I think too many traders focus on “setups” or “trading patterns” when they should be focusing on trying to really understand what is driving market action at any point. Focusing on oscillators or other indicators usually only serves to exacerbate the problem. Real mastery of market patterns follows naturally once a trader has an intuitive sense of buying and selling pressure, but intuition only grows out of constantly thinking about market structure and exposure to tens of thousands of pattern variations. Having said that, today I do want to share a pattern that I have found extremely useful in short-term trading.

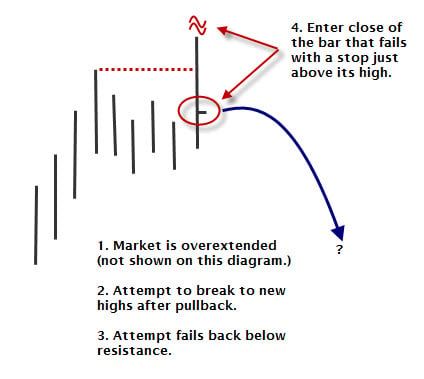

This pattern is simply a failure test of support / resistance. (The examples I am giving all show shorts, but the pattern applies exactly reversed to buys.) The pattern is probably best applied after multiple trend legs up, but, in general, most breakouts fail (ask yourself, did you know that?) so disciplined application of this pattern has a positive expectation under most conditions. Perhaps a picture can best illustrate the concept:

From a mechanical standpoint, entering these can be a little bit difficult. I traded them for about a year on a very large basket of stocks, entering the orders as close to the market close as possible. This was extremely difficult because a large number of stocks would trigger on some days (due to correlation to the market), but it is possible. Another alternative, especially in forex and futures, is to do your homework after the market close and then try to enter unch in the electronic overnight market. This can be done well over 90% of the time, but there will be a certain percentage of the trades that you have to enter at the market on the next regular session open, at a much worse price. These are often big winners so I don’t think it makes sense to skip on this set of trades. Intraday, patterns are not as clean, but it is still possible to trade this concept on anything from 1 minute to 120 minute bars.

From a mechanical standpoint, entering these can be a little bit difficult. I traded them for about a year on a very large basket of stocks, entering the orders as close to the market close as possible. This was extremely difficult because a large number of stocks would trigger on some days (due to correlation to the market), but it is possible. Another alternative, especially in forex and futures, is to do your homework after the market close and then try to enter unch in the electronic overnight market. This can be done well over 90% of the time, but there will be a certain percentage of the trades that you have to enter at the market on the next regular session open, at a much worse price. These are often big winners so I don’t think it makes sense to skip on this set of trades. Intraday, patterns are not as clean, but it is still possible to trade this concept on anything from 1 minute to 120 minute bars.

Trade management is a bit of a potential issue because a certain number of these will give you a chance to short and then the market just explodes higher. Actually, it happens a lot so you must be prepared and execute your stop with iron discipline. Giving these ” a little more room” or doubling up when it moves past your stop will guarantee you have a short, but very interesting, trading career. (It also should go without saying that this is not a great overnight plan for certain kinds of stocks like biotechs, or for anything in front of an earnings announcement or significant report.) Surprises happen, so you must have a plan that encompasses every eventuality. You also need a plan for possible re-entry if stopped out, and clear rules for profit taking, but those are beyond the scope of this post.

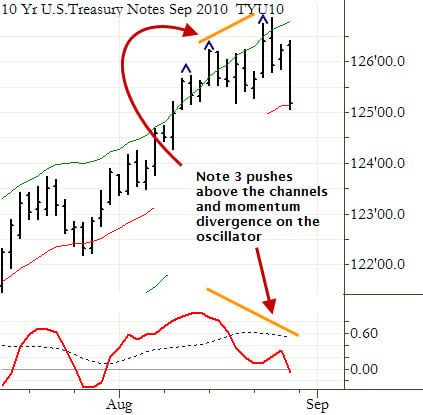

It is also useful when people show actual trades when discussing patterns. Here are two trades that I called several days before the entry in my daily market report (www.themacroreport.com). I was able to alert readers to the possibility of a good trade setup because these markets were overextended and were showing momentum divergence. Note that I have added a momentum oscillator to these charts to illustrate the divergence, but I do not actually use an oscillator in analysis or trading. The choice of oscillator is not important, but the concept that the market is making another leg higher on weakening momentum is key. Here are two example trades on daily charts, in real time.

