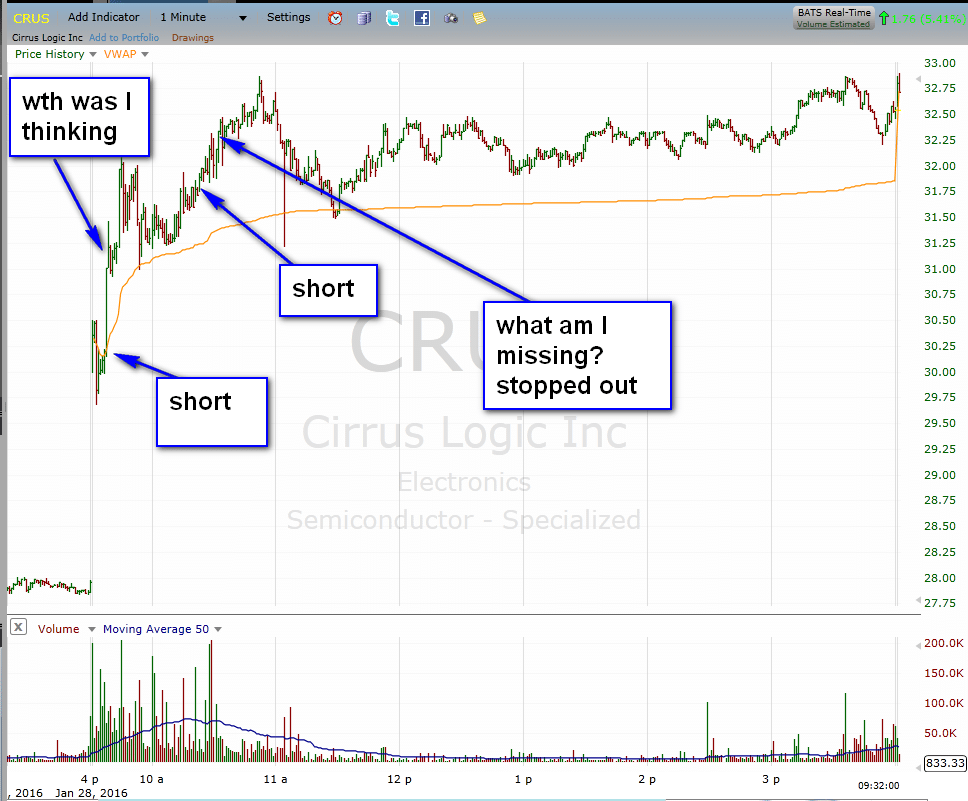

I called out a trader yesterday (Don’t make this trading mistake in Facebook) on a trading mistake and today it’s my turn. Man I messed up in CRUS yesterday. And here’s why. I missed this very important piece of information in Oppenheimer analyst Rick Schafer’s note : As a result, Cirrus will obtain an average of about $5.50 for each … Read More

Do not make this trading mistake

Trader Frequent Flyer was having another solid day on the month. He was up near 2k, which for his level of experience and skill was strong. The trading session ended. He was up near 10k for the month, with a few days to go. He had just closed out his 5th straight profitable trading session. And then Facebook earnings hit … Read More

A Perfectly Ineffective Hedge

In our SMBU Daily Video, Seth Freudberg explains a perfectly ineffective hedge. Many options traders buy puts in a panic thinking they will control downside risk in their trades We did a study on weekly options and found that they were incredibly ineffective at controlling downside risk over the last year In fact, traders would have made much more money SELLING … Read More

SMBU’s Options Tribe Webinar: Frank Fahey, Optionvue Systems, International: Trading Volatility Events—building a recurring earnings event portfolio

This week, Frank Fahey returns to the Options Tribe to discuss his approach to trading earnings events.

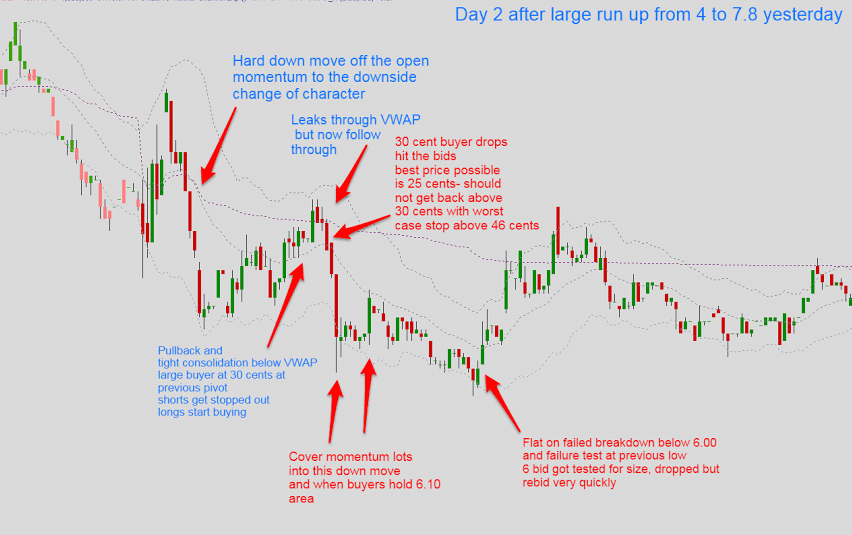

The edge is not just in the chart

During mentoring sessions after the open with our newer traders, I ask each of them what they traded. First up today was a trader who shorted a failed breakout in ENOC. He likes that chart pattern. But is that simple chart pattern enough to trade this pattern with edge? No. There was more to this trade than a failed breakout. … Read More

Market Edges Come and Go

There are two truths that I’ve observed about trading over my trading career. 1. Trading edges come and go 2. Great traders last For these two truths to exist simultaneously, it means that great traders cannot depend on a few edges that currently work. Mike Bellafiore has said many times before that the most important aspect of success in … Read More

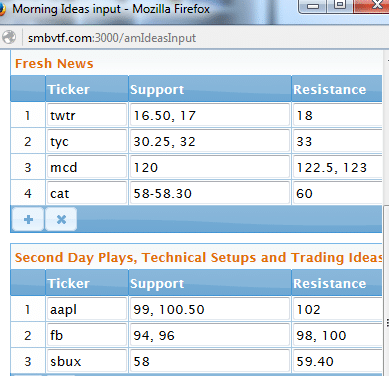

Pre-Market Trade Prep–TWTR TYC SBUX

Each morning before the market opens we outline a series of trading ideas. There is a written “game plan” to make it easier to follow along. We identify the best stocks to trade before the opening bell as this puts us in a better position to execute in the heat of the moment. Here is a screen cap of the … Read More

Selling the dream- I will pass

I got asked to do a podcast to discuss one of the books I wrote. I like doing podcasts. I did one with my friend ChicagoSean for StockTwits here. I did one with Chatwithtraders here. I like listening to podcasts. Soundcloud is an app on my phone, which I frequently use on my walk from the west side to the … Read More