Traders, I look forward to sharing my ideas for the upcoming week. Reminder: The market is closed on Monday, so it’s just a shortened four-day week. I’ll also be on vacation for the entire week, but I certainly didn’t want to leave you hanging, so here are my top ideas for the week if I were to trade.

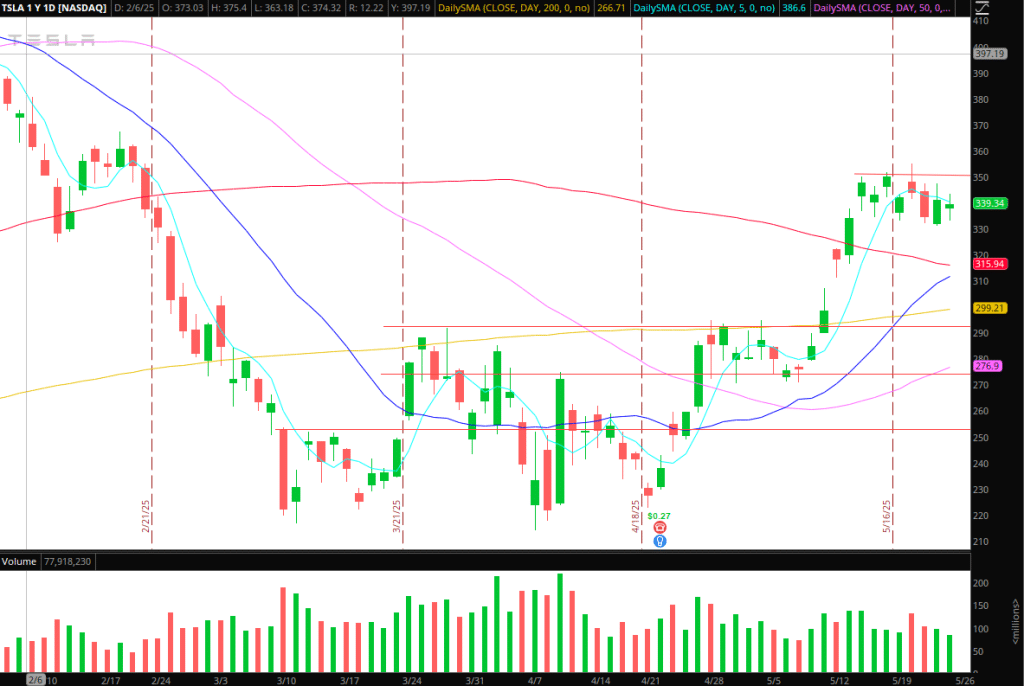

Consolidation Breakout in Tesla

Tesla has been a trader’s dream since the breakout above 293s. That swing setup worked beautifully, and now, it’s setting up similarly again. After making an impressive move and becoming a leader in the short term, Tesla has now consolidated above all key SMAs, forming a higher low in a developing uptrend, and compressed in range, creating another bull flag.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

For entry, and if I weren’t already long, I would look to initiate a long above Friday’s high, just a starter, against the day’s low. For adds, I would need to see a hold above $350. For the breakout, I would target a 1-ATR measured move above resistance to take off a piece and remain long with a core trailing against the prior day’s low once resistance has cleared.

