This is a guest post from one of our traders, SW, about his trading day from Tuesday: A senior trader CB came to me after the close in regards of my recent performance. I expressed my frustration and disgust in missing an “A trade”. At SMB, we are taught to grade our trading setups A, B, and C, for purposes … Read More

The Pre-market Tell

I am really starting to sound a lot like Bella these days. When he lectures our trainees he tends to repeat himself over and over and over again. My style tends to be more like “this is the concept–good luck” (maybe not that bad:) I didn’t fill out a lot of “blue books” in college and law school. I like … Read More

Opportunity, Opportunity, Opportunity

As a day trader this is what you live and train for…opportunity! Be alert, be keen, and be prepared to exploit the opportunities. Today’s action provided trades and set-ups galore to set your sights on and use your arsenal. You had “In Play” stocks like ANR and HPQ offering both tape reading and level trades. There were relative strength plays … Read More

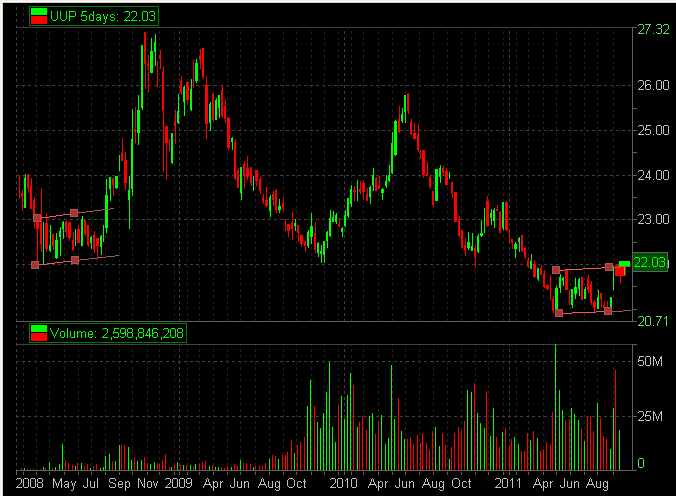

Bears Don’t Exist, Think Like a Bull

This is a guest post from Fred Barnes aka @DCDaytrader: I recently had a conversation with a few somewhat novice traders. For us traders who don’t have the 2007-2008 market experience on our resumes, we’re looking at the recent market activity in awe. Watching the quote screen (of the $ES_F) in August (2011) required the skills of a speed reader. … Read More

Leveraging the talent of your trading community

I have a confession. I hate being the face of SMB. It is not in my DNA. If we were playing pickup basketball I would be the point guard and not the scorer. You may have noticed when SMB goes on CNBC I stay at the office. I pray to the trading gods everyday for Steve to become increasingly noticed, … Read More

Sizing and Entries in This Volatile Market

Surviving as a professional day trader means adapting to the ever changing conditions you’re presented with. In this volatile market how you size your positions at entry is so important. If you think you can still set stops tight like you did when the VXX was in the teens you will miss a lot of nice moves because you got … Read More

A low probability trade

I got long NFLX today at 132.55. It had dropped about 10 points from the open to 132.47 and after it made a new intraday low it traded above the previous low. So I stuck in a bid above the original low and knew if my bid got hit I would most likely be stopped out of the trade for … Read More

What is working now?

I ask myself this question constantly. It isn’t enough to come in each trading day armed with a series of ideas. You must evaluate the price action in the market and for each stock that you are watching. And you MUST be prepared to move your attention to the stocks or ideas that are offering the most opportunity. This is … Read More