Trader, I look forward to sharing several top ideas for the upcoming week, including entry and exit targets.

With several of the recent higher timeframe long ideas playing out perfectly, along with a stretched market to the upside, the week ahead emphasizes patience and allowing charts to set up favorably again. To repeat a great analogy I heard this week, “let the train pull into the station”. As I outlined in my recent IA meeting, I’m monitoring several leading sectors and leaders within those sectors. So I won’t repeat that list in detail. Instead, here are just a few of my focuses for the upcoming week:

Consolidation Breakout in MVST: great breakout above its recent 52-week highs. Spent most of last week finding resistance near $3.5 and consolidating above its 5-day SMA. With the Moody’s downgrade, we may get a gap down across the board. If it turns out to be a nothingburger, and we see sharp reclaims, MVST will be on close watch for a breakout above last week’s high.

Specifically, I’ll be looking to enter long above Friday’s high, with a stop at LOD. My first target would be 1-ATR to a measured move, so between $3.8 – $4 to take a piece off, and trade around a core trailing against LOD. I’d be looking to hold for multiple days, trailing against LOD, and piecing out on extensions above VWAP.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

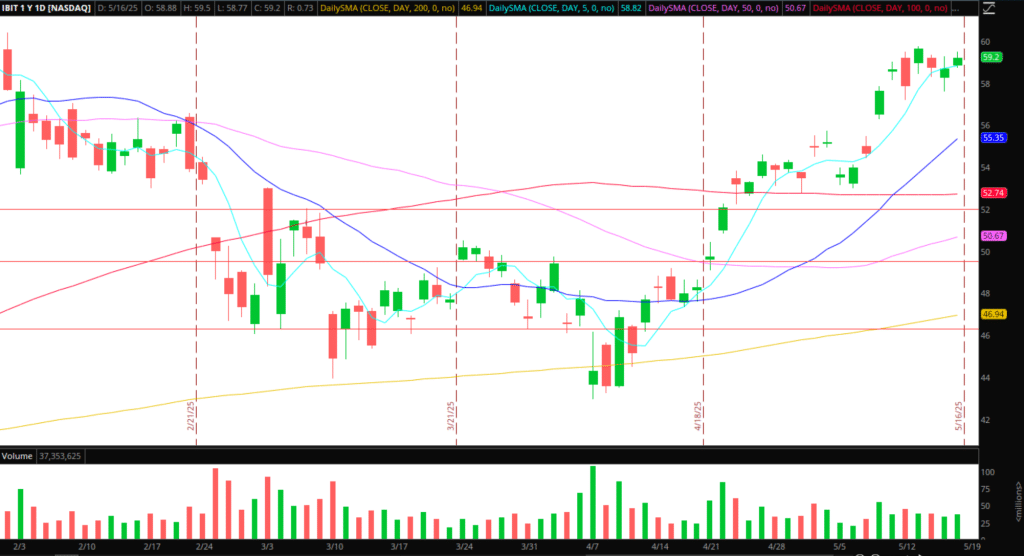

Consolidation Breakout in Bitcoin: Bitcoin is flagging across multiple timeframes. There are various vehicles to express this idea, but I will focus on IBIT. Specifically, I would look for an entry to the long side if we break above Friday’s high, near $59.5, and add through $60. Major resistance near $61 would be my first target, with a $60 stop. Thereafter, I would hold a core against the day’s low for potential follow-through to the upside.

Alternatively, on the off chance we stuff and pull back, I would be open to intraday momentum shorts on a consolidation breakdown, targeting intraday momentum to the downside as long as we hold below the $57.50s in IBIT and maintain lower highs on the 5-minute below VWAP intraday.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Reset and Further Build in Tesla: The same plan applies to a host of names I reviewed in my recent IA meeting. Fantastic follow-through on the swing idea in Tesla and many other names. Now, I need to see a pullback and reset of the chart, setting up a fresh entry to the long side for continuation. For example, a pullback in Tesla toward $335 or the 5-day support established and a few range-bound days before setting up a fresh breakout long entry after a period of rest. A similar plan was discussed in HOOD and several others in IA.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Pullback into Prior Resistance RKLB: After breaking out above prior resistance near $23.7, I’m looking for a secondary long entry if we retest $23.7 – $24, find support, and confirm a higher low against Thursday’s low. If we do, and reclaim intraday / multi-day VWAP on a pullback, I’d look to get long against the LOD with Friday’s high as target one, and trailing the rest against the day’s low for continuation over multiple days. Ideally, after a higher low is confirmed, we base for a few days, setting a higher low and breakout entry across the daily timeframe.

