Every day we hold a pre-market meeting where we discuss the best risk to reward trading setups for the day. The trades fall into 3 categories: Stocks with a fresh news catalyst, “Second Day Plays” that had a catalyst the prior day, and finally “technical setups”.

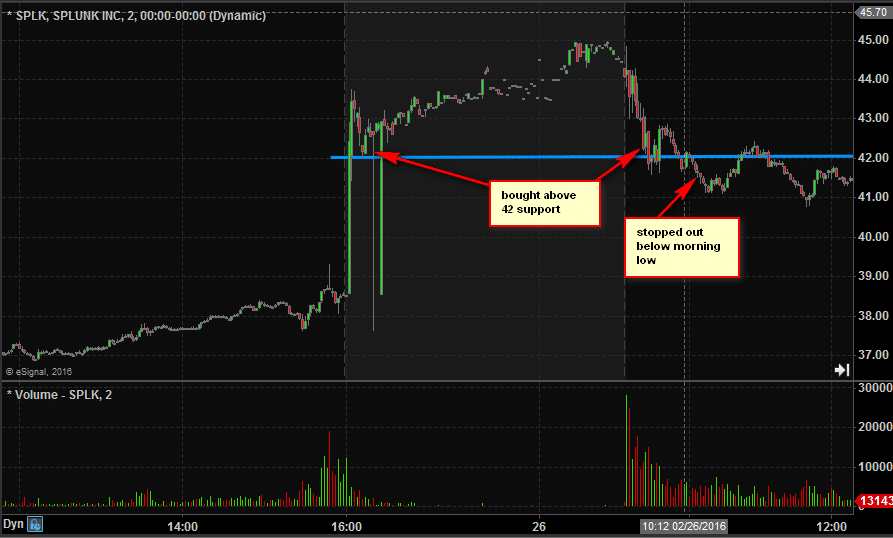

I’ve marked up some charts for five trades I made. 4/5 had a fresh news catalyst. The setup I liked the most SPLK was the only one that wasn’t profitable for me. Which goes to show you that trading is really just a game of probability and sometimes our biggest winners will come from a trade we think is only so so, and our losers could be from something that looks great!

The one trade that was a “Second Day Play” was BBY which had been accumulated the prior day so I bought some at the afternoon support. This has been a “go to” trade of mine for many years. It has a high win rate, which may be related to the fact that people who missed buying on Day 1 are trying to get long where there had been accumulation the prior day.

All of the executions of these trades are shared live on SMB Real Time. And my entire thought process for each stock is discussed during the AM Meeting.

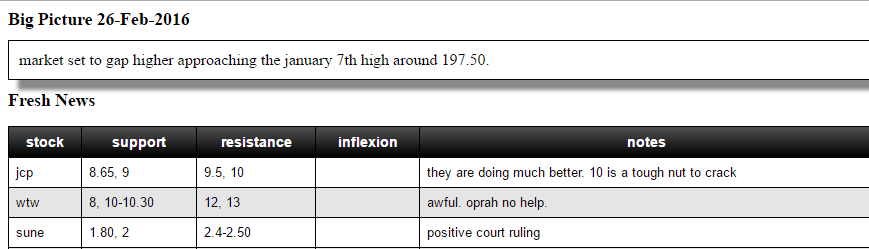

I liked JCP on the long side on improving fundamentals and overall strength I have seen in retail this earnings season. My only real concern was that it had run up quite a bit into its earnings release.

