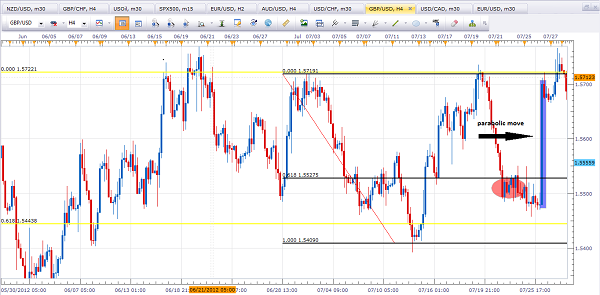

At SMB Forex, we define a “parabolic” market movement as one that goes higher or lower pretty much in a straight line. These thrusts of momentum carry important information for our analysis when we are operating within the rules of our proprietary swing trading strategy.

Let’s use some recent price action from the GBP/USD pair. While it stayed within a price range between 1.5750 and 1.5280, it offered multiple trading opportunities.

The first important piece of the puzzle is when the pair gave us it’s initial parabolic thrust to the previous high of 1.5723. After such excess momentum, we expected another break-out to form.

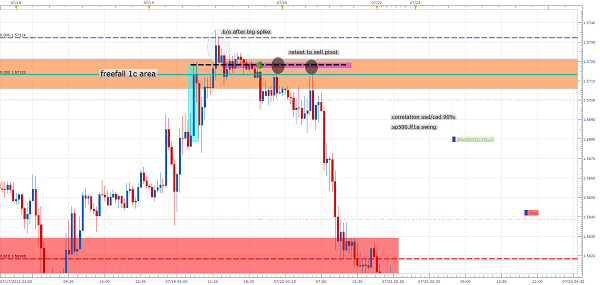

The idea behind the price action is this: the new break out is where anxious buyers who missed the lower prices enter the market on top of what ever is left of the early shorts finally get squeezed out. The question you must ask is: do the buyers in this breakout have enough conviction to keep it going? If the price action and other correlations we look at say otherwise, then we are looking for failure. Meaning all these new longs are going to get stuck and will add to the selling pressure as they exit their positions.

In this GBP/USD example, notice after the parabolic move and new high, price began to struggle, and failed. There were plenty of signs of failure before the heavy selling took place taking this pair below 1.5620.

Parabolic moves typically result from news hitting the market. Inexperienced traders tend to short these moves and rationalize it with the thought, “It’s way too high, it has to pull back.” Ever do that? We all have. These traders help the price push higher to the point where they all exit at the point of price exhaustion.

Our pattern recognition strategy helps us select particular levels where we can anticipate such market behavior. Combined with our correlation analysis and order flow techniques, we can spot these opportunities with confidence and establish short positions with well defined risk.

The lesson take away is this: there are certain type of market conditions that offer attractive reward to risk opportunities, but they are not easy to spot. As a professional trader, you need a set of rules and a particular view of the market to be in the best position to recognize these situations and participate without taking big risks. Our strategy helps our traders discover and participate in these and other particular market situations with defined risk and confidence.

Andres Salazar

Senior Forex trader

No relevant positions unless stated otherwise.