Traders,

I look forward to sharing my thoughts with you this week. As I’m travelling this weekend, there will be a written watchlist and no video.

Following on from last week’s thoughts, the market continues to grind higher, shrugging off negative headlines, with leaders continuing to lead. Like last week, whilst I am most interested in long swings in leaders, I’m certainly not looking to chase after a stretched move in the market.

Instead, I’m monitoring price action in SPY toward the 200-day, whether we reclaim and hold, pullback and base toward the 50-day, and confirm a higher low, or fail the 200-day and potentially confirm a new swing pivot high. This week will be telling. I’d love to see a multi-day pullback and stabilization above the 50d for better risk-reward across the board.

So, with that being said, and key emphasis on patience and stock selection for the upcoming week, along with identifying continued relative strength in leaders, here are my top focuses going into it:

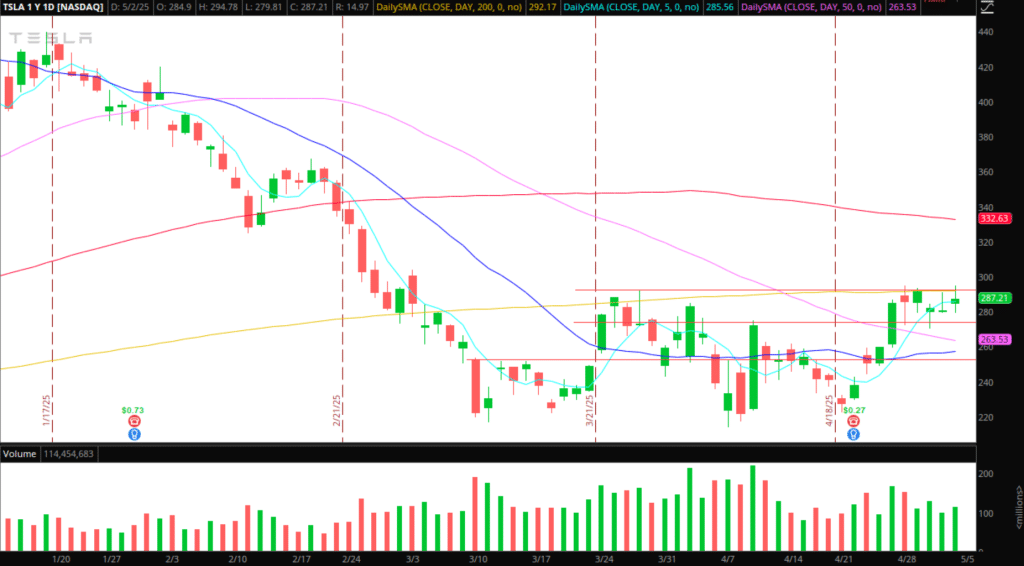

Consolidation Breakout in TSLA

A breakout in Tesla is my favorite setup for the upcoming week, depending on the overall market’s direction and relative strength in Tesla.

Specifically, I like how the $275 area of resistance has become support, with a precise inflection and breakout level near last week’s high, around $295, acting as the key level. If the market continues to hold firm, I’d look to trade this like I did last week: dip buys within its range versus support, selling around a core into resistance, and adding on a breakout above the consolidation highs.

Alternatively, suppose we hold firm intraday near the breakout level. In that case, I will look to initiate a long through the breakout level across multiple timeframes, with a stop below the consolidation breakout intraday, for a multi-day swing. I’d be targeting up to a full ATR as a target.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

