Lately we have been posting some very simple Radar setups that can really step up your trading game. Simple, trend following plays that can be very high probability, good risk / reward plays. Today $OCR made a similar set up to the Spencer Special, however didn’t have as many checks as we would like to see. Consolidation wasn’t very clean, the market was holding higher, and it wasn’t in the top 5 on the Weak Today list. Still, it had a chance and could arguably have been worth a tier 1 trade that could still possibly work (depending on your stop).

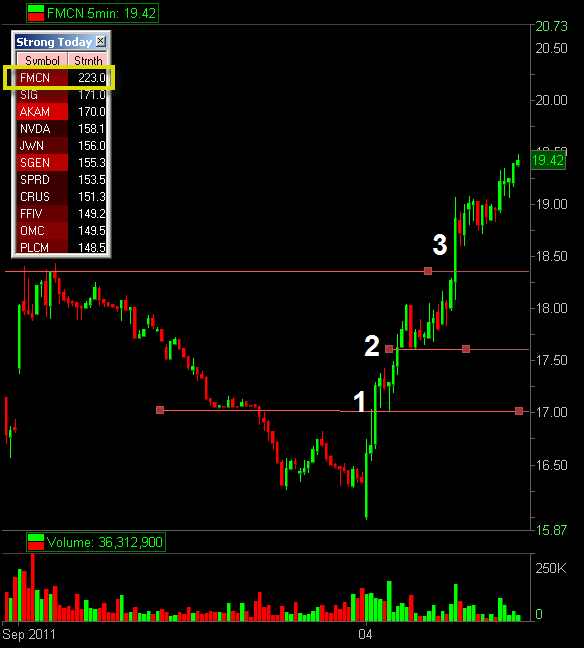

But with some stocks at such low levels, having sold off without any real pull backs – new, more advanced plays emerge. Today $FMCN was immediately the top Strong Today name on the SMB Radar, colored in bright red, indicating it was very In Play (also meaning the probability of follow through in the moves was much higher). This is not an easy play for many traders. Many traded the short side for the last week or so and made good money in the name. Getting long during any of the last few sessions would have been painful. But today traders finally had an edge to be buying.

– the market rejected the lows

– $FMCN immediately rejected the lows and had its first move to the upside

However $FMCN did the same thing yesterday, yet had a reversal. There is a distinction to be made between today and yesterday. Yesterday the $SPY and $FMCN reversed by 10am (we look for stocks to be trending by 10 – 10:15), and yesterday $FMCN was no where to be found on the top Strong Today list, thus making it still just another weak stock in a weak market.

Today it showed great relative strength from the first ticks, was immediately on the top Strong Today list, and was heavily In Play. This is a trade I want to remember, a play I’ll add to my personal playbook.

– @tarhini_smb, trader

Disclosure: No position in $FMCN