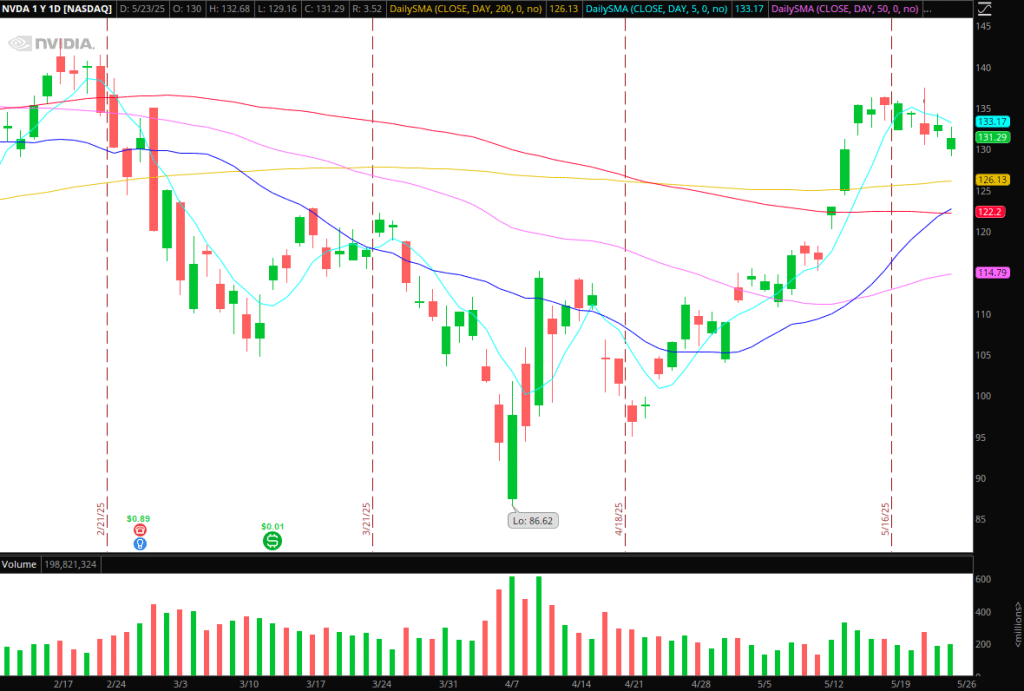

Semis on Watch – NVDA Earnings

Undoubtedly, one of the most significant catalysts of the week will be NVIDIA earnings on May 28. It comes at a time when NVIDIA has formed a beautiful consolidation and higher low above its rising key MAs, after recently reclaiming its 200-day SMA. Similarly, SMH has recently reclaimed its 200-day and experienced a healthy pullback and higher low within its newfound uptrend. AVGO, another leader in the sector, is consolidating near significant resistance, in an extremely bullish pattern, which is ideal for a swing long entry on a breakout. SOXL is another vehicle post-earnings.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, the sector is set up exceptionally well for a breakout and momentum, but it all hinges on NVDA’s upcoming earnings and guidance. If we break out post-earnings, it’s possible to initiate positions in the AHs once the initial move and volatility are out of the way. But most likely, I’d wait until the following day to see if we are holding above breakout resistance / key levels from AHs, and then look for an entry on a pullback for a multi-day swing.

