We’ve heard it a billion times: The most effective way to trade the forex market is to trade with the trend. Like 80 years ago some fast talking high pants guy probably at the New York Stock Exchange said, “The trend is your friend, seee?” So now what do we do? Find a chart that looks bullish and press the … Read More

Forex Trading Room Recap 10.18.12

In this segment, Marc Principato, CMT, explains why larger time frames are so important to analyze before taking day trades or even scalps. He examines the EUR/USD as well as the S&P 500 futures. — Marc Principato, CMT Risk Disclaimer *No Relevant Positions

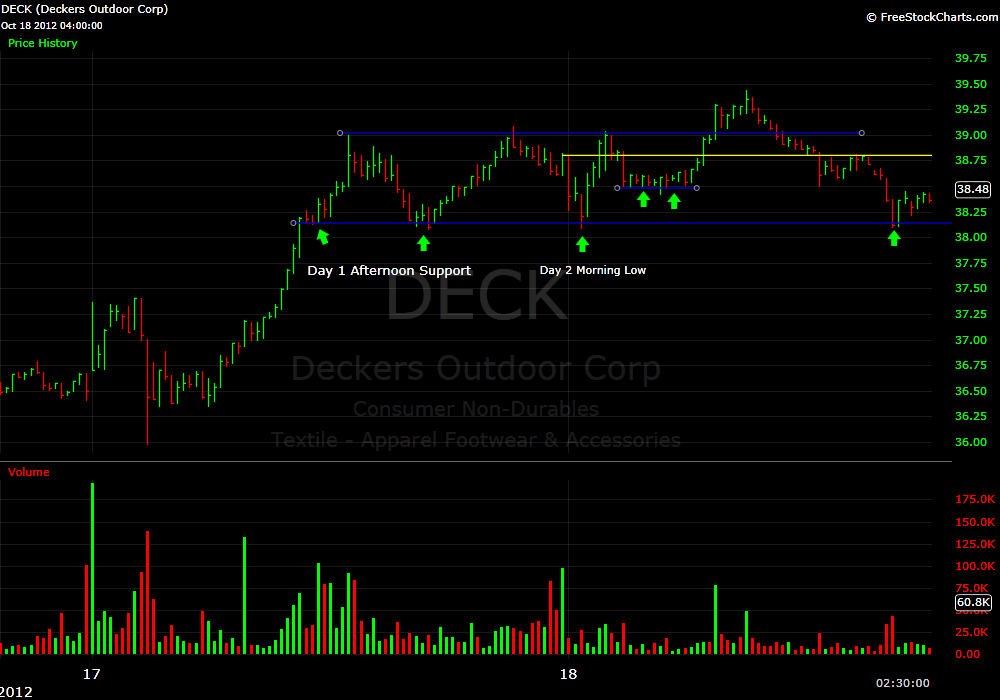

Trading Lesson #1 (Again): Buying A Strong Stock At Prior Day’s Afternoon Support

About a year ago I wrote Trading Lesson #1 offering a safe way to buy stocks that had shown strength the prior trading day. Let’s take a look at the price action from DECK today, which was discussed in a separate post yesterday on information flow. DECK showed huge relative strength yesterday to the market taking out two important resistance areas from … Read More

We are forgetting one important change in our economy

1. As @jheil said on Morning Joe yesterday, “The Yankees suck.” 2. Are we undervaluing an important positive change to our economy? That being: it has never been better to start a small business. If you talk to some of the biggest HFs in the US they are all preparing uniquely for the US fiscal cliff. Worse yet the perfect … Read More

StockTwits Suggested–$DECK

The lifeblood of a trading desk is the flow of relevant factual trading information. We spend time training our traders from Day 1 on how to gather and share information so we can all make more money. We build tools that pump out important information on In Play names all day. We have a chat room where traders can share … Read More

Live From the Trading Floor – 10.17.12

Steve will be broadcasting every Monday, Wednesday and Friday at 11:15 am EDT and you will have the opportunity to chat with him through our new Stocktwits chat feature. Don’t miss it! In today’s show Steve Breaks down the big picture via the SPY (0-2) Talks earnings stocks IBM CREE Discusses why he traded FTNT long (6-7) Discusses 2nd Day … Read More

The Forex Trader’s Fear of Missing Out

One of the more entertaining things I hear out of forex traders that I talk to is, “I can’t believe I missed that 40-pip move! I left so much money on the table!”. My question is whose table did you leave that money on? What’s even funnier is when traders claim they’re losing money because they’re missing nice moves. This … Read More

Forex Trading Room Recap 10.16.12

In this segment, Marc Principato, CMT explains how he likes to utilize whole numbers as part of his price action analysis. Whole numbers like 1.3000 and 1.3050 can serve as potential support and resistance levels where trading opportunities can emerge. — Marc Principato, CMT Risk Disclaimer *No Relevant Positions