SMB receives approximately 5,000 applications each year to trade for the firm. As you can imagine, it’s nearly a full time job to sort through 400+ new applications each month. Of the thousands that apply each year, the net acquisition of new traders that go live with the firm is less than 50. That’s right… Less than 1% of applicants … Read More

Decoding the Secrets: What Do Options Traders Know That Others Don’t?

Options traders like you have been telling us for years what they want to achieve in their trading. Strangely enough, they don’t ask us to show them trades that make bigger profits. Nor do they ask for risk-free trades. The word we hear most from options traders is consistency. Who wouldn’t want to be more consistent, right? However, we believe … Read More

What You Can Do to Stand Out (SMBU Daily Video)

In our SMBU Daily Video, learn what can set you apart from other traders.

In this video, Mike Bellafiore will discuss:

What qualities make a trader stand out

Fitting in with other traders

Why you shouldn’t reinvent the wheel

We hope this video helps you improve your trading skills.

– SMBU Team

SMBU’s Options Tribe Webinar: Seth Freudberg to present a weird version of the Weirdor

Today, Seth Freudberg will be presenting a modified version of the iron condor trade known as “the weirdor”. This will be the first time that this particular version of the Weirdor has been presented on the Options Tribe

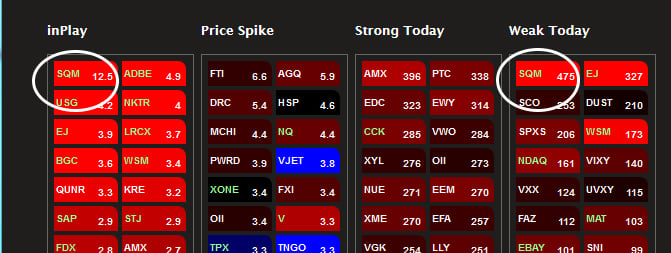

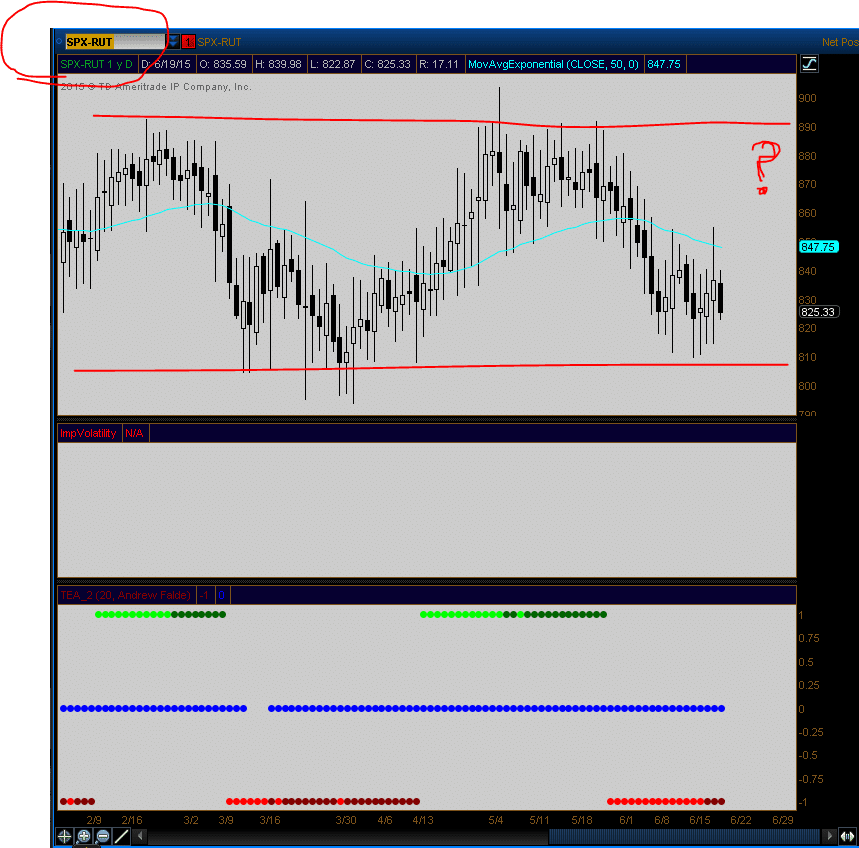

Enhancing Probability: A Guide to Index Mean Reversion Pairs Trade

With RUT accelerating to new highs and the SPX lagging — is there an opportunity for a mean reversion pairs trade? I believe so. The probabilities are high for mean reversion. But, the danger of a mean reversion trade is the possibility of being too early. That is where options can give us additional edges. With options we can “lean” one way … Read More

Long BABA Again

BABA reported solid earnings in early May causing it to gap above 85. On Friday I got long at 85.20 with a stop below 84.50. If it can close above 87.50 next week I would be willing to hold it for a longer term move back into the 90s. Sellers are in control right now so I could get stopped … Read More

Oracle Had A Fundamental Catalyst That Made It A Good Short

ORCL reported disappointing earnings after the Close on June 17th. The next morning it traded lower before rallying back $2 with the market. I had two reasons why I thought it would roll over again the next day. One, I believed the large market rally the prior day was the primary driver of its bounce from 41 to 43. Two, after large … Read More

Why Netflix Was A Short Today

Netflix has been on quite a tear since they reported strong earnings in April trading higher by more than $200. But for short term traders who each day look to trade lower time frame trends NFLX offered a good short setup Friday morning. These are some factors I considered prior to sharing the setup in our morning meeting. Netflix had a huge … Read More