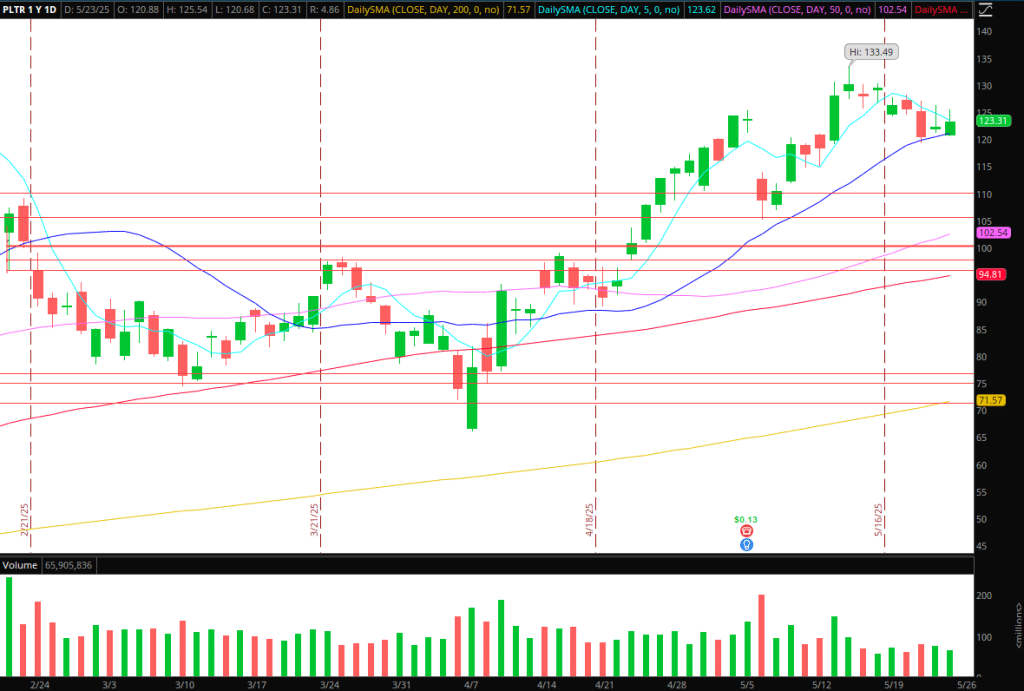

Momentum Trading in PLTR

I wouldn’t be looking to initiate a swing position in PLTR, given how extended it is from its 200-day SMA. However, with that being said, I would be open to getting long intraday if the stock were to break above Friday’s high and hold above intraday VWAP. Why? It’s shown major relative strength, and formed a great risk-reward pattern near 52-week highs, with range and volume compression. Alternatively, given its extension higher, on a higher timeframe, I would also be open to a short if the market experienced a selloff and PLTR broke below 120 key support intraday.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

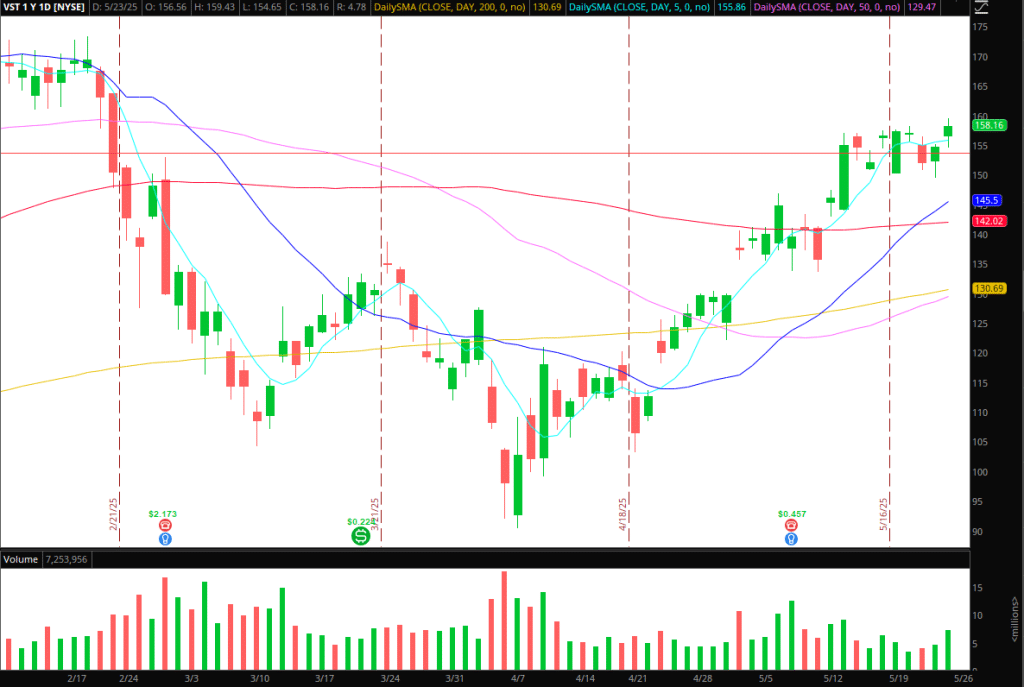

Additional Names on Watch:

Breakout continuation in VST: The Power generation sector has experienced major strength in recent days and weeks. VST is trying to break out of a multi-week consolidation. For entry, I would look for a long above Friday’s high or a long on a pullback to 2-day VWAP and hold / higher low.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

