(this post was originally written May 1st and refers to the price action in WFMI from 4/28/11)

Let me start by saying as an intraday trader it’s ok to have a bias but your mind needs to be open to all different possibilities. A stock is gapping up, my bias would be long, gapping down my bias would be short. But, you need to be flexible. So, a stock is gapping up will there be profit taking? Will there be a gap fill? Will there be a strong drive and an uptrend for the rest of the day? Will there be a pullback? So, a stock is gapping down will there be panic selling? Will there be buyers ready to buy at these cheaper prices? Will it fill the gap? Your mind needs to be flexible with these set-ups throughout the day. Here is a trade that I didn’t take this week, that is eating away at me. And the reason I didn’t take the trade is because my “BIAS” got in the way of my favorite set-up and trade.

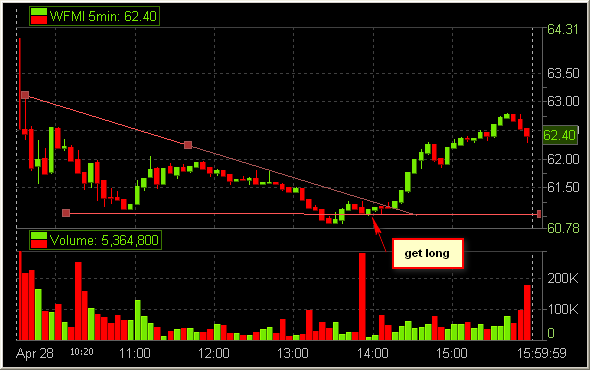

Stock: WFMI

Gapping down below 65. Next Support: 61

Yes I caught the third down leg of the stock, but I was looking for more weakness since the stock was in an overall downtrend. And when I saw the stock holding higher I was looking for a resistance area to get short and play it for the new lows. Yes, my bias was short but if I were to just trade the stock without my bias then I would have made a great trade!!

As you can see on the chart the stock got below 61. It was holding below so I held some of my short when it got above I got flat. As you can see it began to hold above support but couldn’t get above 61.20. A huge buyer came in and took in 150k shares or so right near support. That was the clue I need to see the pattern change and the stock to began to reverse. With a target at 62.80 based on where I saw it fail on the Open

Spencer comment: I would also point out that the tight horizontal consolidation was for about 30 minutes which made a break in either direction more likely to follow through. I look for 5 bars or more of this type of consolidation after 10:00AM. I think Sammy’s 62.80 target was somewhat ambitious but certainly 62 where it failed 3 times between 10:30 and noon was a reasonable target and still justified being long from a risk/reward standpoint.

Also, Sammy’s most profitable trade setup in April (his best month so far) was on reversal trades. Therefore, it made perfect sense for him to take this trade.

Here’s the chart:

9 Comments on “Trading with a Bias: Unlocking Strategies to Overcome Market Challenges (Stock: WFMI)”

You are buying a text book “downwards triangle” at the literally the worst price.

From the point your arrow is.. you could catch a huge drop right through inraday support, to a brand new price.

About three bars to the right has ten times better reasons to get long. It breaks the downtrend line. It actually changes directon.

Support was not confirmed. That is a guess that support holds, on a weak chart

Isn’t every trade a guess? If the stock should be selling on broken S and it isn’t, seems like a great reason to me to look for a micro-pattern for taking a shot with a few cents risk for the pattern failure.

stebert,

interesting comment. on the original chart sammy sent me he highlighted the break of the trend as where he would add to his position after confirmation. in terms of why he initially would get long he observed something on the tape. a large buyer took out 150K shares and the bid was not dropping.

steve

Isn’t every trade a guess?

No.

Spence. I understand somewhat what your method to iniate a trade. Fot me using that arrow for long entry is too risky for me. Back in 2008 that chart pattern would sell off all of the time. (Gap down type selling) You can literally use may 6th 2010 intraday chart to prove the point. On that chart the trend did not change and support broke to what turned out to be a epic intraday sell off. I’m sure you know what I’m talking about.

For me three four bars over is where I would give it a shot.

Also I’m am unsure if this price action is (gap above yesterdays high) or (gap below yesterday Low) or in the middle. This would somewhat change my thinking if we are lets say gap up.

I agree that stubbornly sticking with a bias that has been proven wrong by the market can be trouble, however, a strong bias that is being proven right can result in holding winners for a much larger gain on larger size. When your instinct screams that the market is about to move in strongly in one direction (down in equities over the next several days in this case), if it’s right it can lead to one of the most profitable trades/days/weeks of the week/month/year. As long as you avoid banging your head into a wall repeatedly because of an incorrect bias (the real challenge), the inevitable bias (we all have them to a certain extent unless you play a strictly indicator based system) is a helpful tool, but one to be reevaluated regularly

By entering at the point noted by the arrow on the chart, you are also closer to potential stop/exit points. If the price dropped back down below 61 or even the low made just a few minutes prior, you could be out risking fewer cents than if you waited for the breakout of the triangle. As Steve mentioned, this was a trade made using the tape as much as a chart pattern. That huge volume spike didn’t take the price back down below the support level, which is a bullish sign. Couple this with the fact that the price broke down under the support and then came back up into the pattern. In my experience, these false breakouts that enter back into the pattern regularly result in a breakout in the opposite direction. The body of evidence makes this a great entry point.

andrew,

you summarized my other thoughts on this trade as well but i guess i was too lazy to write 🙂

my guess is u are a pretty consistent short-term trader.

steve

jesse,

great observation. some really smart people read this blog. i have always found the greatest use for my bias is to press winners when the price action is confirming my thesis.

steve

Thank you Steve. I take that as the highest compliment a fellow trader can give. Unfortunately, I currently work in risk management for a full service broker/dealer. Firm restrictions prevent me from trading full-time intraday (thanks to $34 employee “discounted” commissions, my firm’s refusal to let me have an outside account since I’m 7 licensed, and their crazy expectations for me to actually do the job I’m paid to do, haha). However, as Mike writes in One Good Trade, traders find ways to trade. I’m doing my best with the situation I’m in and spending practically every moment of the day I can afford trying to become a better trader for that time in the future when I will be able to trade intraday. SMB has been a tremendous help with that. In addition to the blog, I’ve probably learned more actionable, practical lessons from your Stocktwits TV videos than I have from all the trading books I’ve read combined. Thank you and keep up the good work. Hopefully someday, I will be able to call myself an elite, consistent short-term trader.