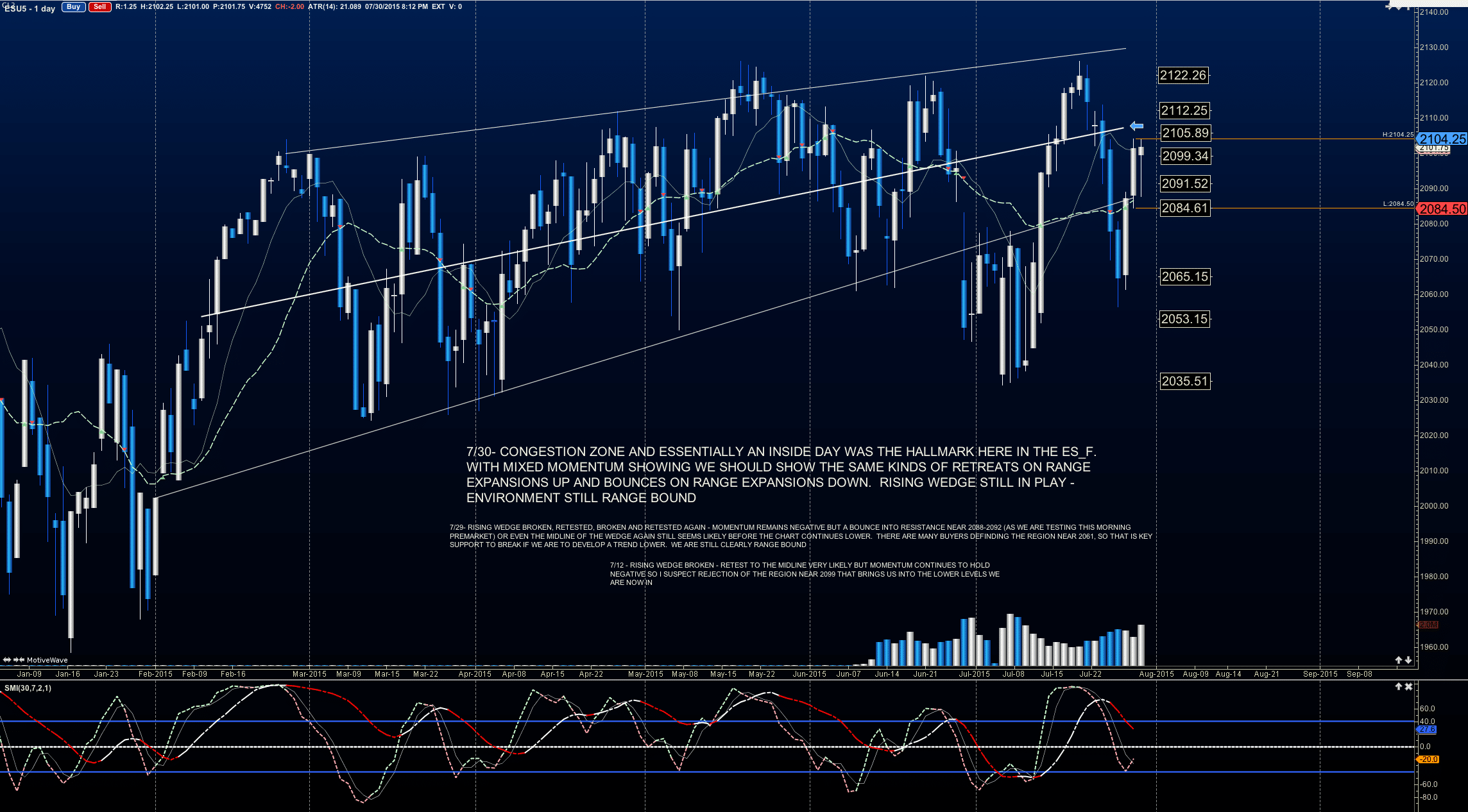

Trading Vault Concept – “Trading charts profitably and with consistency depends on how well the trader understands the current market structure and relationships between buyers and sellers. Once we understand these formations and structures, we become much more capable of creating our own consistent strategies that perform with a high degree of reliability and consistently.” Trading the ES_F overnight and … Read More

The Must-Follow Podcast from StockTwits: Insights with Mike Bellafiore

Mike Bellafiore was interviewed on #TheMustFollowPodcast from Stocktwits by Sean McLaughlin. To subscribe to #TheMustFollowPodcast go here or get them on iTunes. Below is an excerpt written by @ChicagoSean about this #MUSTLISTEN trading podcast with our own Mike Bellafiore. Mike Bellafiore: Trading as a Performance Sport To be the best, you’ve got to train like the best. We know this to … Read More

One Mistake Your Broker is Glad You’re Making

A common mistake that new and developing traders make in the options market is to trade strategies that involve high commissions relative to the earning potential. We often see newer options traders applying great options strategies to the wrong instruments. Option trading strategies that involve frequent management to control risk can be commission intensive. This is especially true if you’re … Read More

Twittergeddon!

The after hours price action in TWTR was epic. The market had been anticipating a large move following its earnings release based on how pricey its options contracts were prior to the announcement. And TWTR certainly didn’t disappoint. After closing the regular session at 36.50 it traded above 40 when its earnings were released. It beat on both top and bottom line … Read More

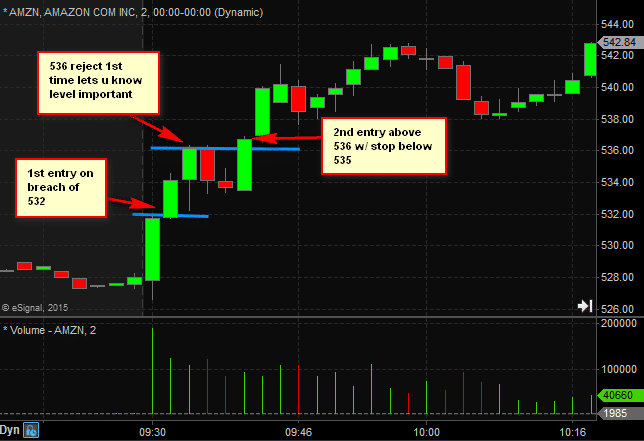

Today’s Top 2 Trade Setups–AMZN & TEVA

This morning we were setting up for a very busy day. In addition to the market continuing its slide from last week — there were a multitude of In Play names and Second Day Plays from Friday. Our #1 ‘In Play’ idea was related to TEVA which had agreed to purchase, in a mostly cash deal, the generics business of … Read More

Are you doing this with your trading/investing? (SMBU Daily Video)

In our SMBU Daily Video, learn how to make the most out of great trading opportunities. In this video from Mike Bellafiore, you will learn: What made $URI a great trend trade How we traded $URI The importance of trade review How you can capture the next opportunity like the $URI trade We hope this video helps you improve your … Read More

Study Price Action & Stop Being A Silly Troll

Back in April I tweeted a picture of a SPY chart that I thought was rather instructive. Here is the chart: A few things we can take away. The first is that the SPY 204.30 had been tested in February and then again in March. The bounce in March was very fast moving from the low to SPY 211 in … Read More

Waves and Candle Retracements (SMBU Daily Video)

In our SMBU Daily Video, learn more about wave and candle stick retracement. In this video from Anne Marie Baiynd, you will learn: Market waves produce certain types of energy When market patterns are about to shift Why you should be trading in the direction of the trend. We hope this video helps you improve your trading skills. – SMBU … Read More