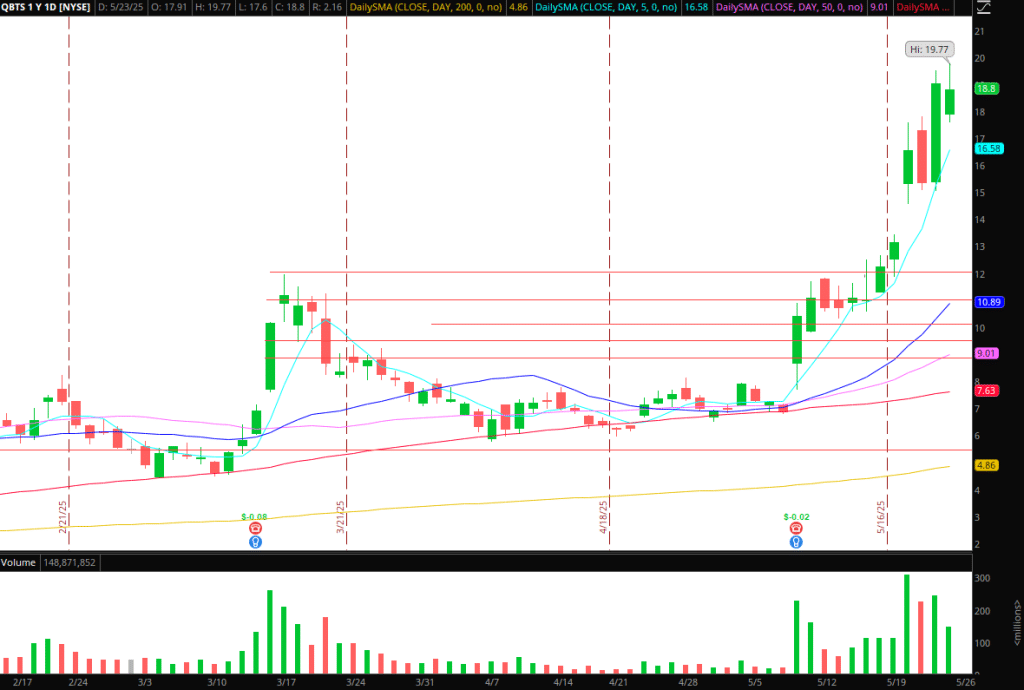

Quantum Names (QBTS, RGTI, IONQ): Too high to chase, and no clear backside yet to short. So until then, it’s all intraday scalping and no swing entry. Higher the better across the board, for the eventual blowoff-top / failed-follow through, and swing short opportunity for a reversion. Hopefully it doesn’t happen his week while im on vacation.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

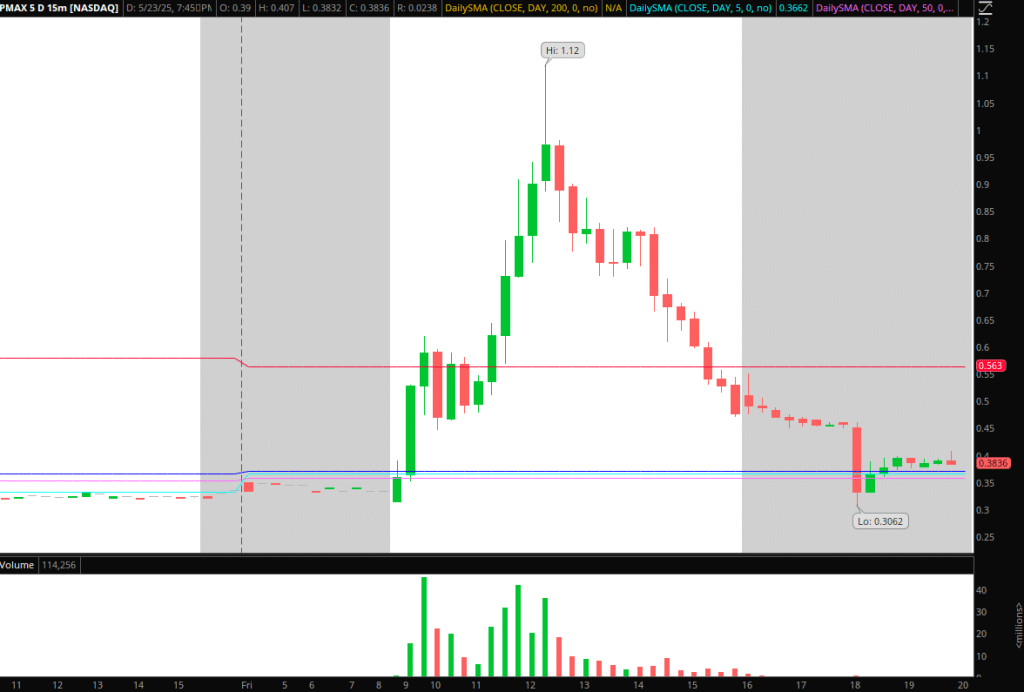

PMAX / IMNN / GORV: Several penny names from Friday. I’d just set alerts across the board in case they stage a brief comeback and push into supply zones from Friday for a day 2 short and unwind.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.