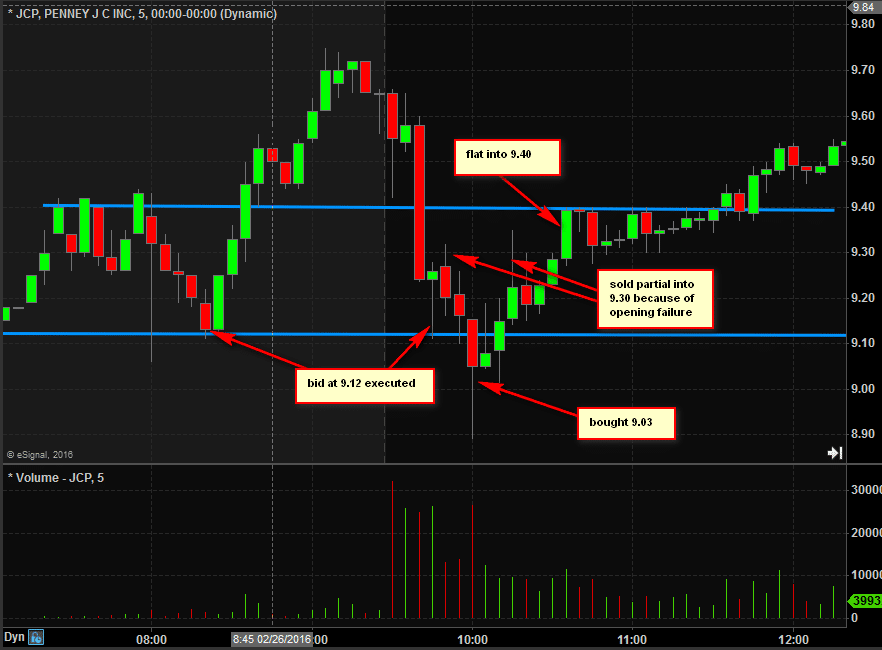

WTW was my favorite short idea. Earnings disaster and some hedge funds had piled in initially after Oprah got involved.

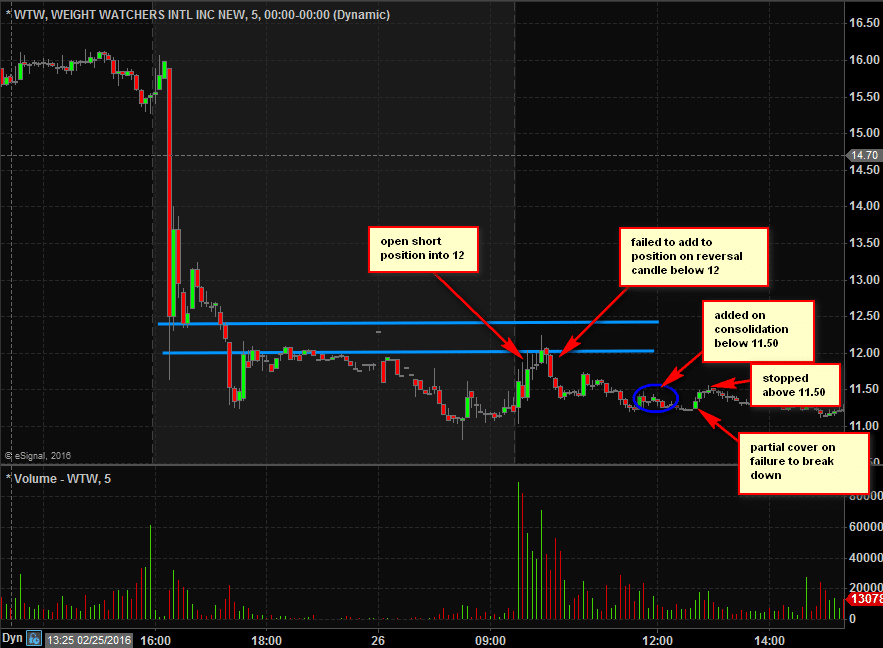

SUNE had run up on a favorable court ruling from $1.40 to $2.20. It is a heavily shorted name and my thought was it would establish its intra-day high on the Open as there would be scrambling of shorts to cover.

BBY was strong the prior day following its earnings report. The prior day I actually lost money buying it on the Open at 31 as there was some strong selling pressure during the first 30 minutes. I was mindful of this selling so was conservative buying the dropout on the Open on Day 2.

SPLK beat earnings and raised guidance and seemed set up well to test the mid 40s. My only real concern with this one was it had bounced 30% from the low coming into its report and thought perhaps some buyers in the low 30s would be incentivized to take profits above 40.

If you want to find out more info on how we share these setups each day check out SMB Trader 90

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 19 years. His email address is: [email protected].

No relevant positions