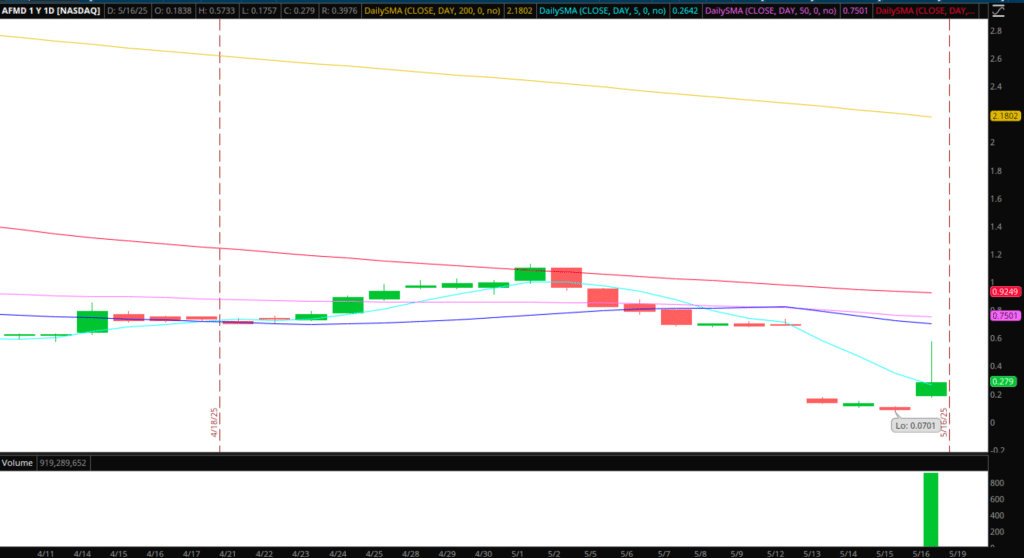

Pops to Short in AFMD: Standout small-cap opportunity on Friday. Trading is to be suspended in the name on May 20. While doubtful, I’m hoping we get an opportunity to re-short the name on a push back into .35 – .40c. If the stock catches a bid back toward resistance and supply within that range, I’d look to short against the HOD and hold for a move back into 0.20. With trading to be suspended on May 20, this either develops on Monday or it’s an avoid.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

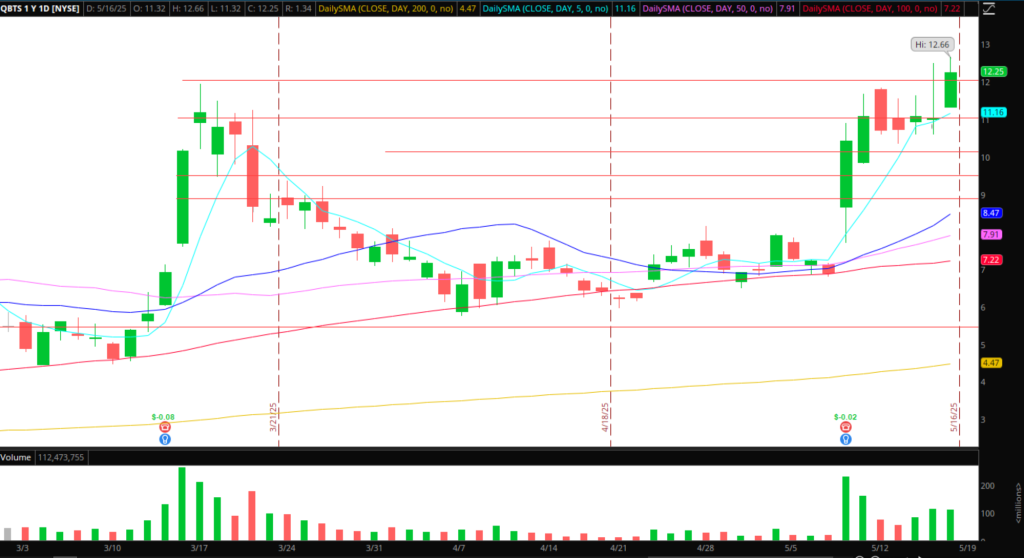

Failed Follow-through in QBTS: QBTS continues to find resistance at a significant band of supply near highs and $12. If I notice some failed follow-through through $12, and relative weakness develops, I might look for a starter short against the HOD. I’d only look to size in if the stock holds below $11.5 and then breaks below Friday’s low. At that point, I would lower my stop to the 5-minute low high, piecing out on extension below VWAP, ultimately targeting a move toward the low $10s.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Get the SMB Swing Trading Evaluation Template Here!