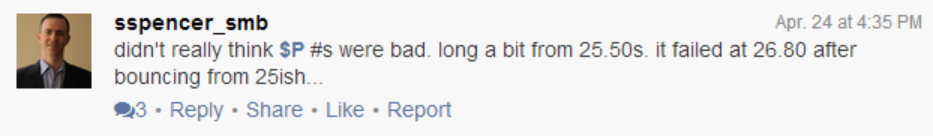

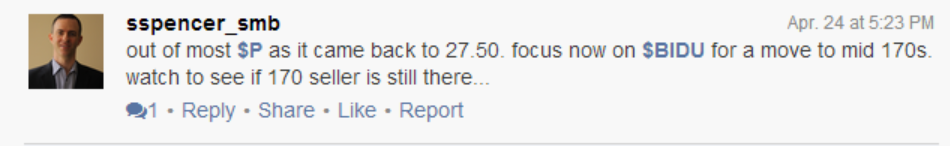

Pandora released their earnings after the market closed Thursday. If the numbers were OK I was looking to purchase at 26 or lower. I broadcasted live on SMB Real Time as I bought shares between 25-26. It eventually bounced to 27.50 where I sold most of the shares.

The next morning I was going to repeat what I had done in my after hours trading. There was no major negative news in their conference call and generally analysts were positive on the stock so with a gap opening of $2-$3 lower I viewed the risk of getting long as limited. As the market opened P dropped like rock to its recent low around $24.60. I was buying above $25 in the pre-market and I bought more as it approached $24.60. When it popped back above $25 I sold ¼ of my position. But very quickly it was back below $25. I watched a seller step down from $25 to $24.90 and sold more of my shares. When it made its new low I sold more now out of 90+% of the position.

All of this occurred relatively quickly in the first minutes of trading. The price action was indicating a bounce was unlikely. It wasn’t simply the aggressive selling right on the Open, but the fact that it was now trading below prices where it traded when the market had bottomed the prior week. I started to develop a new trading plan based on what I was seeing. A common pattern seen intra-day is a selling climax in the 30 minutes following the market Open, and a retracement to a prior failure area. The way P was being sold I figured it could bottom around 24 or a bit lower. I would attempt to get long into this climax for some quick cash flow and then I would begin to short when it traded back up to 24.60 and would be willing to increase my position size closer to 25 .

The selling was so aggressive once P traded below the prior week’s low that it ended dropping all the way to 23.52. I had placed a bid at 23.53 while it was trading above 24, and I was filled on P’s final flush. As it moved back to 24 I sold ½ the position and waited for it to move to higher prices where I felt the risk/reward would be more favorable for a short entry. It traded up to 24.50, and I began to get short. It dropped back to 24 and I thought that maybe I had missed my chance to build a larger short position. Luckily, I was wrong and it worked its way back to the 24.70s and my offers were all executed establishing a larger short position with about 30 cents of risk.

Here is a chart that shows my major “action points” from Friday’s trading.

By adjusting my game plan mid stream to account for P’s price action on the Open I turned a large loss into a small gain. Often in the heat of battle it is hard to change your bias. Many are tempted to double down. But if you develop an expectation of how a stock should behave after you initiate a position and it proceeds to the exact opposite you will find it easier to adjust your game plan.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 18 years. His email address is: [email protected].

Steven Spencer is currently long CROX, LQDT, PLUG, SODA, WAVX and short KO, P, SPY, and TLT