I had a conversation with a new trader today and shared my observations of his trading career. Here is what I liked: He has the ability. He possesses the ability to process information quickly. He has the ability to make fast decisions. This was clear during his firm interview and persists after his start. He has an outsized interest in … Read More

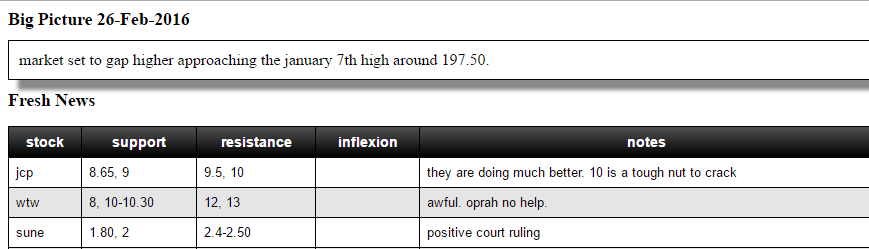

Trade Review–JCP WTW SUNE SPLK BBY

Every day we hold a pre-market meeting where we discuss the best risk to reward trading setups for the day. The trades fall into 3 categories: Stocks with a fresh news catalyst, “Second Day Plays” that had a catalyst the prior day, and finally “technical setups”. I’ve marked up some charts for five trades I made. 4/5 had a fresh … Read More

Unlocking Trading Success: The Formula for Profitable Trades

Yesterday I presented at the TradersExpo in NYC: A study of 5 successful traders from our desk. (Above is a picture of me, chatting with traders after my talk.) It’s important to study traders who have succeeded and learn from them as a trader and firm. The successful traders provide inspiration for those striving and best practices to copy. We … Read More

Andrew’s Strategy Set Theory

In this video Andrew Falde looks at combining diversified strategies in different asset classes to create a portfolio equity curve that is reliable and smooth. This strategy set will be an on-going update. * no relevant positions

A day in the life of a professional trader

Yesterday our education division, SMBU, held a webinar: A day in the life of a trader. The purpose was to share best practices for traders to turn into habit so they trade better. If traders do all the things necessary to improve, then they can improve. As I give this presentation, I have an internal conversation with myself. I really … Read More

Die Hard starts winning again

Die Hard is a senior trader who makes a ton of PnL. Unfortunately for him and our firm, he also loses a ton of PnL. This is actually a good problem to have for the trader willing to review and work. Many experienced traders aren’t willing to journal and review and adapt. They want to just keep hitting the buttons … Read More

SMB will be presenting at the Traders Expo New York

Mike Bellafiore will be speaking at the TradersExpo Tuesday, February 23, 2016, 2:30pm-3:30pm at the Marriot Marquis Hotel in New York City. His Topic: A Study of 5 Successful Professional Traders During this discussion you will learn: • How 5 of the best traders at SMB went from zero to High Performing Trader • The 5 best practices that made … Read More

Mr. Padre hitting singles now

Mr. Padre is a senior trader trying to hit home runs with his trading. It was not working for him, both psychologically and with his PnL.The more famous “Mr. Padre” was the late Tony Gwynn of the San Diego Padres, who built a hall-of-fame career slapping singles. He consistently hit above .300 and got on base at a clip of … Read More