Tuesday September 13, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

Checking back in with VRSN

In yesterday’s post I discussed a few core principles we teach at SMB and used VRSN as an illustration. This morning it was lighting up the SMB Radar again in multiple categories. In case you didn’t have alerts set on your trading platform at the prior day’s key levels the Radar almost forced you to pay attention again. If a … Read More

This is what we teach

Trade stocks that are In Play The market or a stock can become In Play at any moment Don’t fight the intraday trend if you are an intraday trader (think about this one. makes sense?) You don’t have to be the first one in to catch a move in a stock In the middle of the day when many were … Read More

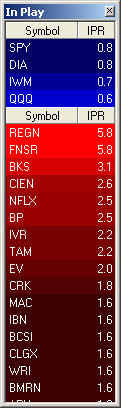

SMB Radar – Snap Shot

Here is a glance at a few of the SMB Radar columns as of the close. Although not a lot of high IPR names, there should still be some set ups in here for tomorrow. We saw a lot of price spikes and big movers today on light volume / order flow that still provided great opportunity today.

SMB Radar Update

Here is a quick snap shot of our In Play list on the SMB Radar. Notice $SPY IPR is below 1.00, along with only a few names above 3.00. Stick to the names with a +3.00 IPR. Keep in mind another plus is if you find the stock across the Radar on more columns like Strong or Weak Today, this … Read More

Traders Ask: Is it better to buy options for swing trading profits, or sell options for time decay?

Trader Sam asks: “Dear Sir: Allow me to ask a question about options, as I am a new trader: I have heard that delta neutral strategies are the best approach to trading options but I have less than $6,000. in my trading account and my broker’s margin requirements make it impossible for me to trade iron condors, butterflies and other … Read More

Our interesting times of Risk

Prop traders are the truest of entrepreneurs. We eat what we kill. We do not have clients. We do not sell anything or organize to sell something to someone else. No one in 13 years of trading has ever called or emailed or IMd my desk with a trading tip. Our pay is based solely on our trading skill and … Read More

Clean Up Print

Back in the day trading NYSE stocks and learning to read the Specialist prints one thing we used to look for was the “Clean Up Print”. This was usually the print on an intraday gap in the direction of the immediately preceding trend with big volume. This was a sign of a floor broker possibly finishing working the order and … Read More