The price action in 2012 presented a very compelling case for a strong market and low volatility in 2013 (see post on #NewNormal). It wasn’t the price action in isolation though. 2012 was in such stark contrast to the latter part of 2011 it really set off alarm bells in my head. We went from a period of massive volatility related to macro events to a period of suppressed volatility despite a constant stream of macro headline risk. So while many experienced traders and newbs alike (in my trading world) were making bets on the impending major market pull back, I continued to “preach” every morning on our desk that we should continue to follow the #NewNormal playbook: focus on buying stocks/sectors into pullbacks, cut out most momo trades, and hold more swing positions.

By late 2013 most of traditional Wall Street was on board with the idea that funds were in performance-chase mode and they raised their SPX targets. The market began to accelerate to the upside and now is in a position entering 2014 that is different than what we faced 12 months ago. On the fundamental side stocks are more richly valued as their rise has outpaced earnings growth (a telltale of a “secular bull” market), but what remains to be seen is if there is enough cash between company buybacks, 401K purchases, bond dollars shifting to stocks, foreign exporters using dollars to purchase stocks, and retail fund flows to continue to push our equity markets to higher levels. Those factors also will need to be sufficient to pick up the slack for a steadily decreasing rate of “Fed dollars” being pumped into the system (if economic numbers stay in line with 2013, QE should be between 0-20 billion/month by end of 2014).

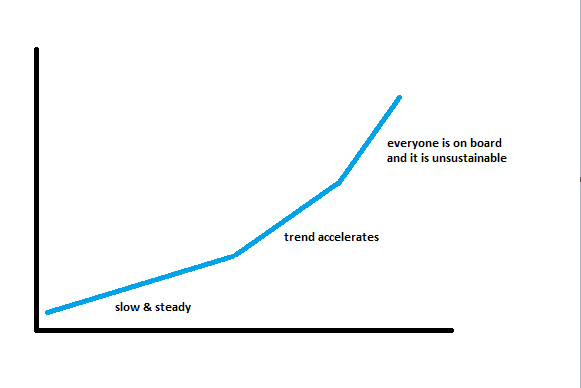

When looking at individual stocks in an uptrend a very common pattern is to see a slow and steady uptrend begin to steepen as more members of the herd recognize the trend until everyone is on board and it looks something like this:

As the trend accelerates it becomes less sustainable and will lead to a sharp pull back. The SPX is now in the second leg of the chart and I’m sure some would argue we may be in the third. But the good news is this type of market action creates new opportunity in the form of “upside volatility”. So although I think it is likely that volatility overall for the SPX will continue to be at below average levels for the foreseeable future (with the exception of a likely sharp correction at some point during 2014), there will be some amazing individual stock volatility. We began to see this process in the 4th quarter with NFLX, LNKD, AMZN, FB, and TSLA, all of which retraced large parts of their enormous late-summer runs once they reported earnings in the fall. Those stocks and their behavior was the primary reason why I began to take more short trades in the final two months of the year. I continue to be quick to exit short positions in contrast to my swing longs.

Under the hood, so to speak, what is happening is that because volatility is depressed in the market the perceived risk of the momentum stocks listed above becomes diminished, which in turn allows them to get bid up in the short term to unsustainable price levels, which creates fast aggressive moves to the downside. I created a few videos recently for Twitter, Apple, and Tesla dealing with these short opportunities.

I still believe the trading concepts outlined in last year’s #NewNormal outlook are applicable but I think adding the trades related to the upside volatility will allow short-term traders to pull more money out of the market. And I very much would appreciate a hard down move in the SPX at some point as I think that would be the only realistic chance to capture 20-30% of upside in 2014.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 17 years. His email address is: [email protected].

Steven Spencer is currently long MU, ADBE, P, JCP, CROX, F, RH, DRYS, WFM, and short BBRY and SPY

One Comment on “Some Thoughts on 2014: Upside Volatility”

Excellent. Will have to read it again with more time…so much to take from this.