Accuracy is simply defined as the percentage of trades that end profitably. It is the final of our seven steps to systems success. To phrase it better, accuracy is the last thing we look at in building a system. Accuracy—almost without fail—is the first question asked about a system. However, it has the least impact on the success of a system.

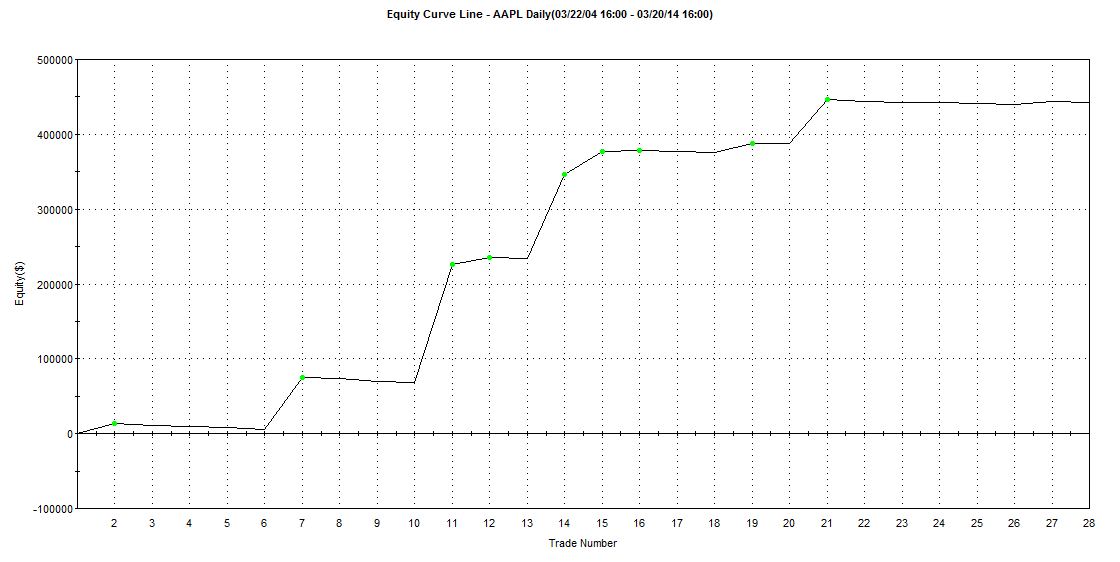

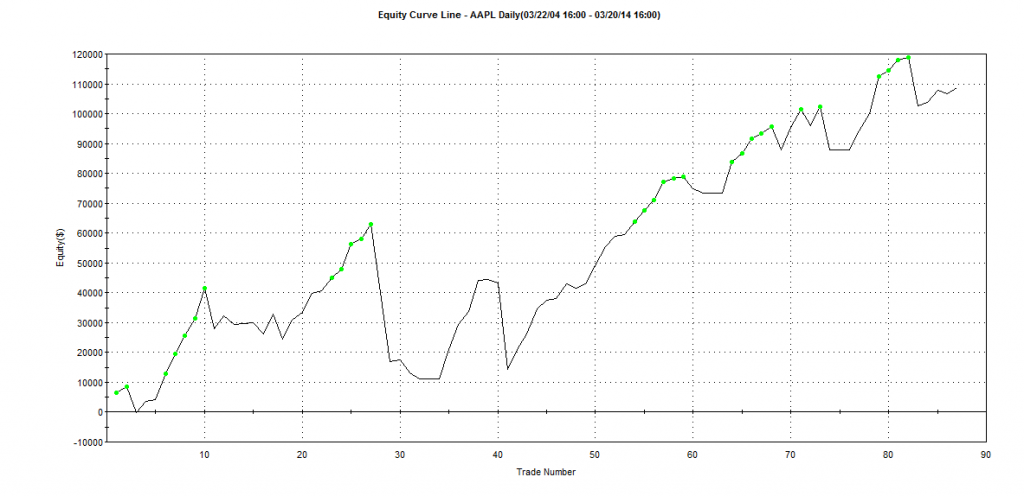

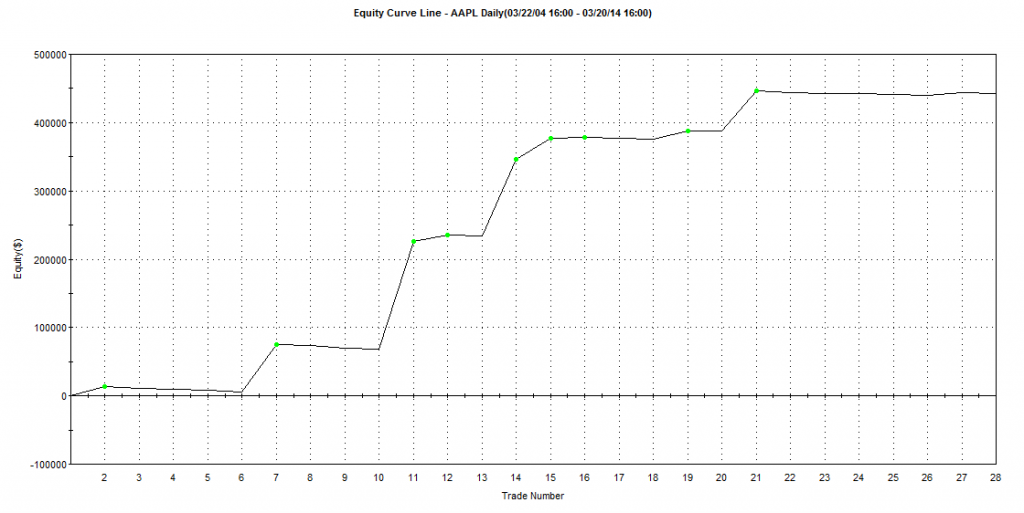

Here’s a quiz. Which of the following performance charts has higher accuracy?

#1

#2

Even though strategy #2 looks the smoothest; this trend-following signal only had 39% accuracy. The first chart (a mean-reversion signal) had 71% accuracy, but much larger drawdown. The key to the success of the second system is found back in the first steps to systems success that we discussed: Risk and Return.

Most trend-following strategies have a lower accuracy percentage compared to mean-reversion signals. Some great trend strategies with high returns and low drawdown can have accuracy rates as low as 20%. And some mean-reversion signals can have accuracy rates near 90% but have very uncomfortable drawdowns as shown in our example.

If accuracy isn’t a key to systems success, then why is it in the Seven Steps? Two reasons.

1) It helps a lot with psychology as you experience multiple small losses in trend strategies and as a way to not get overconfident with five straight winning trades in a mean-reversion system.

2) Comparing the accuracy of two trend systems helps identify which one may be more dependable. A trend strategy that is 39% accurate may be of greater interest than a similar version with 24% accuracy.

Thank you for following following along with these Seven Steps to Systems Success. These are the first things we covered in the SMB Systems Foundation course that was recently filmed at SMB in Manhattan. We are currently in the production stages and hope to release the course in the coming months.

In the meantime, we will be hosting some free webinars and working to build a group of systems traders (ranging from new to experienced) who can share ideas and build great systems.

Andrew Falde

Twitter: @andrew_falde

[email protected]

No relevant positions