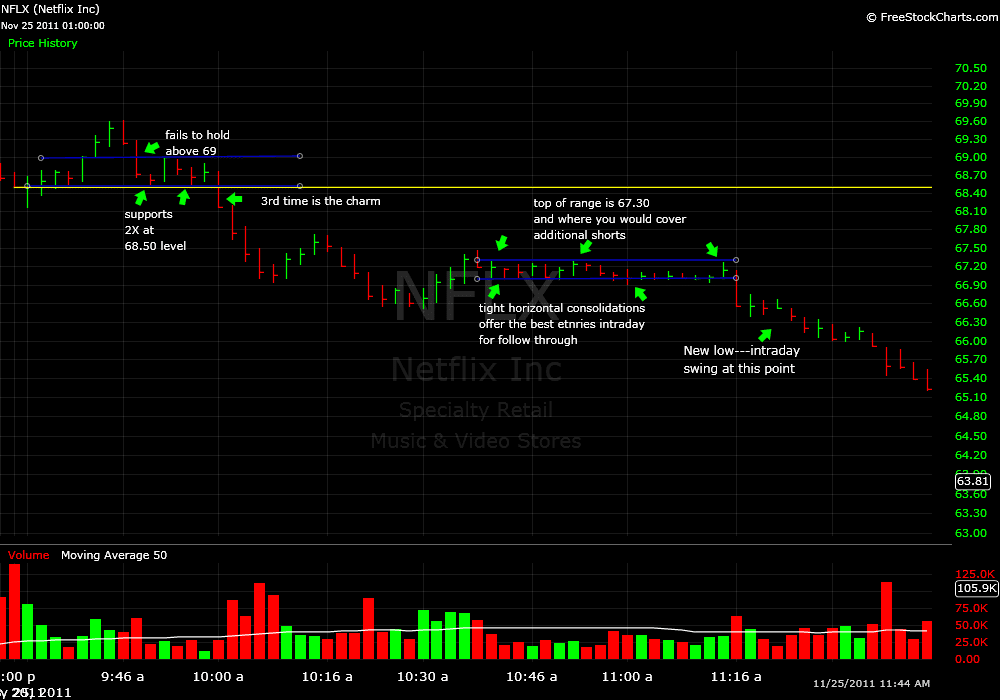

Using Prior Days’ Price Action–NFLX

Prior to the Open of Friday’s shortened trading session there was not much in the way of fresh news catalysts. So my first trading choices were second and third day plays. For those of you who are new to the SMB Blog you can use the “search” feature on the blog to review posts explaining how and why we trade … Read More