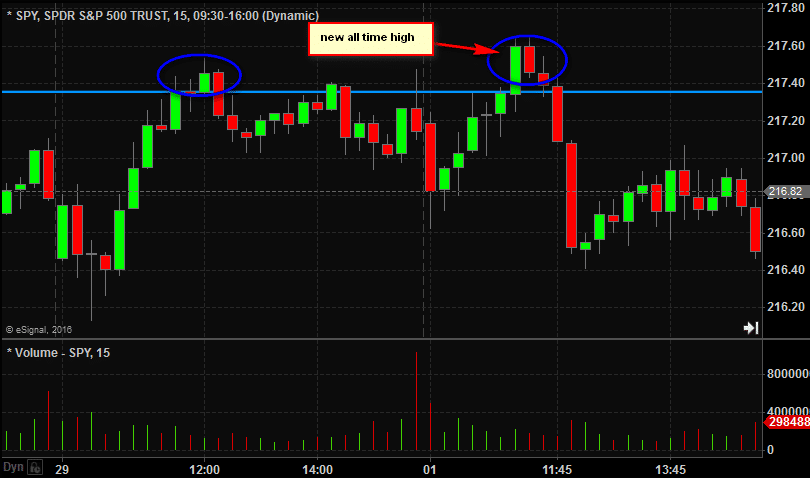

In short term trading we are always on the lookout for something that looks “different”. That is where edge is. That is where good risk/reward is. The past few weeks the SPY has been bopping up and down in a tiny range. After four or five days it was unusual. After two weeks it was historic. Every short term trader was focused on which direction we would break.

Beginning yesterday, I began to become more bearish when we failed to hold above 217.50. So this morning with the market gapping lower I was prepared to get short SPY and look for price action confirmation.

The following items are “textbook” things to look for when making a market play out of consolidation so they are worth reviewing.

- The market makes a new high but then trades below that new high. This is often the first clue for a possible change in market direction but in and of itself is not sufficient to commit a lot of risk to a short thesis. What I told a trader in SMB Real Time was if the market failed at 217.50 I would buy puts. This is the lowest risk way to make a bet on the short side.

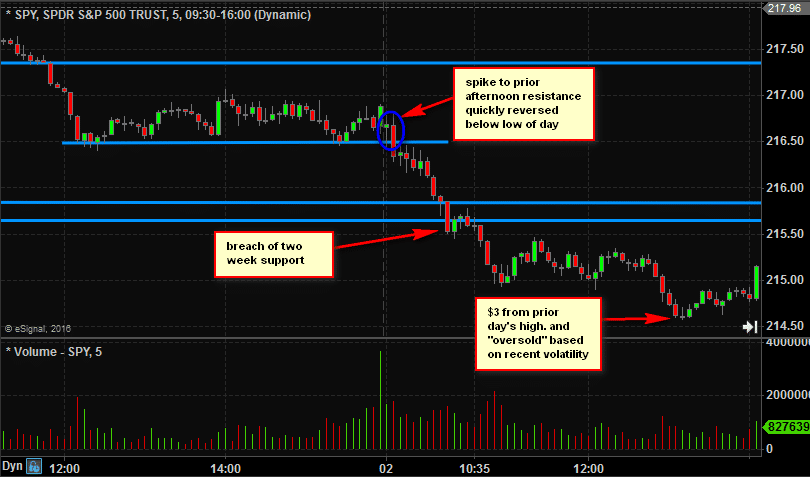

- The market gaps lower the next morning. A gap lower provides traders with a way to gauge the market’s strength. Does buying on the Open push the market above the prior afternoon’s resistance/supply area. If not, the case for being short is stronger

- The market opened the SPY spiked higher. A weak spike failing at the prior afternoon resistance between 216.80-217 was a good potential entry for a short position. We failed just above 216.80 and I shorted the SPY.

- Within minutes the SPY traded below the prior day’s afternoon support. We held below this support and the next move was to 216. At this point my confidence level was high we would work our way to the two week support. I tweeted this.

- The market consolidated at two week support and the next move was lower. At this point sellers were completely in control. A stop above 215.65 (prior support) made sense.

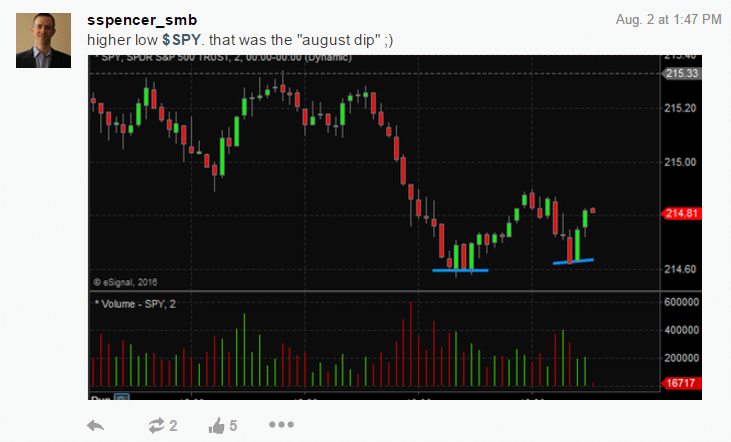

- After consolidating above 215 for two hours we broke lower and traded to 214.60. I tweeted this.

My thought process at this point was $3 is a big one day move in a very low volatility regime. Also, 7/15 supported that area. Odds favored some sort of bounce. I got flat SPY short. I covered some of my august market index puts and placed bids to get long. I tweeted this a few minutes later.

After I tweeted the above the SPY bounced another 80 cents or so and I re-established a short position.

Today was a great example that if you are patient and wait to see something “different” you can put yourself in a very strong position to make money. This is what we teach traders to do on our desk. We share our positions and trading ideas each day in SMB Real Time. If you are a short term trader.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 20 years. His email address is: [email protected].

Steve is short SPY