First, a short in 10 Year Treasury Note Futures:

And another in the S&P 500. Note that this bar, so far, was the exact high of the year. This raises a real issue as you consider your exit strategy on this pattern, because most of these should be treated as scalps. The majority of these patterns will give you a nice profit (1-2 times your risk), and then the market continues higher, but a few of them come at major turning points. Here was a sell on the close of the high of the year in the S&P 500. Again, this is not wishful thinking… this was a trade actually done in real time.

Speaking of major turning points, consider this sell in Crude Oil futures. Major turning points in commodities have this pattern more often than not, but there is also a fairly high false positive rate. (Disclaimer: this is a hindsight trade not taken in real time as I was not trading this market at the time.)

If you are interested in more information on this pattern, Victor Sperandeo has written about it at considerable length with a number of good examples in his first two books. Again, if you choose to use this pattern in your trading it is extremely important that you are disciplined and consistent with it. Start by examining a few hundred examples on charts in your chosen markets and timeframes, then apply it on the smallest size possible for a few months, then scale up. That is pretty much the plan for learning any trading technique, but risk management and having a gameplan for disaster management is especially important in a potentially risky countertrend pattern like this one.

7 Comments on “An important market pattern”

About market structure and what is driving market action. The interesting pattern shown in the first picture (doesn’t this look like a flag?) shows how the current market is acting since programs will buy into weakness and sell into strength. A breakout trade will turn into a failed flag while an hour or two later the computers work their bids and you will see the stock at higher levels.

Very rarely will we see tremendous volume drive into a stock that can make it flag and go to higher levels. This is what is driving current market action, failure of volume to drive stocks higher.

For those of us in the intra day timeframe, do we play these ranges (and adjust our risk reward ratios ) or just stay away for those rare month making days where we can grab multiple points. i feel this may be the key to frustration of a changing market.

Eric,

My opinion is that things really haven’t changed. We blame the programs, but people have always blamed different aspects of the market’s action on the great unseen THEM. Whether it’s the Government, the plunge protection team, the floor, Goldman Sachs, pools, whatever… it has been the same for all of market history. People have always claimed manipulation is driving the market, and our focus on algos and programs manipulating the market is just the latest chapter in this long story.

What you say is true: most breakouts fail, and pull back before they go higher. This has been true as long as we have been recording prices, so I suspect it has nothing to do with program activity. This is not a recent change in the markets. Markets have always been bought into weakness and sold into strength as the competing forces of momentum and mean reversion play out the same theme in countless variations.

though market microstructure is constantly evolving, what is remarkable is that price action has not changed in hundreds of years. Rather than focusing on trying to outplay the algos, try to understand market structure and price action. “Plus ca change, plus c’est la meme chose…”

Adam,

Exactly the reason I’m so excited to read your posts is the awesome thought process you bring us through. I am really looking forward to seeing more from you, this one was great. Thanks.

Thanks Eric. I will definitely keep posting… it has proven a little bit difficult for me to post as often as I had hoped, but I’m trying to do shorter post a little more frequently. Thanks again.

Support can definitely dwindle at these new heights when buyers hit their limits and momentary candlesticks fail to short-term lows. With prices still relatively high, selling looks attractive to those currently in the stock, which presents a desirable risk/reward ratio for potential short sellers.

One risk of shorting though after a recent high is the possibility of another high-breaking rally, which could set up the psychological precedent for further buying. But as we’ve seen in the past, a stock which makes quick new highs is likely to fall much harder. So even the Livermores (traders that get bearish too early several times in a row) can count on an eventual market correction that will cover their losses as long the trader has shown enough discipline to close his or her losing positions early and is able to identify the point of inflection as it happens. Here, the order flow is a key source of information.

Crude Oil in particular has shown a new and somewhat surprisingly high correlation to the S&P 500, despite the two being at odds historically. I wouldn’t say that the S&P is so revealing as to map out oil’s exact path, but it’s useful to consider this along with other technical data.

I also try to keep in mind the fundamental issue of supply and demand that affects the prices of real goods and services around the world. It didn’t exactly take a genius to see for instance that the underproduction of wheat in Russia and its subsequent ban of exports was going to have an effect on the supply side of the equation.

Why is it called 2B?

That is a good question. It’s how Victor Sperandeo labeled it in his books and it’s just what everyone uses.