Traders, In this weekly watchlist, I’ll outline my top ideas for the week and provide my entry and exit plans. Remember, this is a shortened 3.5-day week due to the Thanksgiving Holiday. Historically, this week has often included several outlier moves and even black swan events with small caps. So, it’s essential to remain open-minded and, of course, as always, prioritize risk management.

Starting with the top idea from the previous two weeks in a row, Tesla.

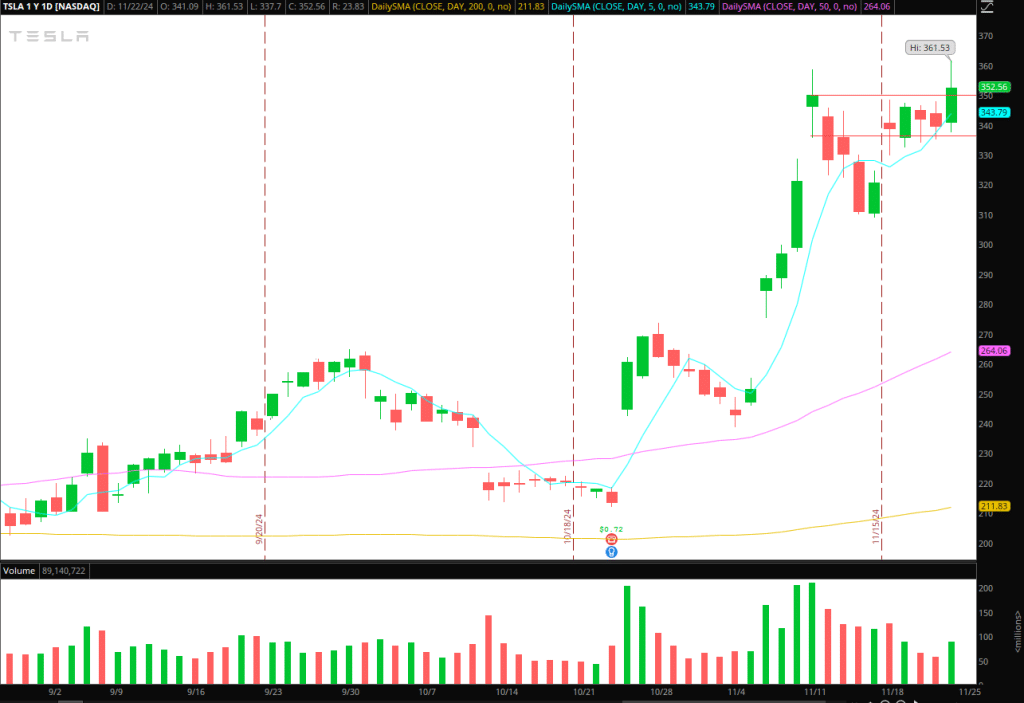

Continuation in TSLA

The Idea and Plan: Tesla had coiled for several days near its recent pivot high and 52-week high, on contracting volume and decreasing range. Then, on Friday, arguably, the trade of the day was the breakout across multiple timeframes and Odte factor. Going forward, and especially coming into a shortened week, if the stock were to continue to find support above prior resistance, the momentum higher could be extreme in my opinion.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Therefore, as long as the stock can hold above the prior significant resistance of $350, I will be interested in a multi-day long swing. Not only is $350 previous resistance, but it is also the 2-day VWAP now.

Ideally, we see a re-test of that area and quick pushback into the range from Friday. A move like that, for example, would enable me to get long versus the LOD. A clean break above another level from Friday, $355, would get me to add to my position, initially targeting a move toward $360 to take a piece off. I’ll trail my stop using higher lows and piece out along the on extensions and higher highs, ultimately targeting multiple ATRs.

Continuation in UPST

The Idea and Plan: After a powerful earnings gap, the stock had a measured pullback and digested the significant gap. That was healthy to see. After several weeks of price discovery and consolidation, buyers are beginning to firmly take control, with a new floor being discovered for the stock at around $70, along with a significant short interest of almost 30%.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

To get long for a leg higher I need to see two things be present. Firstly, I want to see the stock consolidate/hold above Friday’s high, providing a potential momentum-long entry. Secondly, I want to see volume breakout and significant RVOL. Initially, I will look to be long versus the LOD, however, once an ATR move / the stock reaches $80, I’d look to begin trailing my stop using higher lows and scaling out after that on higher high extensions.

Bitcoin Thoughts / MSTR

Of course, the talk of the town is when Bitcoin $100k. That is going to be a significant psychological number and one where a major supply exists. But many scenarios could pan out from this unique catalyst or forward-event if I can call it that.

For example, do we push a few k above the level, supply overwhelms, and get a sharp 10% correction? Does Bitcoin go further than we think in the short-term post-key area break? Does the $100k break take longer than expected, and do we see some premium come out of bitcoin-related stocks? These are all scenarios I am thinking about, as well as game-planning reactive moves.

Of course, I’ll be watching IBIT to react to Bitcoin, along with MARA and MSTR.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

As it relates to MSTR, as long as Bitcoin holds below $100k / fails on the breakout, my plan for MSTR is to short outer areas of supply. For example, I am looking for a push toward $450 – $460 to fail to follow through to get short vs. the HOD. Areas I would look to cover would be $420 support – $400. If the stock remains relatively weak, I’d hold a small core and look to recycle on lower highs.

Additional Names on Watch with Alerts:

Uranium Stocks on Watch / as Sector Continues to Build: URA, DNN, UEC.

Exhaustion in Quantum Computing Stocks: IONQ, QBTS, QUBT.