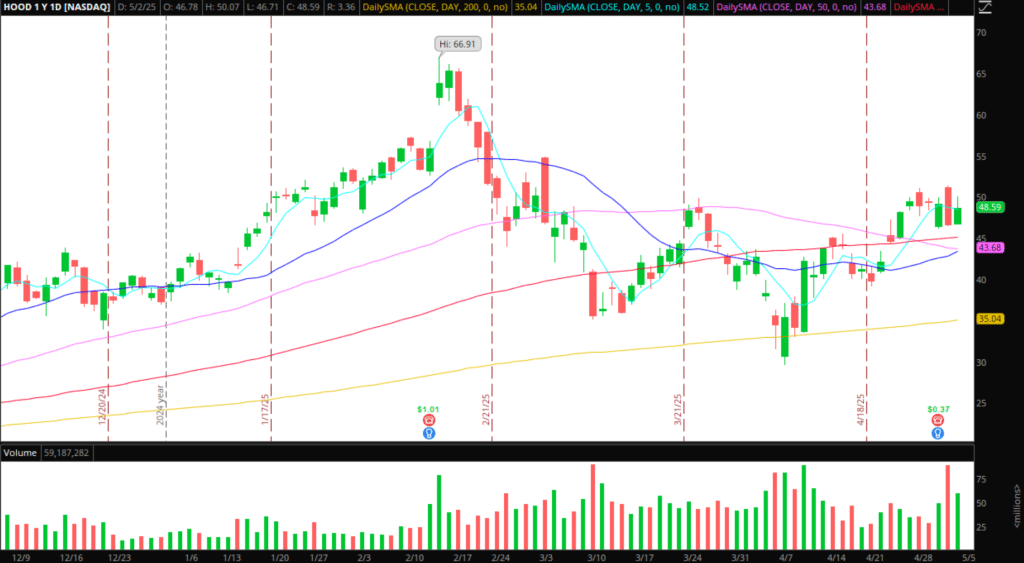

Developing Consolidation Breakout in HOOD

Earnings are out of the way in HOOD, and a steady reclaim and consolidation are developing above all of its key MAs. There’s nothing for me to do right away, and I doubt I will take action on Monday or Tuesday.

Instead, I would love to see a pullback or multi-day hold in the market, for HOOD to outperform during a market pullback, and for its range to tighten. That would indicate relative strength, institutional buying, and a lack of selling. If that happens and the range tightens, I’d look to enter a position long on a breakout above $50 if the market firms up after a rest period. This would be a swing trade, targeting up to multiple ATRs, taking risk off on extensions from intraday VWAP, and trading around a core. It depends on how it is set up intraday, but I will most likely be trailing the position in the 5-minute timeframe against higher lows or VWAP.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Large Caps on Watch For Continuation / Pullback Entries are AI, CRWD, SPOT, UBER, TMDX, RKLB, and MELI.

Small-Caps on Watch:

KIDZ: Nice failed follow-through near $9 on Friday. Going forward, I will look for pops into/near $8 for similar action for a short. Ideally, a push on Monday and failure to hold above $8s / 2-day VWAP for a short against the HOD, with covers into $7 and $6. If volume drastically dries up in it, it’s an avoid.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

FRGT: Excellent action on Friday, similar to how it has traded intraday over the years after similar pre-market moves and volume. Doubtful, but I would love a push back toward its 2-day VWAP on Monday or $2.2 – 2.5 for a short against the HOD once it turns.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

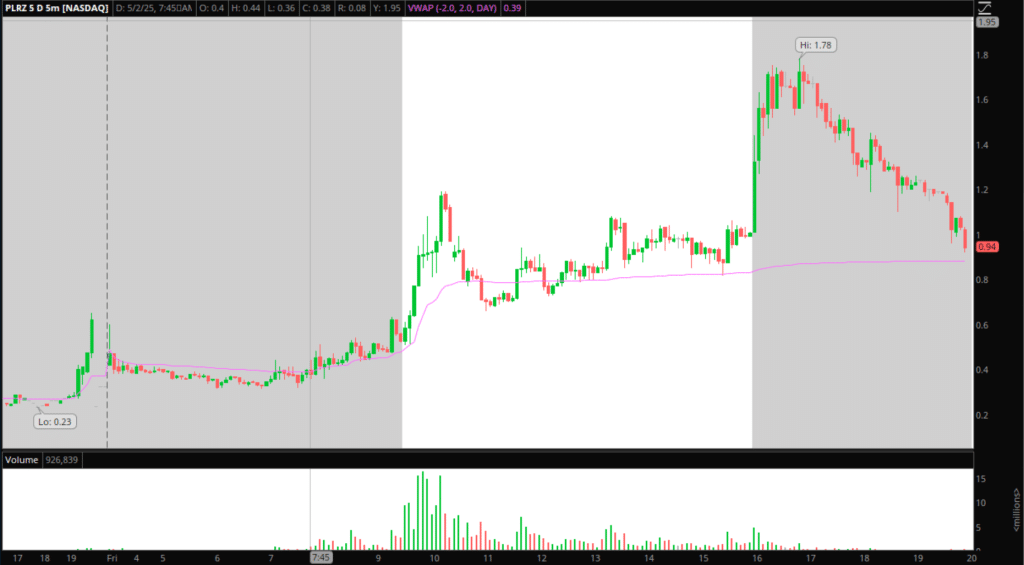

PRLZ: Nice blowout Friday AHs. Not interested in chasing weakness in the name after Friday’s action. Instead, I’d be interested in failed follow-through between $1.2 – $1.5 for a short against the highs, covering extensions lower, and trailing against 5-minute lower highs.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.