Today at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. Today,Greg Loehr … Read More

The SMB Foundation: Proof that Prop Trading is Not Dead

I’m glad I decided to write this now and not when I intended to a few weeks ago, as this particular post addresses Mr. Josh Brown’s debate of whether or not Prop Trading is officially dead – it turns out that, on occasion, procrastination and an overall busy schedule is helpful. I remember speaking with @dynamichedge regarding this particular topic … Read More

Spencer Trade Review – $AMZN $FB

Steve Spencer reviews trading opportunities in AMZN and FB from July 27th 2012. Steve Spencer * No Relevant Positions

How to Become One With Your Trading System

We’ve all heard the sad excuses after a bad run. The lame rationalizations. “I know it was through my stop, but I thought that it would come back”. “Yes, I saw the signal, but I just didn’t believe it” “I don’t know, I just froze” When someone is struggling, one way to lessen the pain is to rationalize it … Read More

The Opportunity for a Prop Trader

@DynamicHedge wrote a must-read piece recently that went viral, “Letters to a Young Trader”, in which along with buckets of awesome advice he also asserted prop trading shops are dying. This is true. But this is not the same as prop trading is dead and/or ALL prop shops are dying. That would not be correct. The author never stated this but … Read More

SMB Forex Daily Review – July 26th, 2012

Marc Principato Director of SMB Forex [email protected] * No Relevant Positions

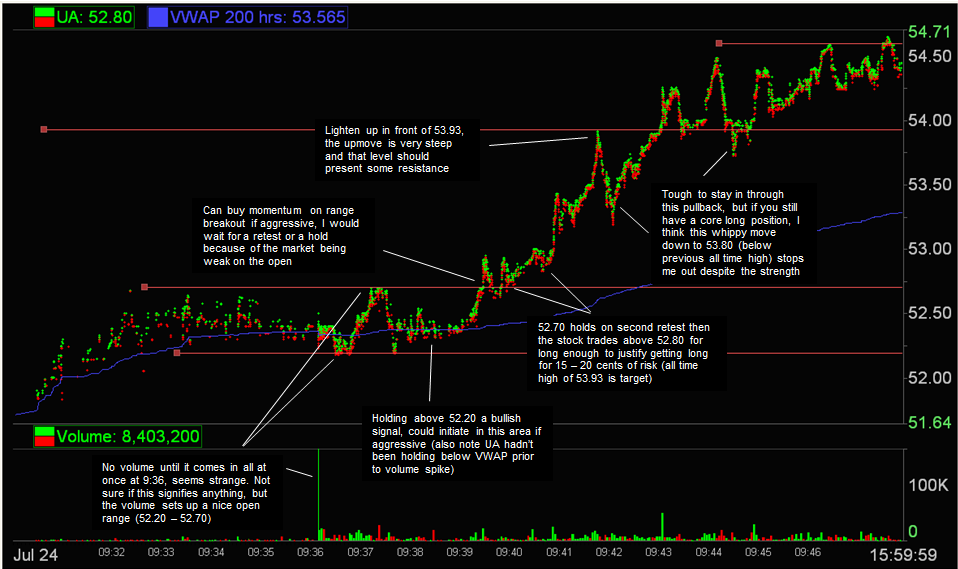

The Opening Drive Play (UA)

I was watching UA on the open and I wanted to write up this drive because I feel like I’m a bit more comfortable with the slower setups in a trending environment. On the open the timing windows are shorter, the price movements are more whippy, and at the moment it’s generally more difficult for me to control my risk … Read More

How To Tell If A Trading Book Is Useful

As part of your desire to learn more and improve as a trader, you have probably checked out some books on the subject. Some of them, like Market Wizards, are truly inspiring and excellent reads. Maybe some of them have been helpful but most likely a lot of them were bad. Similarly, if you go to a bookstore or browse … Read More