Occasionally, you come across setups where your risk is 10 cents and your reward can be multiple points. I usually find these trades no more than three times per month. These are trades that I cannot accept missing when they occur. I found such a trade yesterday afternoon. AAPL had been trending up strongly. It appeared to be heading to … Read More

Do Not Chase Stocks!

A problem I see time and time again in my own trading, but more so in inexperienced traders, is when you miss a move in a stock or in the market, we tend to chase and push. This is obviously a lack of discipline. But how can you protect yourself from this? First, let everybody understand that it is alright … Read More

From the Mailbag – Part 2

Yesterday Sam asked the following question ….Sam Says: February 25th, 2009 at 7:20pm: What characteristics make a good intraday trading stock?A good intraday trading stock offers you excellent risk/reward opportunities. It is a stock that you can read is about to trade higher or lower. A good intraday stock gives you good prints. A good intraday stock is one that … Read More

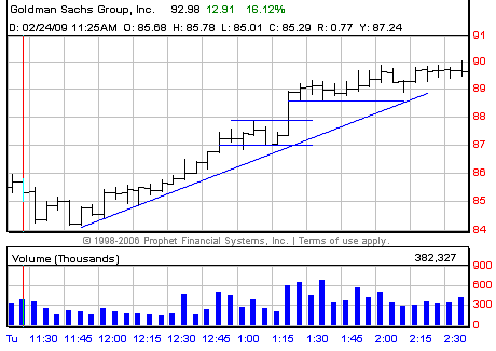

Buy to WYNN

I traded WYNN today. It was a very good intraday trading stock. I have noticed lately that stocks are being bought differently in this new market. Let’s discuss the trading in WYNN today to explain. The market has sold off from 13,000 to today’s close of 7270. WYNN has sold off from 110 to today’s close of 21.75. Lately … Read More

Excellent Risk/Reward Trades

This post is going to be short but sweet. I will highlight two trades from today. The first is a technical trade that was highlighted on our AM Ideas Sheet. The second is an example of a low risk entry point in a stock that is usually quite difficult to trade intraday. Recently, gold has been very strong. For the … Read More

Keep Track of Key Levels

In my last post, I stress the importance of stock selection. Easy money! Bella mentioned CAT in one of his posts. CAT at the key levels of 30 and 29, is a perfect example of easy money and stock selection on three separate days. Check the chart below. All you needed to do was follow up, know the key levels … Read More

How Do You Do It?

Whenever someone makes a good trade on our desk a common retort from another trader is “How do you do it?” I received two of these today from ALJ, who sits next to me. DE was the culprit. I was the protagonist. Profitable trades were my reward. DE was in play today. They reported. DE opened down. It’s first moves … Read More

The Right Trade For Today (February 17th)

Part of the training the traders on our NYC trading desk receive is instruction on the trading setups that offer the greatest statistical significance for In Play stocks. What is not part of our formal training is the most statistically significant trades for specific kinds of “trading days”. Usually, I give a quick comment at our AM Meeting as to … Read More